Upgrades for Helloworld ahead of another strong year in 2017

Published 29-SEP-2016 11:58 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

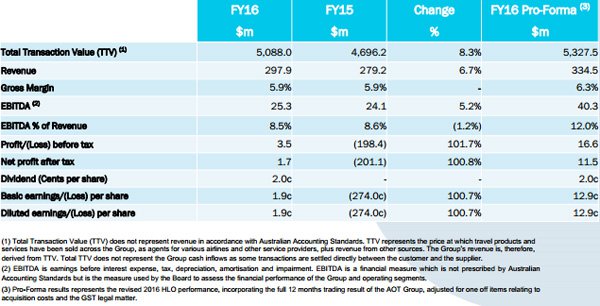

Shares in travel distribution group, Helloworld (ASX: HLO) soared 25% from $4.00 to hit an all-time high of $4.95 after the company delivered a better than expected result for fiscal 2016.

The underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $32 million represented year-on-year growth of 17%. Furthermore, it was 19% ahead of the expectations of Belinda Moore from Morgans CIMB.

Most brokers increased earnings forecasts and price targets in response to the result with the latter close to the company’s current trading range following a retracement to $4.50.

However, in what could signal further forward momentum for the company’s share price, John O’Shea from Bell Potter ran the ruler across the stock today, increasing earnings per share forecasts for fiscal years 2017 and 2018 by 7% and 1% respectively and upgrading the price target from $4.60 to $5.00.

He referred to a number of factors that point to a strong fiscal 2017 performance including annualised synergy and cost savings of $17.1 million, a stabilisation in agent numbers within the retail network and the significant growth that can be generated from the merger with AOT which was completed in February. O’Shea also expects improvement in revenue margins to be an important feature of future results.

The group received a further boost in mid-September after signing a deal with New Zealand based World Travellers to join the HLO retail network in New Zealand effective from October 2016. O’Shea also expects improvement in revenue margins to be an important feature of future results.

These results are yet to be determined so if considering HLO for your portfolio, you should take into account all information about the company and seek professional financial advice.

HLO is Australia’s largest network of franchised travel agents with a strong portfolio of brands including Qantas Holidays, Go Holidays (New Zealand), AOT Inbound, ATS Pacific and Sunlover Holidays. The group has over 2000 staff located in Australia and New Zealand, as well as other large regions such as Southeast Asia, Europe, the UK and the US.

HLO has been one of the few players in the travel sector to deliver consistent share price accretion over the last 12 months. Shares in Flight Centre plunged from a high of $45.37 in March 2016 to a low of $29.38 towards the end of June.

Mantra Group went from market darling early in the year with its share price hitting an all-time high of $5.26 to trade as low as $2.87 at the end of August.

Management appears confident regarding the coming 12 months and provided a positive outlook statement when delivering the full-year result.

In stating that the outlook for HLO was ‘very good’, management said, “The fundamentals of the business are sound and we see continued demand in our retail, wholesale/inbound and corporate divisions”.

References were made to some of the key issues highlighted by O’Shea with positive commentary regarding margins, cost controls and improved brand strategies.

Commenting on the broader macro outlook, management said, “Travel continues to be both a necessity and a pursuit for just about everyone and the demand for our services in the retail, wholesale, inbound and corporate segments continues to grow”.

The company intends to refine its offerings and align a new digital platform with its traditional bricks and mortar businesses which it expects will result in demand for the group’s traditional fundamental value proposition.

HLO is forecasting total transaction value to be in a range between $5.3 billion and $5.4 billion in fiscal 2017. On this basis, EBITDA is expected to be in a range between $46 million and $51 million.

O’Shea’s numbers reflect an outperformance with forecast EBITDA of $52.9 million, representing a net profit of $23.9 million, implying earnings per share of 21.3 cents. This represents a PE multiple of 21 relative to Wednesday’s closing price of $4.50.

This is slightly above the industry group average of 18, but most of HLO’s peers aren’t expected to generate the same level of growth over the next three years.

As an example, consensus forecasts for Flight Centre point to zero earnings per share growth over the next two years. By comparison, following a strong year of growth in fiscal 2017, O’Shea is forecasting further earnings per share accretion of 28.3% in fiscal 2018.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.