Unemployment rate drops in August despite fewer jobs

Published 16-SEP-2016 10:22 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Australian employment data released for August has stumped many with a seasonally adjusted fall of 3,900 jobs nationwide, well short of the expected 15,000 jobs to be added.

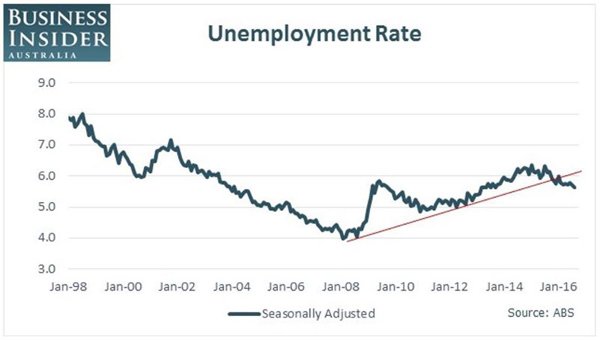

Official numbers released by the Australian Bureau of Statistics showed that the national unemployment rate dropped to 5.6%, the lowest it has been in three years.

So how did the unemployment rate happen to drop when jobs were lost?

It all comes down to the participation rate which happened to fall from 64.9% to 64.7% over the period.

The seemingly contradictory result also saw the workforce experience a drop in monthly hours worked, a 3.9 million hour drop to 1,656 million hours.

Reading into the figures, part-time jobs declined by 15,400 being somewhat offset by the 11,500 fulltime jobs added.

Capital Economic remains sceptical on the numbers released, claiming that 49,000 people were temporarily employed for work on the census in the month of August.

Due to many of the people contracted already having part-time employment, they would have been temporarily pushed into the full-time employed category.

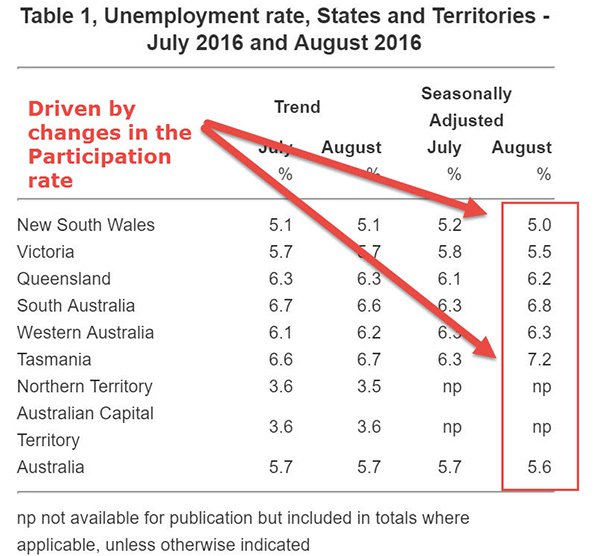

In a state by state basis, we see scattered results across the nation:

New South Wales and Queensland showed signs of a shrinking economy with 9,200 and 7,600 jobs disappearing respectively.

However in Victoria we saw an outstanding 20,700 jobs added.

Meanwhile Tasmania saw its unemployment rate jump from 6.3% to 7.2%, despite job creation being positive.

The mixed results show that the economy on a whole is sending mixed signals, making it difficult for employers and more importantly the RBA to make decisions on the economy going forward.

Policy makers will likely seek to keep the economy stable until the mixed results around the country steady.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.