Tweet nothings – what Musk’s tweet says about dialogue on lithium

Published 10-JUN-2016 13:54 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It was the tweet which shook the market – and a demonstration that one company is so inextricably linked to the lithium-ion revolution that the slightest of pronouncements can make investors jump.

In case you missed the news, there had been whispers on the market that Samsung would be a supplier for Tesla’s Model 3 small car – supplying the batteries to power the cars.

The whispers went on and on – until Tesla founder Elon Musk stepped in and put an end to the speculation with a single tweet.

Whoops.

That single tweet was thought to be the reason why Samsung EDI’s shares plunged by 8% on the market – effectively wiping off $A777 of value from the Samsung subsidiary.

Panasonic shares on the other hand went up 4% on the news.

He later clarified to say that Samsung would provide the batteries for its powerwall, with a corresponding rebound of 4% for Samsung.

While Tesla is building its gigafactory in Nevada to eventually supply its own batteries – it will still need batteries in the shorter-term.

The episode throws up a key question: is one company, and one company solely, responsible for the buzz around lithium-ion batteries?

The buzz is very, very real and has filtered all the way down to the junior resources space in Australia.

It seems that every day there’s another unloved miner pivoting towards lithium or graphite exploration – all selling the potential of lithium-ion batteries as a way to sell the potential of both commodities.

It’s getting so that the junior resources space’s favourite activity – RTO’ing into a tech play, is becoming almost passé.

If you look at the issue rationally though – you’d realise that lithium-ion batteries are not the only thing expected to drive the graphite and lithium markets in coming years – although it certainly feels like it.

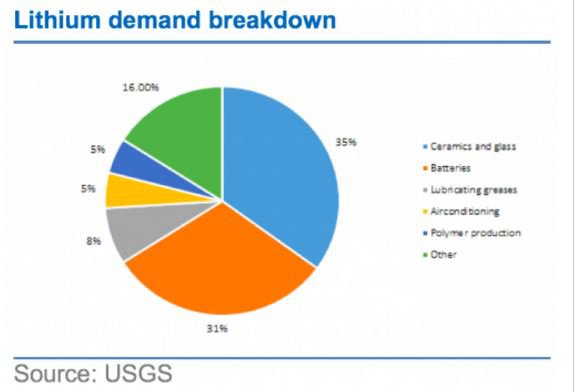

Below is a chart from the US Geological Survey, as presented by MineWeb:

Current lithium demand

This is a static snapshot of what lithium is currently used for.

Undoubtedly the absolute growth area here is in batteries – but there’s a whole 69% of the market that simply isn’t talked about – and that demand driver isn’t exactly going anywhere.

Instead, the easier story to latch onto is the growth in lithium-ion battery demand, and the easier story within that to latch onto is the Tesla story.

After all, it’s a great story.

The Silicon Valley billionaire with a plan to save humanity and ambitions to basically be Iron Man?

Undoubtedly Tesla has gotten the jump on the electric vehicle market – but again, Tesla isn’t the only game in town.

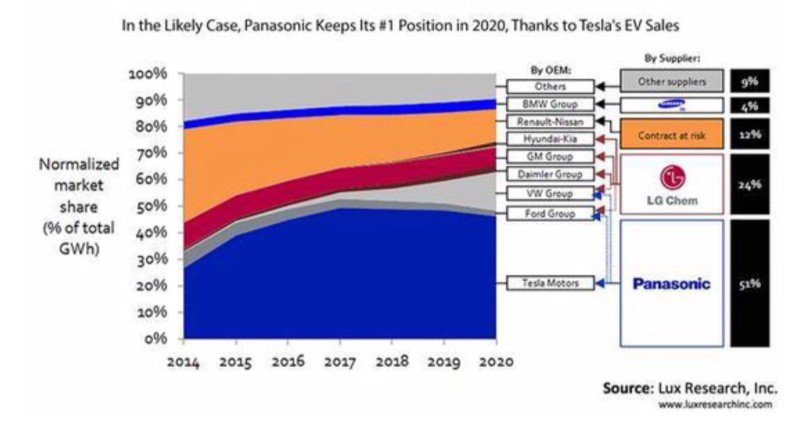

This CleanTechnica report taking a look at a Lux Research piece on potential battery suppliers into the EV market makes clear that it its pomp – Tesla is expected to have 45% of the market.

The market share of various manufacturers

Again – that’s absolutely huge, but not the only game in town.

As previously explored on Finfeed, China is expected to be a huge driver of the electric vehicle revolution – and Telsa doesn’t have huge market penetration in that market.

Investors though, have picked up on the almost incessant media coverage of Tesla and its billionaire founder as the vanguard and figurehead for the revolution.

That’s why a single tweet from Elon Musk has the potential to send shockwaves through the market.

There is a whole other section of the potential market for both graphite and lithium, however, that isn’t even being talked about – let alone tweeted about.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.