Top 10 stocks for November

Published 04-DEC-2020 10:54 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

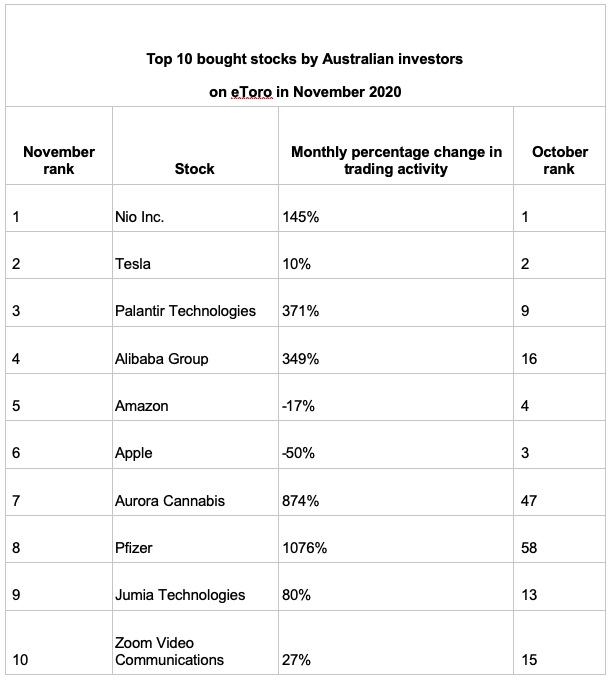

What are the top traded stocks in November?

According to global multi-asset investment platform eToro, Australian retail investors piled into stocks of companies that are expected to perform well in the year to come.

These included:

Nio Inc (NYSE: NIO) remains as the top most invested stock by Australian investors, for the second consecutive month in a row.

Palantir Technologies’ (NYSE: PLTR) recent earnings report excites investors, as the company shows clear signs that the business is looking to grow throughout 2021.

Pfizer (NYSE: PFE) has skyrocketed into the portfolios of many Australian investors in November, as the company announces its vaccine is 95 per cent effective.

The top 10 stocks are:

Here’s market analyst at eToro Josh Gilbert’s assessment ...

Nio Inc

Nio has seen a huge gain of 145 per cent in trading activity in November, as investors look to pile into the stock after what can only be described as ‘FOMO’ from its 1,000 per cent price increase this year.

The EV sector has had a phenomenal run in 2020, despite a market sell off in early March. Nio Inc has outperformed Tesla so far this year, which is surprising as a year ago many investors wouldn’t have thought twice about the Chinese automobile manufacturer.

The recent news that Tesla would be added into the S&P 500 later this month has sent the share price racing in November, gaining more than 40 per cent. The move means that the hedge funds tied to the S&P 500 will have to buy billions of dollars’ worth of shares in the company to add to their portfolios, which investors are seemingly pricing in.

Palantir Technologies

Palantir’s increase in revenue guidance has excited investors, as they start to clue in around the potential behind the stock. Its recently released first earnings report was positive, and showed clear signs that the business is looking to grow throughout 2021. The company has also worked closely with the US government over the pandemic period, which puts them in a great position to continue to work with government agencies, such as the US Army and intelligence services.

Alibaba

Alibaba’s share price tumbled in November, falling as much as 15 per cent. With expectations that the eCommerce industry will continue to accelerate in 2021, investors have seen this as a prime opportunity to purchase shares in Alibaba. Alibaba also recently recorded around $75 billion in sales from The Singles Day event, with $5 billion of these sales coming directly out of US. This shows a continued resilience from Alibaba to grow outside of the Chinese market.

Pfizer

Pfizer, the front runner behind the coronavirus vaccine, has skyrocketed into the portfolios of many Australian eToro investors in November, with a 1076 per cent increase in trading activity. Pfizer’s stock gained around 11 per cent in November, as the company announced the vaccine they had produced was 95 per cent effective.

With an impending decision from the US FDA to approve the drug, the mass scale in which the vaccine would be purchased will provide Pfizer with a steady income stream in the short term. The vaccine has also been approved for emergency use by the UK government, with more than 40 million doses of the vaccine purchased. This is set to pave the way for mass approval around the globe.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.