Thirty solid gold stocks to whet your appetite

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The recent surge in the gold price that has seen it hit a six-year high of US$1442.90 per ounce isn’t showing any signs of abating.

The news is even better for Australian gold companies as there has been little movement in the Australian dollar against the US dollar.

The current rate is in the order of US$0.695, implying an Australian dollar gold price of approximately $2050 per ounce.

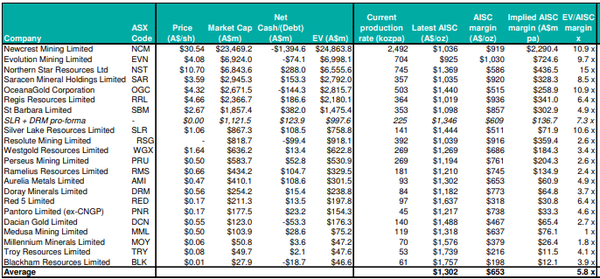

The following table compiled by analysts at Bell Potter indicates that the average all in sustaining costs (AISC) per ounce in Australian dollar terms is approximately $1300.

However, you can see that a few of the smaller/challenged players have placed upward pressure on the average with the likes of the Millennium Minerals, Troy Resources and Blackham Resources recording AISCs between $1570 per ounce and $1760 per ounce.

Notwithstanding that, even based on the average, these miners are reaping margins of more than $700 per ounce.

Finfeed will examine 30 players in this sector over the next three days, some that have operations outside of Australia where the currency benefits aren’t as significant, but the margins remain robust.

Though we will be looking at the big players such as Newcrest Mining (ASX:NCM), Kirkland Lake Gold (ASX:KLA) and Northern Star Resources (ASX:NST) which have a combined market capitalisation of more than $40 billion, we will also run the ruler across some emerging companies that stand to benefit in the current environment.

Picking a good gold stock isn’t all about production, so keep an eye out for some of the companies we feature that have AISCs well below $1000 per ounce, implying outstanding margins that lead to enhanced profitability.

The first ten stocks are...

Alkane Resources Ltd - ASX:ALK

Alkane’s projects are predominantly in the central west region of NSW, but extend throughout Australia.

The group’s gold production is from the Tomingley Gold Operations (TGO) which has been operating since early 2014.

Alkane’s most advanced gold exploration projects are in the 100% Alkane owned tenement area between TGO and Peak Hill, and have the potential to provide additional ore for TGO.

Management recently provided production guidance of nearly 50,000 ounces for fiscal 2019, up by approximately 15% on previous mid-range guidance of 43,500 ounces.

This was well received by investors with the company’s shares up about 50% since the guidance was upgraded in early June.

On a year-on-year basis the company’s shares have nearly doubled.

Also working in the company’s favour is a reduction in costs to $950 per ounce compared with previous guidance of $1050 per ounce in fiscal 2019.

This is well below the average we referred to earlier, and it implies a healthy margin of approximately $1100 per ounce based on the current gold price.

Development of the underground operation continues on budget and ahead of schedule, and this should provide a platform for production growth.

Apollo Consolidated Ltd - ASX:AOP

Apollo Consolidated Ltd is an exploration company focused on its advanced gold project at Lake Rebecca in Western Australia, as well as greenfield gold projects at Yindi and Larkin.

Lake Rebecca is developing into a promising new discovery, with three main prospect areas at Rebecca, Duke and Duchess.

Rebecca is the site of the high-grade Jennifer Lode discovery and adjoining mineralised surface, and the company continues to explore this deposit and surrounding targets.

There was some recent positive news flow from extension drilling at Jennifer Lode which included intercepts of 9 metres at 8.0 g/t gold and 19 metres at 3.6 g/t gold.

Step-out drilling has extended the Rebecca gold system to more than 1.4 kilometres strike, and the trend continues to remain open in a southward direction.

Apollo sees excellent potential for new gold surfaces to be delineated in this area, and additional drilling is being planned for the current campaign.

The company is fully funded beyond its 2019 drilling activities, with consolidated cash of $10.8 million as at May 31, 2019.

Alacer Gold Corp (ASX:AQG)

In mid-June Alacer Gold commenced commercial production at its low cost Çöpler sulfide plant in Turkey.

This was a significant milestone for the group as has allowed management to tune and optimise the plant with the expectation of achieving quarter-on-quarter improvements over the remainder of 2019.

Performance to date has provided management with the confidence to reaffirm 2019 sulfide plant production in a range between 125,000 ounces and 145,000 ounces at an extremely low mid-range cost of $675 per ounce.

Alacer continues to pursue opportunities to further expand its current operating base to become a sustainable multi-mine producer with a focus on Turkey.

The Çöpler Mine is processing ore through two producing plants.

With the recent completion of the sulfide plant, the Çöpler Mine will produce over 3.5 million ounces at first quartile AISC, generating robust free cash flow for approximately the next 20 years.

Analysts at Macquarie recommenced coverage of the company with an outperform recommendation and a 12 month price target of $4.90 following the commencement of commercial production.

However, with the company now trading broadly in line with the price target there may be limited near-term upside.

Beacon Minerals Ltd (ASX:BCN)

Beacon Minerals is another company that has surged on the back of project commissioning with its shares surging 50% since June 20, 2019.

The commissioning phase has commenced at the company’s Jaurdi Gold Project, 35 kilometres north-west of Coolgardie in Western Australia.

Management expects to be in full production by the December quarter with an initial target throughput of 500,000 tonnes delivering 25,000 ounces of gold per annum.

Prefeasibility (PFS) results indicate life of mine revenue of $208.5 million and surplus operating cash flow of $98.4 million based on an Australian dollar gold price of $1650, implying significant upside relative to the current spot price.

Juardi is a low-cost project with AISC of $870 per ounce.

The ore reserves imply a mine life of five years which is likely to increase with the inclusion of the Black Cat resources and exploration upside as the company embarks on a 20,000 metre drill program in the coming months.

Bellevue Gold Ltd (ASX:BGL)

Bellevue Gold is advancing the historic Bellevue Gold Mine in Western Australia which was in its day one of Australia’s highest-grade gold mines, producing 800,000 ounces at 15g/t gold from 1986 to 1997.

The Bellevue Gold Project is located approximately 30 kilometres north of Leinster township and sits in a major gold and nickel producing district with mines such as Jundee (Northern Star), Agnew and Lawlers (Goldfields), Darlot (Red 5), Bronzewing (Echo), Sons of Gwalia (St Barbara) and Thunderbox (Saracen) all in close proximity.

The company has a compliant independent JORC Inferred Resource inventory of 1.53 million ounces at 11.8 g/t gold, making it one of the highest grade undeveloped gold discoveries in the world.

The resource includes the Viago Lode which hosts a resource inventory of 550,000 ounces of contained gold at an impressive 22.0 g/t.

The resource inventory is currently being expanded with further exploration and step out drilling.

Macquarie was quick to latch onto the Bellevue story, in mid-January nominating it as its ‘high conviction top explorer pick winner for 2019’.

It certainly hasn’t let them down since then with its shares up 50%, and recently hitting a 12 month high of 72 cents.

However, there appears to be more upside to come with the group delivering outstanding drilling results at its Viago and Tribune Lodes and it certainly being talked up:

These included 3.2 metres at 17.2 g/t gold and 2.7 metres at 22.6 g/t gold from the Tribune lode.

Bellevue intersected a new, high priority ‘flat lying Viago look-alike’ target immediately west of the Tribune Lode with the first drill hole intersecting 4 metres at 8.3 g/t gold and a second step out drill hole 80 metres to the north intersecting a 1.8 metre zone with abundant visible gold.

Management noted in mid-May that the company was in a strong cash position with $28.6 million sufficient to maintain ongoing drilling throughout 2019.

There should be a relatively near-term catalyst in the way of a resource upgrade which was flagged to occur in the June quarter.

Despite the recent share price rally, the company is still trading at a discount to Macquarie’s 12 month price target of 80 cents per share.

The broker expects Bellevue to transition to profitability in 2021, forecasting a net profit of approximately $55 million.

Cardinal Resources (ASX:CDV)

Cardinal Resources Ltd (ASX/TSX: CDV) is a West African gold exploration and development company that holds interests in tenements within Ghana, West Africa.

The company is focused on the development of the Namdini Project with a gold Ore Reserve of 5.1 million ounces (400,000 ounces proved and 4.7 million ounces probable), and a soon-to-be completed feasibility study.

Exploration programs are also underway at the company’s Bolgatanga (Northern Ghana) and Subranum (southern Ghana) projects.

Management noted in June that positive leach results were expected to enhance project economics, and through the laboratory test work that has been initiated on this front.

This involves using Aachen technology, a proven process being used by number of successful gold producers globally and specifically in Africa.

The company expects the use of this technology to increase gold recovery, while also reducing upfront costs and AISCs.

While the company’s shares have been on a downward trend for most of 2019, a surge of more than 10% in the last fortnight could be the signs of a turnaround.

Chalice Gold Mines (ASX:CHN)

Chalice Gold Mines is developing the Pyramid Hill Gold Project in Victoria and the East Cadillac gold project in Canada.

The former is located in the Bendigo region where historical production has exceeded 60 million ounces at an average grade of 15 g/t gold.

Kirkland Lake Gold (ASX:KLA) has put the area back on the map following the discovery of bonanza grades at its low-cost Fosterville project.

Chalice is focusing on the highly prospective North Bendigo zone, but at this stage there is only early reconnaissance exploration drilling being conducted.

It is a similar story in Canada in terms of nearology with the East Cadillac project being located in the prolific Abitibi Greenstone belt with known gold endowment of more than 200 million ounces.

Chalice controls more than 27 kilometres of strike along the Larder Lake Cadillac fault, the most prolific gold trend in the southern Abitibi.

The drill bit will tell the story with Chalice, but there are high expectations with the company’s shares spiking nearly 20% last week.

Catalyst Metals Limited (ASX:CYL)

Shares in Catalyst Metals surged 50% in February/March, largely driven by exploration success.

The company also has exposure to the high profile Bendigo region.

Of particular note were high-grade gold intersections at the Boyd’s Dam Zone part of the Four Eagles Gold Project with one hole containing bonanza grade gold mineralisation, assaying 1380 g/t gold over a one metre interval with abundant visible gold within a broader zone of 8 metres at 174.5 g/t gold.

The zone is still open to the north where widely spaced drilling has shown high grade gold mineralisation at depths of 20 to 40 metres (Boyd North) and there is a likelihood that this could plunge southward below the limit of previous drilling.

The Four Eagles Gold Project covers an area of gold mineralisation about six kilometres long and 2.5 kilometres wide and is situated along the Whitelaw Fault Corridor which is considered to be a major structural control of gold mineralisation north of Bendigo.

Catalyst holds a 50% interest in the Four Eagles Gold Project in joint venture with Gold Exploration Victoria Pty Ltd (GEV), a wholly-owned subsidiary of high profile Hancock Prospecting Pty Ltd.

The company manages the entire Whitelaw Gold Belt and has interests in eleven Exploration Licences and two Retention Licences which extend for 75 kilometres along the Whitelaw and Tandarra Faults north of Bendigo in Victoria and in other areas north of the Fosterville and Inglewood gold fields.

Catalyst is another exploration story well worth monitoring.

Dateline Resources Ltd - (ASX:DTR)

Dateline Resources is in the process of completing a much anticipated 8000 metre drilling campaign at the company’s 100%-owned Gold Links Project in Colorado.

Drilling will test near-surface extensions of the Sacramento and ‘2150’ veins located in the northern section of the Gold Links Project.

Both targets are highly prospective and are immediately beneath structures that are known to have produced high grade gold.

Previous production of up to 150,000 ounces featured outstanding grades of up to 493 g/t gold and in particular, records indicate crude ore shipments up to 287 g/t gold from the Gold Links ‘2150’ vein.

Mineralisation can be traced on surface and underground for almost 6 kilometres from the northern to the southern sections of the project.

Well-documented records indicate that there are large areas that remain untested at surface and little to no exploration has been done below the valley floor.

Of the 41 holes planned, 20 holes will be drilled into the Sacramento vein and 21 into the ‘2150’ vein.

The combined strike being tested is approximately 600 metres.

The drill spacing is 33 metres on the strike and between 15 metres and 50 metres on the dip of the veins.

Recent assays of the ‘2150’ vein reported by Dateline range from 1.2 metres at 38 g/t gold to 1.2 metres at 250 g/t gold, including grab samples up to 151 g/t gold.

E2 Metals Ltd (ASX:E2M)

Drilling results from an exploration program conducted by E2 Metals at the group’s Sierra Morena Project in the Santa Cruz province of Argentina led to a surge in the group’s share price in April/May as it doubled from 15 cents to hit a 12 month high of 30 cents.

The Sierra Morena Project is located on the western margin of the Deseado Massif geological province that is host to world-class epithermal gold and silver deposits like Goldcorp’s Cerro Negro and AngloGold Ashanti’s Cerro Vanguardia mines.

The drill program comprised 23 holes totalling 1903 metres at four prospect areas.

Seventeen holes for 1361 metres were completed at the SM6 prospect where historical sampling has yielded high surface grades of up to 23.3 g/t gold and 3240 g/t silver at the Eastern Vein and 7.17 g/t gold and 602 g/t silver at the Western Vein.

All drill holes intercepted the outcropping vein or host structure at expected depth ranges, confirming the company’s target models.

This yielded encouraging visual results at both prospects and identified additional targets that were previously unrecognised.

Importantly, the program highlighted new prospectivity options for Sierra Morena including the potential for additional blind veins at SM6 and additional mineralised prospects at the Southern Project Area, making E2 Metals another ‘watch this space’ story.

Part two examines ten more gold stocks, including the three big players we mentioned earlier, as well as the $7.3 billion Evolution Mining (ASX:EVN).

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.