Is there a unique approach to gold exploration? The CSIRO thinks so

Published 28-MAY-2020 11:52 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Australia’s national science agency, the CSIRO, has produced new understanding of mineralisation in the Yilgarn Province in WA.

Research supported by the Western Australian government through the Minerals Research Institute of Western Australia (MRIWA), has found the formation of ancient gold deposits during the Archean period over 2,500 million years ago, also produced distinctive patterns of chemical alteration in the surrounding rocks.

Finding distinctive patterns of chemical alteration will make it faster and more efficient for exploration companies to identify potential new deposits.

The CSIRO believes this could greatly assist exploration in the Eastern Yilgarn region. Despite its proximity with the Eastern Goldfields and its shared Archean geology with its richly-endowed neighbour, Eastern Yilgarn has produced fewer gold discoveries to date than expected.

Those who follow exploration companies will know that conventional exploration relies on geological and geophysical mapping, coupled with whole-rock geochemistry to find a gold deposit, or suitable host rocks and structures that might host the deposit.

Research conducted by the CSIRO took a different approach. The CSIRO studied the chemical system that deposited the gold.

Bringing science to mineral exploration

The CSIRO is possibly the last organisation, you’d expect to have an influence on gold exploration, however this latest research not only has global application, but also reinforces CSIRO’s position as a leader in the development of mineral exploration technologies.

CSIRO’s Director of Mineral Resources, Dr Rob Hough, said their work assists Australian industry by translating science to mineral exploration and supporting the role of Australia’s resources in sustainable global development.

“This research project is a great example of CSIRO’s close collaboration with the Western Australian Government and MRIWA, to support a productive, sustainable and globally competitive mineral resources industry for the benefit of Australia,” Dr Hough said.

“We have world leading research capabilities in Perth and welcome opportunities to develop minerals sector innovation in partnership with the industry and government.”

The $10 billion capped Northern Star Resources Limited (ASX:NST) is a project sponsor.

“The new approaches developed from the project have challenged conventional wisdom, established new models for the genesis of mineral systems and provided insights into how we might navigate them," Jamie Rogers, General Manager Exploration for Northern Star said.

“Northern Star sponsored the project to help fast track and ultimately benefit from the development of new mineral exploration tools and technologies.”

The $1.4 billion capped Gold Road Resources (ASX:GOR) is also a project sponsor, illustrating how seriously this work is being taken.

“Discovery of the next generation of gold mines requires developing better ways to target and map the gold mineralising systems," Kevin Cassidy Chief Geologist FAIG, FSEG for Godl Road said.

“Gold Road Resources is utilising the innovative technologies and knowledge advances developed from the ground-breaking project to identify new areas with gold potential and refine understanding of known gold systems, effectively improving the way we go about our exploration.”

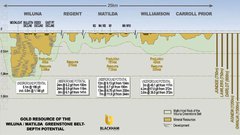

Further sponsorship has come from the $1.3 billion capped Ramelius Resources Limited (ASX: RMS), the $9.8 billion capped Evolution Mining Limited (ASX:EVN), the $140 million capped small cap, Blackham Resources Limited (ASX: BLK), privately owned Echo Resources Limited and the $5.5 billion capped Saracen Mineral Holdings Limited.

The technical report summarising the findings of this research can be found at Mapping the Chemical Architecture of Gold Camps.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.