The broad reach of ‘Narrow AI’ and tailor-made technology

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

If you’ve been paying attention over the last few years, you’ll know that Artificial Intelligence is set to dramatically change all of our lives — and add value in ways the average person can’t even imagine.

The type of AI which is disrupting society most right now is what’s referred to as ‘Narrow AI’. Narrow AI is the technology that can ‘chat’ to you online to answer a customer enquiry at any hour of the day; the automated voice system that can direct your call based on what you tell it; and is also the ‘brains’ behind the self-checkout systems at the supermarket.

This AI tech does a specified job very well within a limited context, hence the descriptor ‘narrow’. Self-driving cars for example are classified as narrow AI — in fact, they work via the coordination of a complex mix of multiple narrow AI technologies.

These systems can perform routine tasks extremely well, and are capable of data analysis on an enormous scale — giving it the ability to determine patterns within databases that would simply overwhelm the human brain’s data-processing skills.

Narrow AI is defined in comparison with General AI; a level of intelligence that can match human capabilities, including the ability to understand and ‘think’ reasonably within broad contexts.

Going one step further is Super AI, a futuristic concept which describes the point at which AI becomes smarter than the smartest human brain across all fields — including not only scientific endeavours, but softer skills like creativity and emotional intelligence.

Narrow AI presents a major opportunity in customer service

Essentially, Narrow AI represents machine technology which enables it to perform a single task, or narrow set of tasks, extremely well — either as efficiently as a human could, or more so.

The more a job involves tasks which are automated, straightforward or repetitive in nature, the more this tech can swoop in and provide an easy, cost effective solution.

This can be in the form of bots — that’s the device that helps you with a restaurant recommendation or a traffic update by quickly scanning and pulling the answer from large databases — but it can also go beyond this kind of bot technology, and offer much more. Narrow AI is now entering a phase where it can utilize machine learning to become truly powerful, as well as highly disruptive across a multitude of industries.

How Narrow AI is changing the game

Whether you know it or not, these systems have almost certainly been impacting your life for some time — unless you’ve been living as a recluse.

In fact, any software or application that uses pattern recognition and voice recognition, data mining and so on to autonomously make decisions, could be considered narrow AI. This also includes sophisticated spam filters, autonomous cars and Facebook’s algorithmic newsfeed.

We are now entering an era where narrow AI is increasingly advanced, and able to produce results at a level of sophistication never seen before. In large part, this is due to the advances made in machine learning.

Machine learning can be thought of as a path towards creating Artificial Intelligence — the capacity for a machine to learn X information, without X being explicitly programmed into it.

In other words, AI can be manually created through millions of lines of code with complex rules and ‘decision-trees’ manually entered; or the machine can, itself, learn these things through being trained to do so. In this way a machine with the appropriate existing algorithm could be fed large quantities of data, and the algorithm could adjust to improve itself, based on training and feedback.

A machine ‘learning’ is about its ability to make accurate predictions about the future through weighing up key factors from inputted data — all via its ‘brain’ (an algorithm). As Finfeed featured in December last year, the foundations of machine learning are not new, however the introduction of powerful processing tools, plus access to huge datasets required, are two crucial developments that have allowed machine learning to become a reality.

Which industries are set to benefit most?

Narrow AI is most apt for industries where the main game is to solve precise, reasonably well-defined problems, where the means to do so relies heavily on data capture and analysis.

Financial services is one such field, and in particular the heavily data and prediction-reliant world of insurance.

Finfeed.com readers may be familiar with ASX small-cap Flamingo AI Limited (ASX:FGO). This company has been stacking up the major client clinches across the insurance industry, including Nationwide Insurance in the US, AMP, CUA and DirectMoney in Australia, Liberty Mutual (international), CHUBB Asia Pacific and MetLife Asia in Singapore.

All of the above are currently participating in paid trials of FGO’s AI tech. Specifically, those companies are trialling FGO’s proprietary ‘cognitive virtual assistants’ who guide customers through sales, on-boarding, claims and service enquiries, and virtually any enquiry typically handled by a company’s call centre.

It isn’t just prospective clients who are taking an increased interest in FGO. Investors have also shown their support, most notably through a stunning A$15.5 million capital raise announced by the company in December. The market is no doubt catching on to the rapidly escalating momentum of machine learning and narrow AI tech, and the enormous benefits and disruptive potential it already holds across plenty of heavyweight industries.

It should be noted here that FGO remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

True machine learning: the future

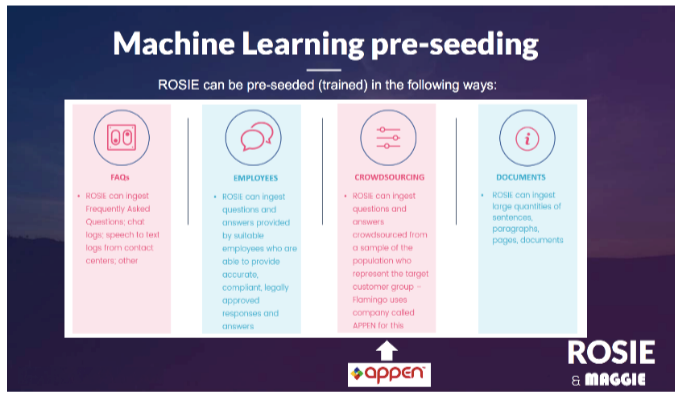

FGO’s ROSIE platform can be pre-seeded with information via four different pathways:

Through these four options, the machine learning engine has the ability to learn more and more, ad infinitum.

Since Flamingo AI has been interacting with insurance companies for over a year, they have gathered a lot of information already which can now be used to pre-seed future editions of the platform (in a cycle that can keep perpetuating). As time goes on, the product becomes more and more advanced, and more and more valuable to prospective clients.

While there are a number of ASX companies claiming to offer AI solutions, there are relatively few that are offering true machine learning solutions like Flamingo AI.

Given the susceptibility of the insurance industry to disruption by these kinds of technologies, FGO’s considerable efforts since listing late last year could shore up its uniquely lucrative position in the market. And all of this, at a time when the financial services industry prepares for major AI upheaval.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.