The beginning of the end for fossil fuel starts with a 55 year wait

Published 15-DEC-2015 10:11 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This past weekend’s climate agreement in Paris is the most multilateral climate agreement ever.

Nearly 200 countries adopted the UN-led global pact calling for all nations to cut and ultimately eliminate greenhouse gas pollution.

The Paris Agreement aims to keep global temperatures from rising a further 1C Celsius (1.8F) between now and 2100, a central point linked to rising sea levels.

In practical terms, achieving that goal means the world would have to stop emitting greenhouse gases altogether at some stage over the next 75 years, according to scientists.

In the pact, the countries commit to limiting the amount of greenhouse gases emitted by human activity to the same levels that trees, soil and oceans can absorb naturally, beginning at some point between 2050 and 2100.

Word cloud of Paris climate agreement

The Paris agreement encourages signatory countries to limit greenhouse emissions to only the amount the world’s habitat can naturally absorb. Controversy still rages as to how much that really is however. Furthermore, the biggest critique of the pact has been its toothless nature that doesn’t enforce any of the targets set, which many critics say will enable the worst polluting countries to avoid reducing their emissions levels.

In the final draft of the agreement, the wording implies that the world will have to stop all greenhouse gas emissions by 2070 to reach the 2C goal or more optimistically, stop all emissions by 2050 to reach the 1.5C target.

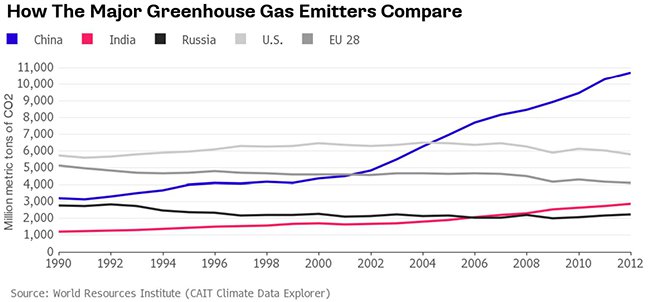

China, currently the world’s top carbon emitter, will eventually have to make the biggest cuts. Overall, for the world to hit its new target, global carbon dioxide emissions will have to peak by 2030, maybe earlier, and then fall to near-zero.

Winners and Losers

The Paris agreement will ultimately create both winners and losers depending on just how serious its limits, targets and ambitions are.

Fossil fuels aren’t on their way out just yet, although investing in renewable energy and clean energy is gradually picking up speed around the globe.

In Australia, companies such as Dyesol (ASX:DYE), Lithium Australia (ASX:LIT), and Stonehenge Metals (ASX:SHE) are all small-medium size startups looking to take advantage of the seeming global shift away from fossil fuel dependence.

More broadly, national initiatives aimed at increasing innovation in energy and clean energy applications have grabbed headlines but are still at grass roots level compared to billions spent on exploration and mining activity with respect to fossil fuels.

In a recent survey by the Energy Institute, over 60% of its members said they’re “not confident that a binding agreement from COP21 [Paris agreement] will be sufficient to keep global temperature increases below 2°C.”

At least for the time being, fossil fuels and renewables will have to find a way to coexist.

Political commentary

Following the public spectacle of weeping and heartfelt embraces amongst the Paris delegates, commentary from prominent politicians has also been widely disparate, especially in the country responsible for the greatest amount of historically cumulative carbon emissions – the United States.

Upcoming elections are likely to make the Paris agreement a central talking point, with views already widely divided.

Former Secretary of State Hillary Clinton, the 2016 Democratic presidential front-runner, praised the agreement, calling it “a historic step forward in meeting one of the greatest challenges of the 21st Century – the global crisis of climate change.”

Fellow Democratic presidential hopeful US Senator Bernie Sanders, however, offered a less rosy view on the agreement, contending it “goes nowhere near far enough” to commit nations to lower carbon emissions.

“The planet is in crisis. We need bold action in the very near future and this does not provide that,” said Sanders. “We need to “transform our energy system away from fossil fuel as quickly as possible,” he added.

With the agreement now signed, the next hurdle is for its signatories to ratify the agreement domestically which could still scupper commitment to the agreement. At least 55 countries, representing at least 55% of global emissions must agree to the deal for it to take effect in 2020.

Fossil fuels have been slated and blamed for the globe’s temperature fluctuations in recent years, but in the reality of the modern world, they are likely to stick around as the dominant energy generator until at least 2070.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.