Tesla: Learning from History

Published 10-MAY-2017 16:16 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a throwback to Ford’s historic launch of the Model T in 1908, the Tesla Model 3 launch could potentially repeat the feat of revolutionising how people get around and transforming mass transport in the 21st century, the same way Ford’s Model T did in the 20th century.

Ford sold over 15 million Model Ts between 1908-1925, and grew from a small car start-up, to the largest automaker in the world – able to grow through the Great Depression, which saw 183 of 200 car-makers leave the industry.

Arguably, if the world entered a Depression to the same extent as it did in 1929 – it would be companies like Tesla who would have the best chance of safeguarding its investors’ money – just like Ford did in the early 20th century.

Here are the electric cars (EV) that Tesla is pinning its lithium-sensitive hopes on:

The automotive industry has reached a watershed moment.

Up until now, electric cars were seen as novelties struggling for mass adoption because of lengthy charging cycles, a low range of travel and overpriced compared to standard petrol cars.

Tesla is making such concerns seem outdated, as Model 3 sales numbers have outpaced those of normal combustion cars since Tesla’s EV car was first launched.

This demand is also driving the lithium mining and exploration boom, which we will touch on shortly.

Tesla’s aggressive business model and cutting-edge lithium-based battery technology appears to have cracked the code of marketing electric cars to the mainstream public.

The best-selling car in the US in 2015 was the Toyota Camry and Corolla models which racked up 361,111 and 306,693 sales respectively. Tesla’s Model 3 beat both these totals in a single week, receiving pre-orders for over 300,000 EV cars.

In other words, Tesla has convinced people that it’s worthwhile to part with significantly more money for a Model 3 than it is to opt for a combustion car that’s much cheaper.

Convincing staunch EV aficionados is one thing, but Tesla’s glitzy PR engine has now moved the company into economies of scale and mass commercialisation with consumers.

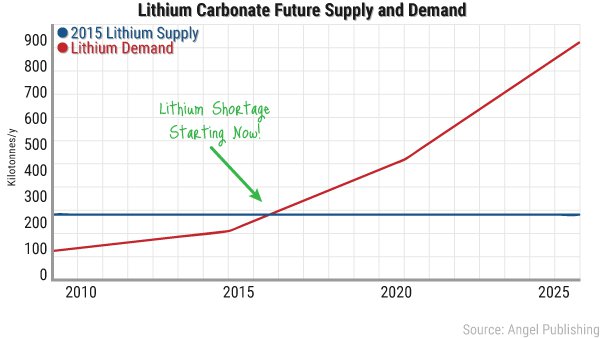

The knock-on effect of this socio-economic consciousness shift is that the raw materials such as lithium that Tesla needs to manufacture its ~500,000 cars each year, are expected to suffer shortages given current production levels.

And if we throw in Tesla’s PowerWall device — a means to store and distribute energy efficiently around consumer homes (at greatly lower cost to existing energy provision) — the lithium consumption ramp-up steepens even more.

Here is the PowerWall in all its glory — these devices are now being installed in several developed countries including the US, Australia and Europe.

Resources repercussions

Benchmark Intelligence estimates that Tesla will require about 25,000 tonnes per year of lithium (6% of global supply), 112,500 tonnes per year of flake graphite, 45,000 tonnes per year of spherical graphite (28% of global supply) and 7000 tonnes of cobalt per year (7% of global supply) if it reaches its target capacity of 35 GWh by 2020.

Here is the developing demand-supply mix in lithium, charted:

Lithium has been a rather boring commodity for decades — until now.

And it’s all thanks to Tesla.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.