Tel-Aviv, Silicon Valley….Joondalup?

Published 16-DEC-2015 11:53 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Perth, seemingly the capital of the resources universe over the past few years currently has a higher start-up density than Melbourne, the home of funky warehouse offices.

The latest report from StartUpWA, published last week, found that there are currently 420 start-ups in WA, and the growth of the sector has panned out almost as the slump in the resources sector has occurred.

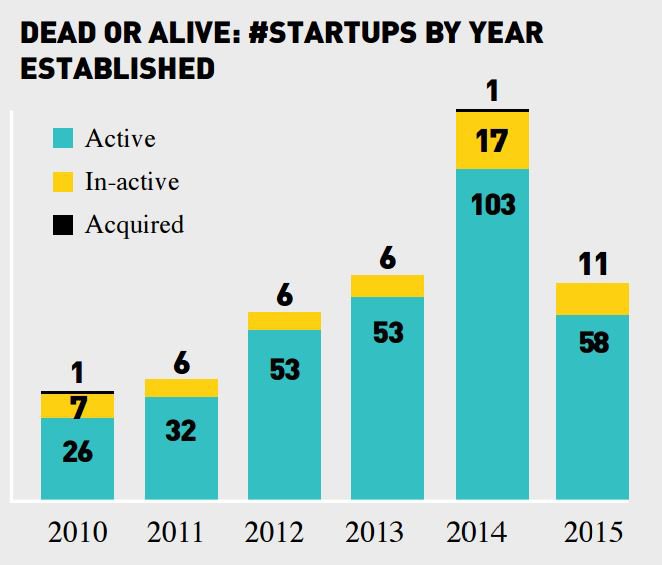

The report found that there were 59 start ups established in 2013, 121 in 2014, and 69 this year. This is a 235% increase from 2013.

A snapshot of the start-ups founded in WA since 2010

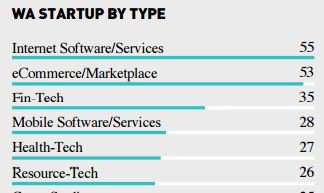

However, this growth in start-up culture out west has occurred almost independently of the resources sector, with only 26 out of a possible 559 start-ups focused on the resource sector tech.

The types of start-ups in WA

This is the case despite the huge disparity between tech funding and resources funding in the state.

The report estimated that in the 2014 financial year, there was $47 billion in resources-related investment made in the state.

In tech?

Less than $100 million.

So this becomes both an opportunity and instructive of the vibe happening in Perth over the last few years.

The report’s authors note that resource-tech start-ups quite often need the sort of large scale funding and expertise not currently available in the WA market.

However, it could very well be the case that the start-up community in Perth is simply looking to the future, having seen a dramatic decrease in the price of iron ore and oil over the past couple of years.

Yesterday’s mid-year economic outlook put out by the Federal Government painted a bleak picture, writing down the value of iron ore from $48 per tonne to $39.

This had a dramatic impact on the bottom line of the budget, with $7 billion in tax receipts now effectively written off over the forward estimates period.

The federal government doesn’t get direct royalties from iron ore sales, but gets its cut from things like company taxes.

The WA state government is expected to hand down a similar update next year, and given it collects royalties, it’s not expected to be pretty.

The doom and gloom over the resources sector in the east has been more than matched by those living in WA – so could this be behind a start-up boom in the state?

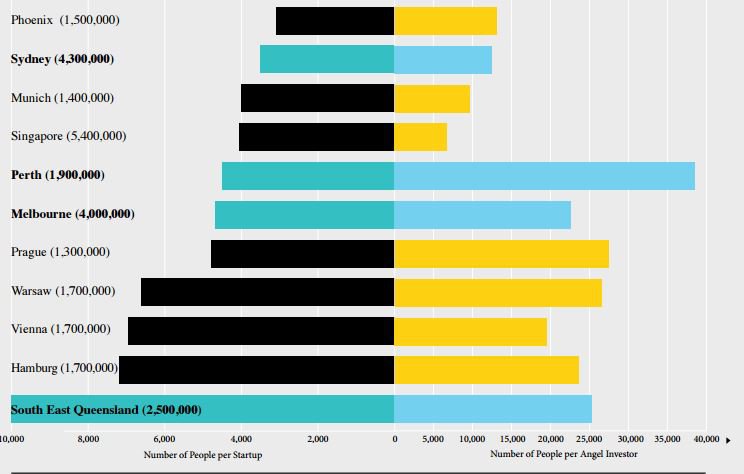

The report found that WA currently has a higher start-up density per person than Melbourne, but it still lags behind Sydney.

Start-up density per person

The report also made some bullish predictions about the size of disruptive digital technologies, the seeming raison d’etre for start-ups.

It found that the digital disruptive technology space could be worth $76 billion per year in 2025, making this about 25% of the state’s gross state product.

For a state long dominated by the resources industry, this would be somewhat of a seachange and help diversify the state government’s bottom line.

However, this was a report put out by the peak body for WA start-ups, and all the numbers should be taken with a pinch of salt.

Start-up culture is thriving pretty much everywhere at the moment though, so perhaps it’s no massive surprise that the scene in Perth is going through a boom, because it’s happening everywhere else too.

However, for Perth to have more start-ups per person than Melbourne is perhaps instructive of what’s happening in the state’s economy more broadly.

WA has always been a state of small-scale punters having a go. Walk into West Perth and you’ll find roughly a ‘bajillionty’ (our estimate) headquarters of resources companies.

While the entrepreneurial spirit has usually been applied to rocks, there are certainly emerging signs that it’s starting to be applied to code.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.