TechKnow teaches that knowing Tech is only half the story

Published 11-APR-2016 12:59 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Last year’s TechKnow Roadshow held in Brisbane, Sydney and Melbourne returned this year to showcase the latest crop of ASX companies offering all sorts of business ideas.

Spanning 3 events in 4 days, TechKnow has become synonymous with presenting Australia’s smallest-capped stocks with some of the biggest ideas of our generation.

At this year’s event, 17 companies took to the stage including a company that can diagnose your respiratory condition via your phone without a doctor, a company that puts SME’s into a cockpit usually reserved for bigwig CEOs and a futuristic interior design business that connects homeowners with designers.

Also back this year was DJ Carmichael’s Michael Eidne, who sketched out some rather interesting caveats facing every technology company showcased at TechKnow.

DJ Carmichael Director Mr. Michael Eidne

Mr. Eidne has over 14 years experience working in financial markets in South Africa, UK and Australia. Prior to joining DJ Carmichael Michael held research analyst positions at Bell Potter Securities and Blackswan Equities.

What’s the buzz in Tech

This year’s TechKnow Conference provided a string of ASX-listed tech firms, all with a blistering array of tech solutions for various business problems. The companies being showcased may have changed since last year’s event but the core principles of tech investing remain the same according to Michael Eidne from DJ Carmichael, a co-sponsor of TechKnow.

DJ Carmichael started out as a financial broker in the 1890s helping resources explorers pursue gold exploration in the WA gold rushes of the late 19th Century. Today, the broker is proud to be “looking at a new gold rush for data and information” Mr. Eidne said. He went on to discuss some of the most important caveats investors should be looking for when considering a small-cap tech startup with a bright new disruptive idea.

“If you’re considering investing in a tech company being showcased here today, there are some essential elements and questions worth considering,” Eidne said.

- What business problem does the idea solve?

- How strong are performance metrics such as revenues, sales and earnings?

- How future-proof is the business idea?

- What is the monetisation plan?

- Is the business geographically diversified?

- What is the state of play with Management?

“If you ask a tech company what business problem are they solving, and they fail to give you a clear answer, it probably means they’ve not done enough in their market preparation,” Eidne said.

Tech companies must solve some kind of problem or inefficiency to become popular and establish revenue growth. This is often borne out in sales and revenue figures which are becoming increasingly important for new startups. “The days of the dotcom boom with any online startup being able to raise millions in days are over,” Eidne said.

One of the most important issues for Australian tech companies in particular is geography.

Australia has a population of around 25 million people which is a rather small market by global standards. “Successful ASX tech companies must consider the wider Asian and global markets that are larger and often see higher online participation compared to Australia. If revenue generation is spread across several territories with many verticals, it greatly improves the chances of that business succeeding in the long-term,” Eidne added.

Tech versus the Market

One of the macro themes still valid in the tech sector is that of valuation against benchmarks.

“Australian tech companies have outperformed the broader ASX 200 index by over 300% both in terms of valuation and real returns,” Eidne said.

This is mainly due to the overarching theme affecting most industries in the world today: Mechanisation.

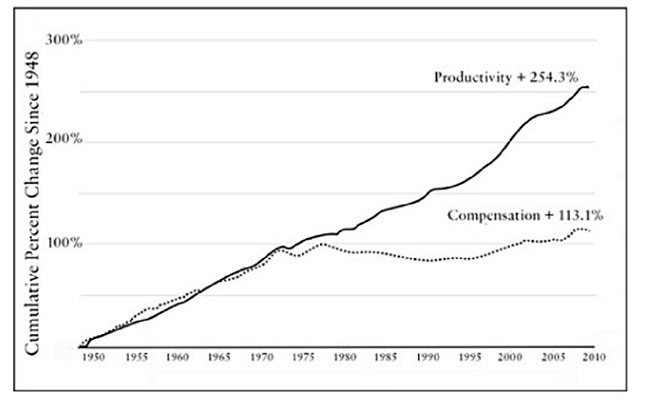

The Rise of the Machines and robotics has created a disconnect between wages and productivity. Whereas wage and income growth remain subdued, firm productivity and returns are growing – this is made possible by automation as robots do the jobs that humans used to do but in a much more efficient and cost-effective way.

The trend is repeated across all developed countries including the US, Australia, Europe and Asia.

Comparing US Hourly Compensation and Productivity since 1950 | Source: The Rise of the Robots: Technology and the Threat of a Jobless Future – Martin Ford

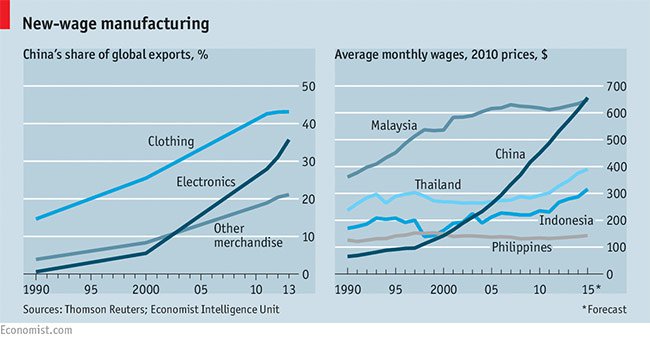

The theme of automation is even more pronounced in Asia. China’s rapid industrialisation phase has led to a situation where the country must now automate as quickly as possible in order to hold onto productivity gains made in the last decade.

“For China to stay competitive on an international basis, it will have to embrace automation,” Eidne said.

Robots are becoming increasingly able to accomplish complicated tasks and gaining greater market share of all market sectors. Examples seen already include the Roomba for consumers, automatic brick laying for construction and automated content creation for digital media companies.

The Rise of the Machines has only started and it will be one of the most dominant market themes for generations, affecting every market sector in the process.

Editor’s note: Finfeed is a sponsor of the TechKnow conference.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.