Targeting stocks that tap into the tourist dollar Part 2

Published 24-AUG-2017 12:04 P.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Yesterday, in part one of our Inbound travel feature, Finfeed looked at why it would be worthwhile to consider a more stable mass market to invest in, namely the travel and hospitality industry. Today Finfeed now looks at a number of ASX listed players that are well-positioned to cash in on spending from inbound tourism.

Despite the strength of many of the stocks in this article, it is important to note that any investment decision you make with regards to these stocks should be made with a cautious approach and your personal circumstances taken into account.

Flight Centre Travel

Flight Centre Travel (ASX: FLT) is the first and largest of the companies we examine with a market capitalisation of circa $4.6 billion. The company has a firmly established position in the Australian market, and through acquisitions and expansion into other geographic regions it has established itself as a high profile global brand.

Having been a listed company since 1995, FLT has established a robust financial record, consistently delivering profitability and earnings growth even at times when the tourism industry has faced headwinds.

This is important to keep in mind because there have been several short-term sell-offs in the company’s stock over the last 20 years. The advent of the Severe Acute Respiratory Syndrome (SARS) in 2002/2003 and the 911 terrorist atrocities, as well as other terrorist events such as Bali where many Australians were involved sent FLT’s shares into a tailspin.

However, look at the company’s share price chart and you won’t find any sustained downturn with a sharp falls mainly being blips that it quickly recovers from – indeed, these have historically been buying opportunities. You don’t often get blue-chip 10 baggers, but that is exactly the extent to which investors were rewarded who bought into the stock in the midst of the GFC.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

There were even stages where investors questioned whether the company with its traditional bricks and mortar point-of-sale could withstand the onslaught of online travel competitors.

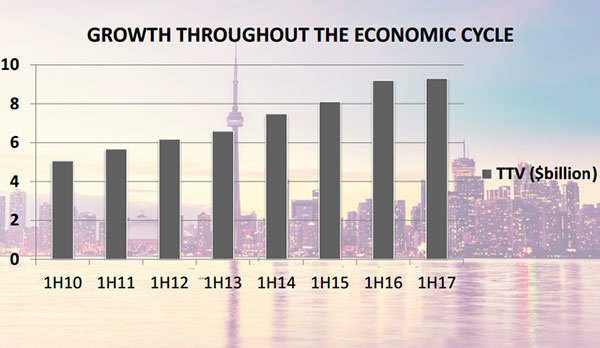

However, with a strong brand behind it FLT has been able to penetrate the online market and generated in the order of $1 billion in online total transaction value in fiscal 2017. The company’s TTV growth over the last seven years speaks for itself.

In fact, FLT has made an art form out of identifying new means of selling travel, having only recently added Travel Partners, a Sydney-based business with a strong sales force of home-based or mobile travel agents.

Consequently, it could be argued that the company’s omni-channel distribution network is unrivalled in Australia and many other countries throughout the world.

The company has a strong balance sheet, enabling it to not only pay quality dividends, but generate growth with the stroke of a pen. At the start of August the company announced that it had bolstered its Americas division by acquiring leading Québec City-based travel company Les Voyages Laurier du Vallon (LDV) for C$9.4 million, a transaction that should generate annual total transaction value of approximately C$100 million.

FLT is a one-stop shop for travel services with customers able to book flights, accommodation, car rental and special packages all at one point of sale with one customer attendant. Other services such as travel insurance can be organised as part of the process, perhaps emphasising that there will always be a place for bricks and mortar travel agents.

Mantra Group

Mantra Group (ASX: MTR) will report its fiscal 2017 result on Tuesday, August 29. Analysts at Morgans CIMB are forecasting a net profit of $46.5 million from revenues of $697 million.

Although broker projections are only estimates and may not be met.

This is below consensus with the analyst citing potential negative impacts from the fatal accident at Dreamworld (Gold Coast) and extreme weather conditions such as Cyclone Debbie.

However, MTR is a large organisation which could potentially handle one-off shocks such as these. The company has more than 21,000 rooms and circa 130 properties led by its own Mantra brand, as well as Peppers and Breakfree.

It was only a fortnight ago that the company announced it had added to its portfolio with an agreement to acquire The Art Series Hotel Group, comprising seven luxury four-five star unique hotels in popular cultural hubs in key capital cities of Australia. This will effectively add a further 1000 hotel suites and apartments, as well as a number of conference and event facilities, restaurants and luxury hotel style amenities.

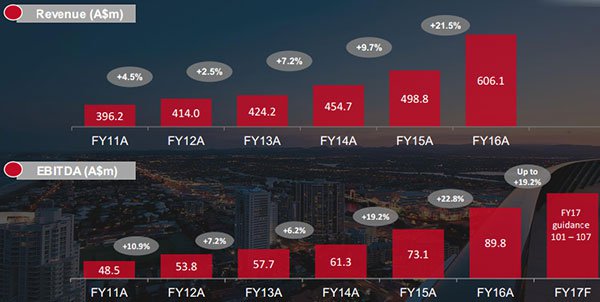

MTR has also demonstrated its ability to efficiently integrate new businesses, extracting maximum value as demonstrated below in its financial performance.

The acquisition is also expected to contribute approximately $7 million in underlying EBITDA in its first full year of ownership, increasing to circa $9 million once integrated. This indicates it is a significant addition to the group’s business as it represents nearly 10% of forecast EBITDA in fiscal 2017.

There is no doubt that negative sentiment has had a significant impact on the company’s share price. Between listing on the ASX in mid-2014 and December 2015, MTR’s shares had a virtually uninterrupted run from approximately $1.70 to an all-time high of $5.26.

However, the issues mentioned by Morgans, along with nervousness regarding the potential impact of the entry of www.airbnb.com.au saw its shares halve to a low of $2.58 in March 2017. Since then they have traded erratically, hitting a high of $3.22 in late July, but then falling to $2.70 in the following week.

Now in the vicinity of $3.00, the company’s shares are trading at a discount of approximately 12% to the consensus 12 month price target of $3.40.

However, much will hinge on next week’s result, in particular management’s outlook statement and it should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated.

As we mentioned with Flight Centre there will always be one-off incidents in the tourism industry that are beyond the company’s control. Importantly, in MTR’s case the events of Dreamworld and cyclones over the last 12 months are unlikely to impact how investors value the stock in fiscal 2018.

There will be a strong focus on how the company is competing with a major such as airbnb, but they tend to cater for different markets so this may not be as much of an issue as some may have anticipated.

Interestingly, MTR was sold down because of its Gold Coast exposure, but as the largest accommodation provider in that region it stands to cash in substantially in 2018.

On April 4, 2018, 6600 athletes and team officials from 70 nations, along with hundreds of thousands of spectators will converge onto the Gold Coast for the largest sporting event Australia will see this decade, resulting in an estimated $2 billion boost to the economy.

This suggests the company could increasingly be viewed as a 2018 story over the next 12 months, and if it is priced accordingly there could be a significant share price rerating.

SeaLink Travel Group

Although SeaLink Travel Group (ASX: SLK) only listed on the ASX in October 2013, it is a long established player in the tourism industry, and one with high profile brands. The company also has an impressive operational record, and this has been reflected in its stellar financial performance since listing.

Despite the relatively small market capitalisation of circa $80 million implied by the company’s IPO price of $1.10 per share, the company quickly rerated with its share price closing 36% higher than the IPO price on day one.

As a backdrop, SLK is a leading provider of cruises, ferry and charter services, and it also offers barge services which cater for both tourism and commercial clients. As well as operating its large fleet of 74 vessels, the company also coordinates activities such as day tours and specialised charter operations.

SLK even offers exclusive four-wheel-drive foreign-language adventure based tours, and as a retail travel agency and tour wholesaler to the travel trade, the company is well positioned to generate income from multiple sources.

SLK is strongly represented on the east coast of Australia and operates one of its longest serving businesses between mainland South Australia and Kangaroo Island where it provides passenger, vehicle and freight services.

The company has made every post a winner since listing on the ASX, generating strong organic growth as well as making earnings accretive acquisitions, initiatives that are now easier to undertake with increased access to capital.

This saw its shares traded as high as $4.85 in April 2016, and while it has tended to plateau since then this was understandable given it was cycling against a period of rapid growth and also investing in acquisitions, the value of which will be reflected more so in 2018.

Consequently, the recent retracement to circa $4.00 could represent a buying opportunity. Indeed, the consensus share price target of $4.90, implying upside of approximately 22%, is arguably more representative of the company’s prospects.

SLK announced some important initiatives in June/July which should provide near to medium-term earnings momentum. These included an expansion of its Captain Cook Cruises in Sydney after the New South Wales state government granted permission for a new ferry service to and from the International Convention Centre wharf and Circular Quay.

The company has a strong presence in this area as a major provider of commuter and tourist ferry services on Sydney Harbour. SLK recently announced that it would be using two of its fast passenger vessels including the 400 passenger jet ferry MV Capricornian Sunrise which has been redeployed from its Gladstone operations to provide the first-ever direct ferry service from Manly to Barangaroo.

Another important development was announced at the end of July with the company expanding its Captain Cook Cruises operations in Western Australia by introducing services to Rottnest Island. Operating between Freemantle and the main jetty on the island, the service will be coordinated to tie in with SLK’s Swan River operations, providing a seamless transfer between the two renowned tourist destinations.

Nearly 500,000 people visit Rottnest Island each year and management expects this to grow as the south-western corner becomes increasingly attractive, in part due to its high profile wine industry and pristine surf beaches.

Webjet

It could be argued that Webjet (ASX: WEB) is the most successful ASX listed online business in terms of making the transition to an e-commerce platform and then growing that operation over a period of 15 years.

While plenty of investors can rightly skite about jagging that elusive 10 bagger, when shares in WEB hit an all-time high of $13.19 at the start of August, the company which has emerged over the course of nearly 15 years since from a struggling player in the travel industry to finding its place in the burgeoning online travel space delivered loyal shareholders a 130 bagger.

Again, share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

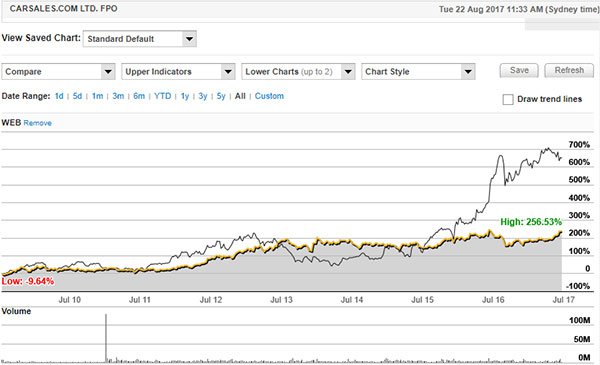

The chart below shows the rise and rise of a company that tends to be forgotten when analysts are singing the praises of stocks like carsales.com (ASX: CAR) whose shares have increased circa four-fold since listing on the ASX approximately eight years ago.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Even comparing the performance of the two companies since CAR listed demonstrates the substantial outperformance of WEB.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Importantly, this performance hasn’t been driven by dotcom hype with the company consistently delivering strong earnings growth over a sustained period of time.

Consensus forecasts for fiscal years 2017 and 2018 point to earnings per share growth of nearly 50% in both years, suggesting that the company’s fiscal 2018 PE multiple of 20 could be regarded as conservative.

Consensus forecasts for fiscal 2018 were only increased in the last week from approximately 50 cents per share to 58 cents per share.

This should be underpinned by the recent acquisition of JacTravel, a market leading European business to business travel operation with circa £400 million in annual total transaction value.

Management described the acquisition as transformational as it positions WEB as the second largest player in the European business to business market. It is definitely a step change for WEB with the current directly contracted hotel relationships of its WebBeds business increasing from approximately 10,000 to 17,000.

Management expects the acquisition will be circa 25% earnings per share accretive in fiscal 2017 on a pro-forma basis before synergies, indicating that once integration is complete and the synergies are realised, the fiscal 2018 impact will be substantial.

This acquisition also provides healthy diversification of revenues, and while the company maintains a prominent position in the Australian market, from a shareholder’s perspective the transaction is a game changer.

WEB releases its full-year result for fiscal 2017 on August 31, 2017, but the following highlights from its interim result indicate the strength of its business across the board.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.