Targeting stocks that tap into the tourist dollar Part 1

Published 23-AUG-2017 14:38 P.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While healthy headline unemployment numbers tend to suggest that household income is in a sweet spot, this is far from the case. The issue of underemployment whereby employees are not able to work the number of hours required to generate a reasonable income is a real problem.

A lack of wage growth has also put further pressure on household income, and this is evidenced in constrained consumer discretionary spending. Bricks and mortar retailers aren’t just struggling because of the transition to online purchasing, they are finding it increasingly difficult to generate top line growth because of depressed consumer spending.

Static wages, increased costs and potential for mortgage stress paints gloomy outlook

Combine these dynamics with the fact that essential services such as power and water, as well as many basic household items are appreciating in cost, particularly power where increases have been substantial, it is fair to draw the conclusion that the Australian population won’t be providing the economic growth that the country needs to pull out of the long-term hiatus which has persisted since the global financial crisis.

Should interest rates rise, the aforementioned issues combined with mortgage stress will negatively affect consumer spending, with a flow on effect to investment in the corporate sector and those that service a broad range of industries.

As a country still heavily reliant on the export of hard and soft commodities it is difficult to see where the growth is going to come from. Given these dynamics investors need to identify areas of the market where there is evidence of growth, and just as importantly signs that this can be sustained.

Follow the money trail

One way of going about this is to follow the money trail. For instance, what has been a key driver of the housing market at a time when Australian consumers are struggling to pay the bills? Overseas investment played a significant role to the point where the government had to stifle overseas investment by introducing financial hurdles.

Similarly, many of the big corporate buyouts in the resources and agricultural sectors are being funded by overseas investors with those domiciled in China and other Asian regions at the forefront of these transactions.

However, with the property sector poised to retrace and investment in the next takeover target in the resources sector particularly difficult to identify it may be worthwhile considering a mass-market which is more stable, namely the travel and hospitality industry.

Tapping into overseas investment

There is ample evidence in Australian Bureau of Statistics (ABS) data, as well as the performance of ASX listed companies exposed to the inbound travel and hospitality industries to suggest that targeting specific stocks that generate income from overseas visitors could be a useful investment strategy.

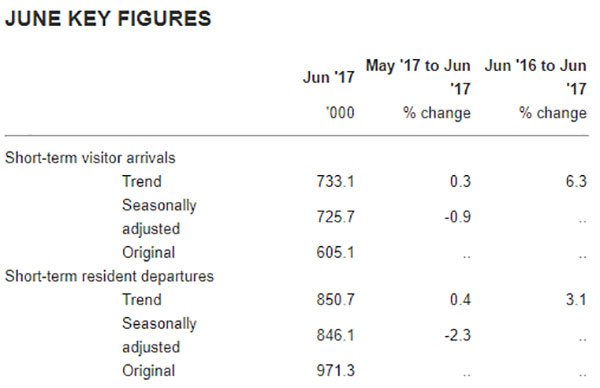

For example, examine the following recent ABS data and it is clearly evident that inbound tourism is alive and well with 6.3% year-on-year growth to June 30, 2017.

Also in June, Sydney Airport (ASX: SYD) recorded outstanding growth with Managing Director Kerry Mather commenting, “International traffic growth of 9.7% compared with the prior corresponding period is a fantastic result, and represents our strongest monthly result this year”.

Note that domestic traffic grew by a much more moderate 3.6% during the same period.

It was only on Friday that SYD provided July traffic numbers, which reflected a similar trend with international travel up 7.6% while domestic growth trended even lower to 1.4%.

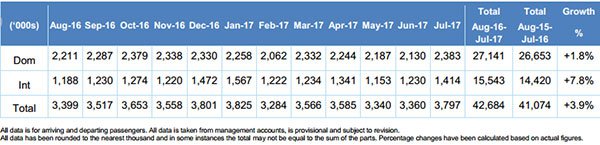

The following airport traffic data from SYD provides a good insight into the sustained strong performance over the last 12 months. While month on month figures fluctuated due to seasonal factors such as the Christmas period, the overall trend was impressive as indicated by the 12 month increase of 7.8%.

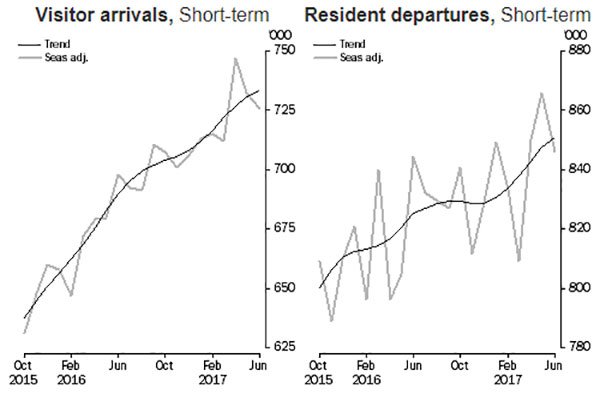

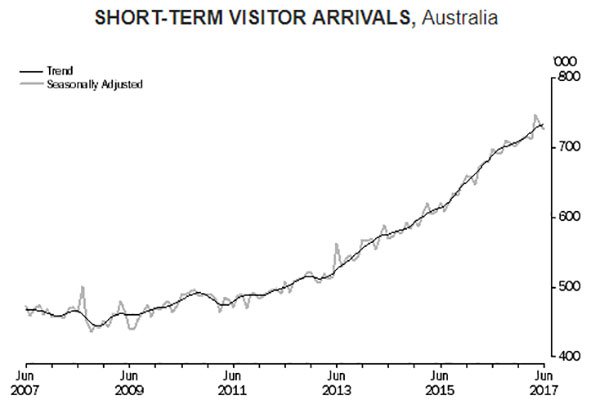

The following ABS data provides further evidence of this long-term trend, also indicating the extremely strong growth between 2015 and 2017.

Countries with strong growth account for largest proportion of inbound travel

While not all that significant in terms of identifying which ASX listed stocks to target, the following ABS data is evidence that economies with the stronger economic growth profiles account for the lion’s share of inbound travel.

It is worth noting that SYD has just announced a new service from another mainland Chinese airline, Beijing Capital Airlines, which serves its 15th mainland Chinese city, Qingdao. Seven Chinese airlines now provide services to Sydney Airport.

The chart below this table further reinforces the fact that the increase in inbound tourism and the associated income generated from that source is not a blip, it is a trend that has been building over the course of nearly 10 years.

Direct correlation between inbound travel and financial performance

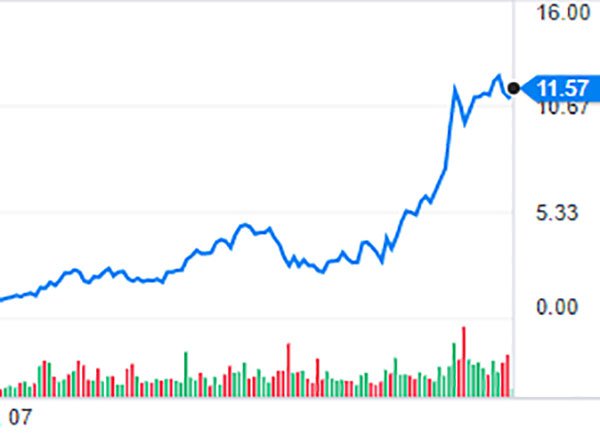

And if you aren’t convinced there is a correlation between this trend and the fortunes of ASX listed companies, check out these share price charts which cover the last 10 years.

Webjet (WEB)

Flight Centre (FLT)

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

In order to highlight the longer term trend in tomorrow’s follow up we will illustrate the share price performances of some of the more established players in the market, but there are others worth considering.

A factor worth noting, and arguably one that is overlooked by some considering these stocks, is that they generate a significant proportion of income from inbound tourism even though they are based in Australia.

For example, when Webjet (ASX: WEB) delivered its interim result in February the company noted that international bookings had grown by 24%, outstripping the 8% growth delivered by domestic bookings. Furthermore, international total transaction value (TTV) accounted for 37% of the group’s overall operations.

With regard to Flight Centre (ASX: FLT) it has operations in a number of overseas countries which contribute to group revenues. In fact, nine of FLT’s 10 countries/regions delivered record first half TTV in local currency, and Europe, South Africa and mainland China generated record first half profits.

That gives you a taste of what to expect in tomorrow’s coverage, where we look at FLT, WEB, Mantra Group (ASX:MTR) and SeaLink Travel Group (ASX: SLK) in more detail.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.