Strong retail momentum continues but be selective, Part 2

Published 10-JUL-2018 14:32 P.M.

|

8 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After yesterday examining some of the basic retail areas such as supermarkets, grocery stores and department stores with limited investment options, today we are presented with a wide range of stocks to choose from across popular sectors.

One of the sectors involves the home, with companies active in areas such as construction and renovation under the microscope.

We also look at the takeaway food services sector and come up with the stock idea that perhaps only a few think of in terms of what fits into the cafe and restaurant space.

The other two areas relate to the pharmaceutical and clothing industries with the latter presenting an interesting option in terms of taking advantage of consolidation in the women’s fashion sub-sector.

Hardware, building and garden supplies

This could be one for the yield chasers.

The sector has been extremely resilient over many years, and this year is no exception with year-on-year growth of 1.5 per cent and May turnover being 2.7 per cent ahead of April.

Investors looking for some growth exposure could consider Reliance Worldwide Corporation (ASX:RWC), a prominent player in the design, manufacture and supply of high quality premium branded water flow and plumbing products.

Those considering this stock shouldn’t make assumptions regarding future sales, nor should they base investment decisions on performances to date. Those considering this stock should seek independent financial advice.

However, the company’s shares have nearly doubled in the last 12 months, and with a fiscal 2018 PE multiple of 35, the two-year compound annual earnings per share growth rate of circa 30 per cent appears to be factored in.

Perhaps this is reflected in the consensus share price target of $4.82 which represents a significant discount to the recent trading range of $5.50.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

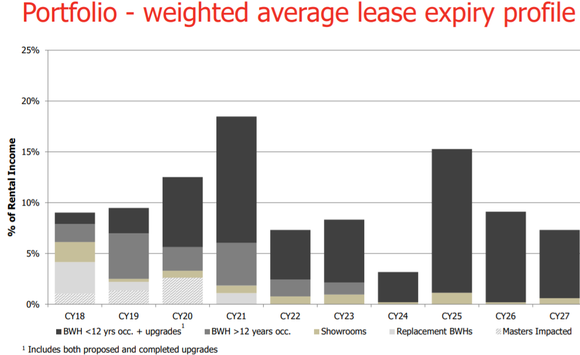

BWP Trust (ASX:BWP) had 79 Bunnings Warehouse properties in its portfolio as at the end of December 2017.

The company has consistently delivered strong dividends and dividend growth.

Its ability to continue to outperform expectations is assisted by predetermined rental reviews, as well as the sustainable expansion of its property portfolio.

The performance of Bunnings stores has been strong, indicating that it shouldn’t be in a position where it is faced with rental defaults.

Most rental agreements are over a long-term providing earnings and dividend predictability and visibility.

Management recently informed the market that it would be paying a final dividend of 9 cents, bringing the full year dividend to 18 cents. This implies a yield of 5.5 per cent relative to Thursday’s closing price of $3.28 - much better than bank interest.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Takeaway food services

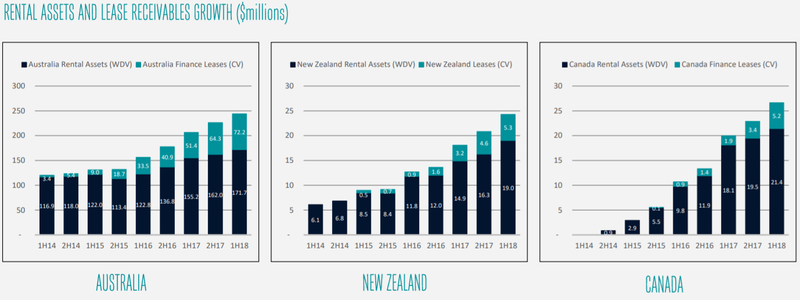

Silver Chef (ASX:SIV) has had a tough year, making some hard decisions, most notably shutting down its GoGetta equipment hire business.

That said, exiting the underperforming business was the only option and with Silver Chef returning to its roots as a provider of products to the hospitality industry on a long-term rental basis it could be poised for a turnaround.

When the company delivers its fiscal 2018 result in August, it will take the financial hits that come with the decisions taken.

However, investors don’t seem to be able to see past that, as its share price is languishing in the vicinity of $3.00.

What should be noted is that despite these circumstances the company’s hospitality business still expects to deliver an underlying pre-tax profit of circa $18 million.

With the company poised to operate off a low cost base and without the impost of one-off write-downs in fiscal 2019 one would expect the group’s financials to appear markedly better.

This is a company that for a period of more than 10 years since listing in 2005 consistently delivered strong earnings and dividend growth by employing a very simple business model.

It services the cafe and restaurant market which is the second best performing retail sector on a year-on-year basis, and it also should be noted that turnover from the ‘other specialised food retailing’ sector was up 2.9 per cent on a year-on-year basis in May.

Consequently, Silver Chef appears to have exposure to buoyant markets and looking to the future it should benefit from expansion in North America where it can generate strong growth off a low base due to its comparatively recent entry into that region.

Pharmaceutical, cosmetic and toiletry goods retailing

It has been a strong year for the pharmaceutical industry with year-on-year growth of 3.9 per cent.

One of the benefits of the industry is that a significant proportion of revenues are generated through non-discretionary spending.

With an ageing population there should be natural organic growth in health-related revenues.

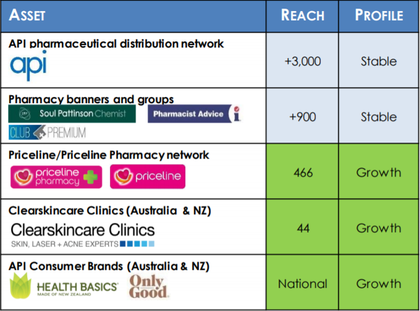

It is hard to go past Australian Pharmaceutical Industries (ASX:API) in this sector given that it has circa 460 pharmacies in every corner of Australia with a premium stable of brands including Priceline, Soul Pattinson and Pharmacist Advice.

The company is financially robust, leaving it well-placed to continue to grow through store expansion.

API recently demonstrated its ability to push into adjacent markets with the $127 million acquisition of Clearskinclear Clinics.

Management views the addition of the business as highly compelling and complementary, providing diversification and the potential for accelerated growth.

Through its existing business, API believes that it has a clear understanding of customer demographics in the health and beauty industry and with its proven operational capabilities in network growth, retail marketing and consumer goods development this could be a one plus one makes three transaction.

Analysts at Blue Ocean Equities estimate that the acquisition will be 8.5 per cent EPS accretive in fiscal 2019, prompting the broker to increase its valuation and price target from $1.80 to $2.00. This implies circa 30 per cent share price upside relative to Thursday’s closing price of $1.50.

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

Clothing retailing

The clothing sector has performed strongly with year-on-year growth of 2.1 per cent and May turnover 3.5 per cent ahead of April.

This has provided share price momentum for many players in the sector including the large diversified retailer, Premier Investments (ASX:PMV), as the company’s share price recently hit a 12 month high of $17.37, only just shy of its all-time high of $17.92.

Noni B (ASX:NBL) has also benefited from positive sector sentiment with its shares increasing from $1.70 to circa $3.00 in the last 12 months.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

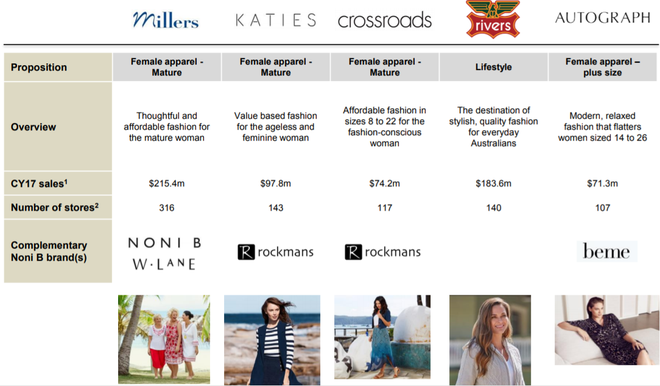

There was a significant development in May when the company announced the proposed acquisition of Specialty Fashion Group’s (ASX:SFH) portfolio of key brands including Millers, Katies, Crossroads, Autograph and Rivers.

This provides Noni B with the benefits of scale which include improved buying power and a significant increase in its share of the women’s clothing market.

Post the acquisition, the company will be one of the largest women’s apparel retailers in Australia with over 1350 stores across nine brands.

The acquisition prompted analysts at Morgans to increase their price target from $2.73 to $3.50 which implies upside of nearly 20 per cent relative to Thursday’s closing price of $3.03.

The addition of these stores will generate medium-term earnings growth as they are brought under the Noni B umbrella.

The most significant increase in annual EPS projections made by Morgans was in fiscal 2020 with a 38 per cent lift to 34 cents per share.

This implies a forward PE multiple of 8.9 which appears conservative given the company now has one of the best medium-term growth profiles in the sector.

The company also presents as an attractive yield play from fiscal 2020 with Morgan’s forecasting a dividend of 20 cents per share, implying a yield of 6.6 per cent.

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

Tomorrow we look at companies that are active in the footwear, furniture and fun and fitness sectors, as well as an interesting play in the liquor retailing space.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.