Strong gains despite dour end to the week

Published 01-MAY-2017 10:06 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While not giving up all of the strong gains made during the week, global markets trended lower on Friday with the Dow coming off 0.2% to close at 12,940 points and the NASDAQ falling slightly, closing at 6047 points.

Given there were some stellar surges in the Dow in the early part of 2017, the fact that the week just gone was the best to date with a gain of 1.9% demonstrates the degree of confidence remaining in equity markets.

This has mainly been supported by an impressive earnings season where there have been more beats than underperformances, suggesting that there could be more momentum in the last two weeks of reporting season.

In Europe though, figures released by Eurostat regarding core inflation for energy and food reflected an inflation rate of 1.2%, a four year high and above consensus of 1%.

This appeared to impact the FTSE 100 as it came off 0.5% to close at 7203 points.

However, the DAX and Paris CAC 40 were relatively unaffected with declines of less than 0.1%. They closed the week out at 12,438 points and 5267 points respectively.

On the commodities front, oil regained some ground, hitting an intraday high of US$49.76 per barrel before closing at US$49.19 per barrel.

Despite being sold down from circa US$1280 per ounce levels amidst the surge in equity markets during the week, there is still support for the precious metal as it closed just shy of US$1270 per ounce on Friday.

Iron ore also made a comeback of sorts, gaining nearly 4% to US$68.80 per tonne.

Time to rethink base metals

There was strong support for base metals with lead leading the way as it gained nearly 2%.

Nickel was also impressive gaining more than 1% to close at its high for the week of US$4.26 per pound.

Zinc rallied nearly 1%, and its close of nearly US$1.19 per pound represented the top end of a three-week range it has traded in post a sell-off that occurred in late March/early April.

Copper also finished at its highest level in approximately three weeks, closing at circa US$2.59 per pound.

With copper having now strung together five gains out of the last seven trading days there appears to be some confidence showing through which is normally a good guide to the performance of other base metals.

It is worth noting that the timing of this positive momentum coincides with a noticeable decline in 30 day London Metals Exchange copper warehouse stock levels.

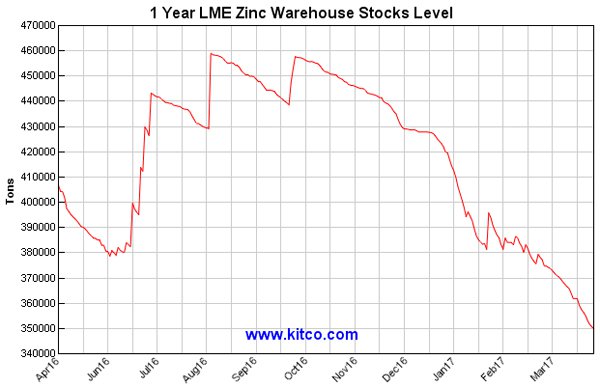

Zinc is the other metal to watch in terms of inventory levels. The decline in one year LME zinc warehouse levels from circa 460,000 tonnes in mid-2016 to approximately 380,000 tonnes in January was a significant fundamental underpinning the metal’s increase from approximately US$0.90 per pound in mid-2016 to more than US$1.30 per pound in January 2017.

This sharp decline was arrested in February/March, triggering a retracement in zinc prices. However, it has resumed in April and appears to be accelerating with warehouse levels now hovering in the vicinity of 350,000 tonnes, the lowest they have been in more than five years.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.