Steel driving the next coal boom

Published 07-SEP-2017 11:53 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

We will always need coal, even in a future where all our power is generated from renewable sources.

When you mention coal to someone, it’s usually a safe bet that they assume that you mean thermal coal; the kind of coal that is burned en masse to boil water, turn steam turbines, and generate power.

Much has been written about the need to reduce our reliance on thermal coal, but regardless of what your beliefs on this are, it is hard to argue against the bright future of the other type of coal: coking coal.

Coking coal is currently trading at roughly twice the price of thermal coal, and coking coal producers are therefore enjoying high margins, and in many cases, strong profits. Coking coal is an essential component in the production of steel, and this is why demand for it is likely to continue to flourish.

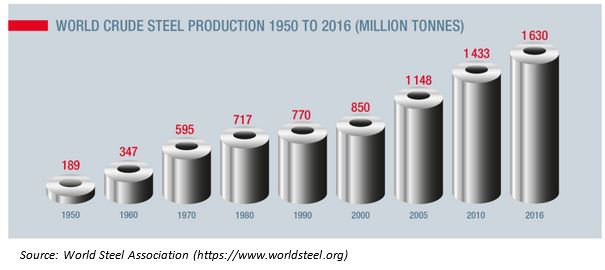

Global steel production is booming thanks to ongoing development in Asia, particularly from China and India, and Australia is well placed to capitalise on the surging demand for steel’s raw ingredients. According to the World Steel Association, global steel production has roughly doubled over the past 20 years, and is expected to grow further.

Despite, China’s reputation as the most important customer for Australian minerals, it is actually India that is scheduled to be the biggest customer for Australian coking coal according to Vivek Dhar, mining and energy analyst at the Commonwealth Bank.

“India’s promising steel production growth offers more opportunities in coking coal than iron ore,” he said. “India has enough local iron ore to help expand domestic steel output, which is growing at a world-leading pace.

“An absence of good-quality coking coal will mean that India will likely become the main consumer of Australian coking coal in coming years.”

Freight rail firm Aurizon agrees, stating that Australia has one of the lowest freight costs from mine mouth to customers in Asia compared to competing seaborne coking coal suppliers.

It is against this backdrop that coking coal prices are rising. After trading below $US100/t for parts of 2016, prices are now trading near $US200/t.

Indeed, early this week, Macquarie bank lifted its Q1 and Q2 2018 price forecasts for coking coal by 32 and 40 percent respectively, which they say is due to Chinese re-stocking and a tightening coal supply.

This may be why Anglo American has reversed its decision to divest from Australian coking coal, and why Peabody energy’s Australian coal business (predominantly coking coal) is the largest profit contributor to its bottom line.

All in all, the fundamentals are looking great for the Australian coking coal industry.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.