Spirit Telecom – The nimble, ‘One-Stop’ Telco shop that has caught investor attention

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The current Covid-19-inspired global lockdown has demonstrated the extent of the community’s reliance on the telecommunications industry: its networks, apps, conferencing tools and IT solutions have all been utilised to the fullest extent.

Businesses have had to adjust quickly to this new environment, with billions of people now dependent on their internet connection to work.

It was always going to be a good year for the telcos, with 5G entering the fray.

Kevin Westcott, Vice Chairman and US telecommunications, media, and entertainment leader from Deloitte LLP says, “The transition to 5G is expected to generate a windfall for network, infrastructure, and equipment vendors. Gartner predicts that worldwide 5G network infrastructure revenues will touch $4.2 billion in 2020, recording year-over-year growth of 89 percent.”

Westcott adds that 5G will open up industries such as Manufacturing, Healthcare (e.g., for telemedicine solutions), Retail, Transportation, and Education (e.g., for distance learning).

The advent of COVID-19 seems to have accelerated the industry’s infiltration into these industries.

Acquisitive small cap telco, Spirit Telecom (ASX:ST1) is an emerging challenger brand; a company that is nimble and executing a simple growth strategy in multiple key target markets including Healthcare and Education.

Spirit is a modern, ‘One-Stop’ shop for Telco and IT Services that can transform organisations.

It is one Telco to watch as the world adjusts to its new normal.

The Spirit story

ST1 has transformed itself from a 2005 telco reseller to an ASX listed IT&T provider and in doing so has become one of the more touted small cap telcos in the country.

The company has a stack of accolades to its name, including making the 2011 and 2012 BRW Fast 100 list, being named Australia’s Fastest ISP (the company offers symmetrical Internet speeds ranging from 25Mbps to a whopping 1Gbps) for two years in a row in 2015 and 2016 – when it listed – and listed in Deloitte’s Fast 500 in 2017 and 2018.

According to recently minted CEO Sol Lukatsky, who took over the reins in September 2019, the company’s vision “is really to be Australia's leading provider of IT&T to small businesses and essential services. The company has a reliable fixed wireless network and the ability to sell ‘over the top services’ across that network as part of that vision. There is little value just selling High-Speed Internet these days. Businesses are demanding bundled Internet & IT services.”

Spirit’s growth during this period has been two pronged: a mix of organic advancement and acquisition that has broadened its offering from ‘just selling High-Speed Internet’.

Its first acquisition was solutions-focused telecom, Voxcom, which facilitated businesses by setting up 1300 and 1800 numbers. In 2015, the company acquired My Telecom and in 2017 Phone Names & World Without Wires. The latter of the two, acquired for $4.6 million, was a wireless provider that generated $2.6 million in revenue in 2016, with $1 million in EBITDA and $607,000 net profit.

World Without Wires is typical of Spirit’s acquisition strategy.

“We look for the ‘right’ deals, which means bringing the ‘right’ people, and the ‘right’ profitable acquisitions into the Spirit Team,” Lukatsky says.

“People and profit are the first principles we look at. Then we look at strategic fit in terms of does it give us a new product or a new service? Does it give us geographic expansion? In all these things, you want a one plus one equals four type deal. So just bolting on an extra business isn’t a great strategy. That’s a one plus one scenario. If you can bolt on the ‘right’ people, the ‘right’ profit margins, data, new channels, new sales channels, and new products, then that's a one plus one equals four deal.”

Over the journey, Spirit has developed its own advanced fixed wireless network, which means it can provide Australian small to medium sized-businesses (SMBs) with Sky-Speed Internet, along with Managed IT Services and cloud-based business solutions.

“Our Managed IT Services mean you don’t have to worry about making sure IT works. Instead you can focus on running your business, powered by our Sky-Speed Internet.”

Spirit is continuing to expand its reach and looking for ways to provide more Australian businesses with the connectivity and tools they need.

As such, it has been on a heavy acquisition trail.

Editor’s note: To learn more about Spirit Telecom and how it on track to becoming Australia’s leading Telco & I.T. company, the company is hosting an investor webinar on Friday 15 May.

Click the link below to register your interest:

Recent acquisitions open up essential services

Spirit’s recent acquisitions have given it greater strength to deliver custom designed cloud-based technology and internet solutions into high growth markets such as Schools, Hospitals, Aged Care Facilities and Medium-Sized Businesses.

In January, Spirit acquired Sydney based Cloud Business Technologies (CBT). This was an important acquisition in the current climate as it gives the company a cyber security offering.

“That acquisition delivered us a Cyber Security practise within an engineering skillset. Ransomware and cyber security fraud is probably the second or the third largest lead generator for our IT business.”

In February, Spirit completed the acquisition of the Trident & Neptune Group, a transaction which is directly aligned with strengthening Spirit’s share of these designated markets.

Trident and Neptune generated combined revenue of $34 million in fiscal 2019.

The revenue impact of acquisitions over the last 12 months is impressive.

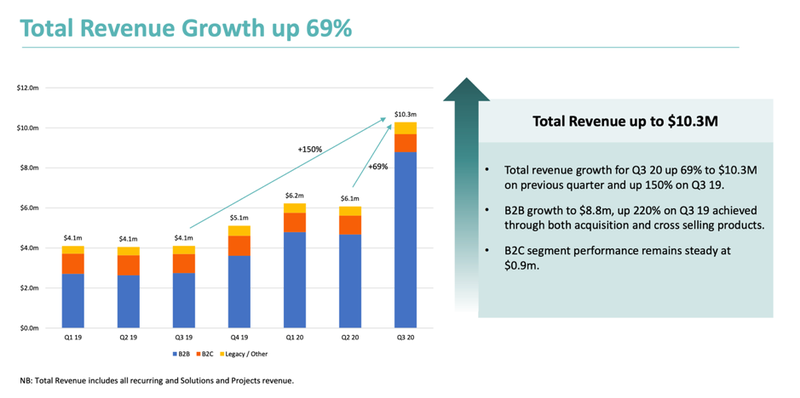

Revenues grew to $10.3M in Q3 up 69% on Q2 20 and up 150% on Q319. Additionally, Solutions and Projects revenue is up: $3.3M to $4.0M in Q320.

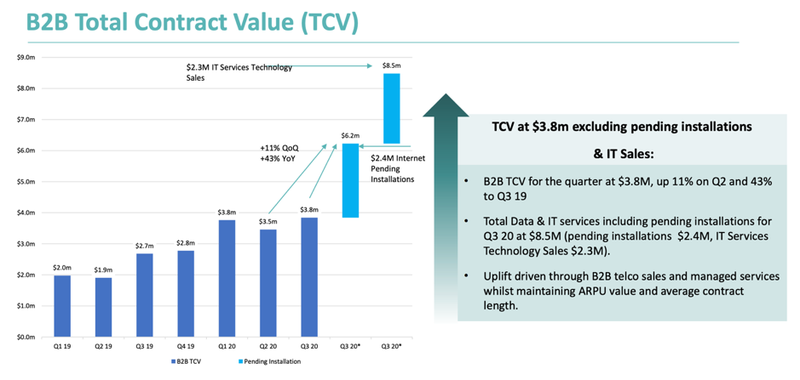

Also impressive is the rise in new Sales/Total Contract Value (TCV) coming out of these acquisitions.

Note the TCV for business-to-business in the last quarter was up 43% from Q3 2019, whilst total data and IT services including pending installations for Q320 is $8.5 million.

The acquisition of the Trident and Neptune Group saw Spirit create a new business division in Trident Technology Solutions, providing the group with opportunities to cross sell into Schools, Hospitals and Aged Care Facilities among other essential service industries, which should continue to add significantly to contract growth.

These types of clients are moving through a major generational technology change as they migrate to the cloud and require High-Speed Internet and specialised tech services which Spirit can now provide nationally.

For instance, Spirit was recently engaged to work at schools in Horsham and Toorak in Victoria, due to Internet reliability being compromised, further compromising their IT dependent teaching approach.

Spirit is now providing High-Speed Internet at both sites that is not vulnerable to traffic congestion, which is vital, particularly in Victoria, in this time of remote learning.

“We have launched all these services at reduced prices to the schools, to not only maintain our goal of ensuring affordability and flexibility during this challenging time, but also do our part in the broader community’s efforts to prevent the transmission of COVID-19.”

“As businesses and schools address this unprecedented situation, they need to ensure their bandwidth remains operational and secure against strains caused by increased usage on their networks, without a compromise on speed or quality of connection,” Lukatsky said.

The rapidly changing environment that is being caused by the COVID-19 virus presents Spirit with additional traction to drive an accelerated growth agenda through mergers and acquisitions.

“This is a transformational period for Spirit and through the acquisition of these businesses, Spirit will build and strengthen Cloud, Security, Data and Managed IT Service capabilities whilst providing entry into target growth verticals including Schools, Health (hospitals and medical centres) and Aged Care Facilities.

“The existing Spirit information technology and telecommunications division will continue to focus on the SMB (small to medium sized businesses) sector with the new Trident Technology Solutions Division targeting higher value complex segments.”

Through these acquisitions and acquisitions to come throughout 2020, the company hopes it can significantly build on its current market cap of $55 million. The company expects to be generating revenues at a run rate of circa $80 million by the end of calendar year 2021, which could have a material impact.

Capital Raise & More Acquisitions to come

An aggressive acquisition cadence will continue.

Lukatsky says “there are two to three acquisitions in the pipeline that are in either due diligence or negotiation stage across both Telco and MSP

“And,” he says, “we are being approached from different advisors and different vendors about joining us.”

In Spirit’s case, patience is a virtue. Its due diligence, which includes looking at profits and people is, in many companies’ cases, best for Shareholders.

“We're patient because we think being patient in this marketplace will deliver a better return to Shareholders as deals get done. We get more value for our money from acquisitions, especially when we ensure they fit our strategy.”

This month the company completed a capital raise to the tune of $9.2 million. Part of these funds were used to complete the Trident acquisition. Notably, the company has completed seven acquisitions, which has allowed it to solidify its position as a leading provider of High-Speed Internet & IT / MSP Services to SMBs and essential industries such as Hospitals, Schools, Aged Care Facilities and Government.

Funds will also be used to service further acquisitions, as well as expand ‘Spirit X’ – the company’s telco digital sales platform which generated 3200 service qualifications in its first three months of operation across Q320.

“Over the past 12 months we have transformed the company from being a fixed wireless provider to a fully integrated Telco & IT services company which provides High-Speed Internet, IT Services, Cloud, Security and Voice Products.

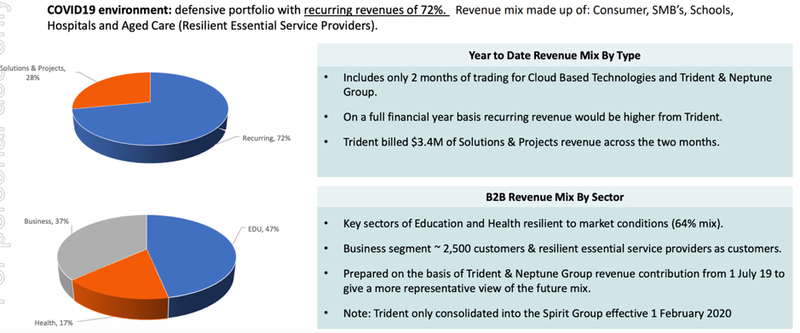

“We are now a leader in bundling these products into one service and one bill. We have been effective in cross-selling, delivering growth in recurring revenue with a sticky customer base in SMB and essential industries. This puts us in a strong and defensive position, in an uncertain economic environment – with 74% of our revenues being contracted and recurring.

“With all four of our 2019 acquisitions now integrated and having proven the effectiveness of this approach in the Q320 results, we have a unique opportunity now to acquire profitable businesses at lower multiples.

“We will continue to seek out opportunities that complement our strategy in terms enabling expansion of our service offering and geographic footprint in both Telco and IT/MSP Services.”

The current acquisition targets identified have >$35 million in annuity based revenue.

Telco in a COVID and Post-COVID world

The current COVID-19 environment provides a unique opportunity to drive an accelerated growth agenda via M&A, as asset prices in Telco and IT/MSP services companies become more attractive.

The pandemic also highlights the company’s diverse and defensive revenue mix.

Of course, the pandemic has brought out the humanity in many businesses and Spirit is no exception.

The company has set up a Corona Control Centre on its website, which identifies services needed during this time. The company has modified existing products specifically for people who are working from home and offers reduced pricing and 24/7 support.

To help struggling businesses during this time, Spirit has launched zero-month, three-month, and six-month terms on its high speed data products.

“This works for businesses who obviously see volatility and maybe don't want to get into long term contracts,” Lukatsky says.

“And for our IT services, we recently launched zero term IT Services Contracts.”

What COVID-19 has actually demonstrated about Spirit, is how nimble the company is; how adaptable to changing environments; and how, as a small company itself, is able to understand the needs of its SMB clientele and act accordingly.

As such, Spirit can fill a gap that some of the bigger Telcos can’t service.

To be able to act in the way it does, means that it can continue to strengthen its brand, as it looks at further acquisitions to bolster its product and service offerings.

At its essence, Spirit is a growth story and a challenger brand that is challenging Telcos big guns and succeeding in doing so.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.