SMSFs expected to outperform in the age of COVID-19

Published 23-MAR-2020 12:40 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Self managed superannuation funds (SMSFs) could avoid the full brunt of COVID-19’s impact on financial markets, thanks to higher than average exposures to cash and other low-volatility assets.

One quarter of the SMSF sector is held in cash and about 45% is held in shares, compared to other super funds that hold 10% in cash and 60% in shares on average.

“This heavy exposure to low risk assets like cash may prove to be fruitful in the current COVID-19 climate as they may be better protected than the average not-for-profit and retail fund,” said executive director of research at Rainmaker Information, Alex Dunnin.

“Some super funds’ diversified default investment options have fallen 10-15% as a result of the current market conditions.”

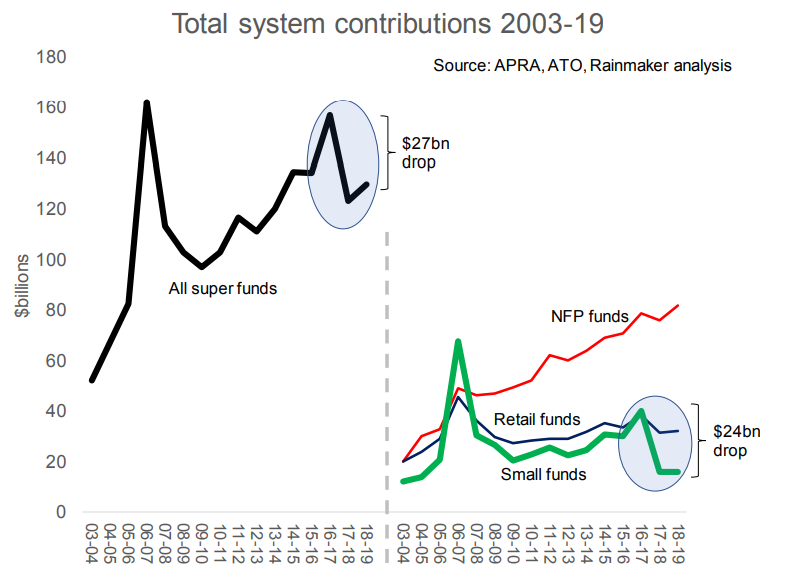

Despite their potential strength in the current climate, contributions into SMSFs and small APRA funds fell by 60% over the last two years, according to research from Rainmaker Information, published in their Advantage Report.

SMSFs reached a peak of 33% of all superannuation funds under management (FUM) in 2012, though this has since dropped to 26%, which is around $750 billion.

“A higher than average exposure to cash previously dampened the returns of the average SMSF when compared to a retail or not-for-profit fund, so perhaps it also damaged their appeal.”

Interest in SMSFs has slowed in recent times, with the number of SMSFs being started each year falling almost 75% from their peak.

Ten years ago there were a net 40,000 SMSFs started each year, though only 12,000 were started in 2019.

Simultaneously overall annual superannuation contributions have fallen from $157 billion to $130 billion, and SMSFs made up 90% of the reductions.

This number is even more significant given that SMSFs only make up 9% of all superannuation members in Australia.

A key cause of the reduction in contributions into SMSFs appears to have been the introduction of the Transfer Balance Cap (TBC) in 2017.

The TBC removed unlimited tax concessions for retirees with large account balances.

Following its introduction retirees with large balances, many of whom were likely members of small funds, appear to have responded by significantly reducing their contributions.

“The drop in contributions has been so extreme that SMSFs are only marginally ahead of the retail fund segment, which fell out of favour with Australians after the global financial crisis,” Dunnin said.

Other determining factors contributing to a decline in contributions are increased regulatory scrutiny, reductions in their taxation advantages and persistent attention on the segment’s low benchmark investment returns.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.