Safe Havens on the Rise as Investors Fret Over Geopolitics

Published 13-APR-2017 10:27 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Last Thursday two US ships launched cruise missiles at a Syrian airbase, in response to a Syrian chemical weapons attack. The attack followed warnings from the Trump administration that chemical weapons attacks were an un-crossable red line for the Syrian regime. Despite this, I doubt many expected the subsequent missile strikes, with news of the strikes sending US stock market futures lower.

US shares quickly levelled out, as it became clear that Syria’s powerful ally Russia would most likely overlook the attack. However, Donald Trump has since ramped up his warnings against the North Korean regime, with the rogue nation responding that they will launch a nuclear strike if provoked.

Whilst North Korea is often supported by its neighbour China, the Rogue Nation’s increasingly frequent missile and nuclear weapons tests appear to be pushing away its powerful ally.

This fresh round of sabre rattling has once again rattled stock markets, with most share markets failing to post any gains this week.

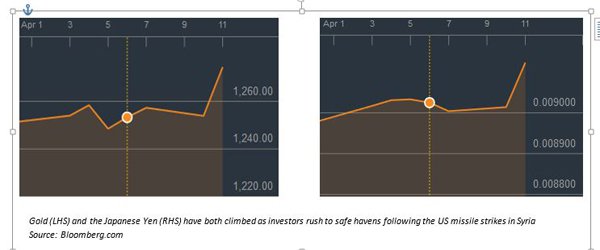

With stock markets falling on geopolitical tensions, investors are rushing for safe haven assets. Gold and the Japanese Yen, both seen as safe stores of value, have risen to five-month highs relative to the US dollar, with the Yen yesterday recording its biggest one-day rise since January.

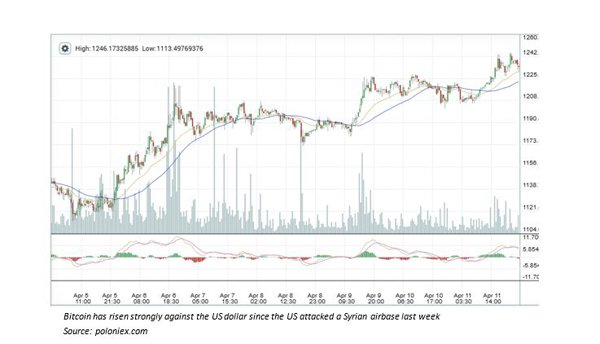

Other potential safe havens have also seen an influx of cash, with strong rises in cryptocurrencies such as Bitcoin since the missile strike on the 6th of April. Bitcoin proponents state that the currency will act increasingly as a monetary refuge, due to its relative insulation from authorities and financial markets.

Another indication of market uncertainty has been the movements in the US VIX index; an index that measures volatility of the S&P 500. The index, which is referred to as the “fear index”, hit its highest level since November, highlighting the anxiety that investors are experiencing over the Trump Administration’s increasingly aggressive foreign policy.

I think the Trump administration is unlikely to launch fresh strikes in the short-term unless provoked. However, the attacks were well supported in the US and led to a small increase in Trump’s approval rating. If I were a Syrian or North Korean military leader, I’d certainly be trying my best to avoid giving him an excuse.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.