Ruralco outperforms last year’s record first-quarter earnings

Published 23-JAN-2017 14:19 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

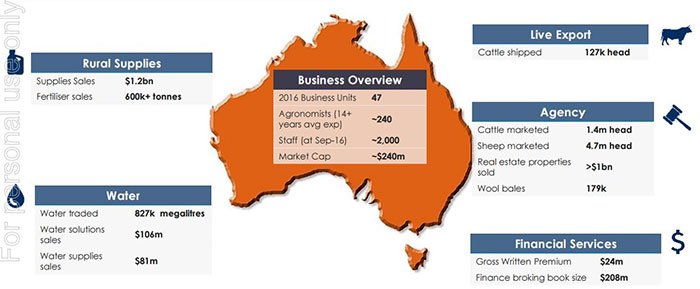

Ruralco (ASX: RHL) informed the market on Monday morning that it had experienced positive trading conditions across most of its businesses in the three months to December 31, 2016, a development that appears to have been well received with the company’s shares hitting a high of $2.96 in the first 15 minutes of trading this morning, representing an increase of more than 7%.

It should be noted that broker projections and price targets mentioned in this article are only estimates and may not be met. Also, historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

The group reports its full-year result on a September 30 basis, making this the company’s first-quarter result for fiscal 2017.

From an operational perspective, rainfall in the latter part of last year has been favourable for its summer cropping season with increased plantings of cotton and rice.

The group has also seen growth in sales of agricultural chemicals and pre-season fertilisers, reflecting improved farmer confidence. This has in turn generated robust cash flows from increased demand for general rural merchandise.

While Ruralco’s water business has experienced challenging conditions with above average rainfall experienced in the first quarter in South Australia, and recent and continuing warm weather in Tasmania where the group has a major project underway, management expects a full recovery of earnings by the end of year.

Ruralco enters 2017 with strong sales pipeline and improved livestock and wool pricing

Following the successful restructure of Ruralco’s live export operations in 2016, volumes have increased on the same period last year with a solid sales pipeline in place for the next quarter.

Over the next three months the recent rainfall and the availability of the irrigation water in a number of regions is expected to continue the demand for rural supplies products and services. This combined with continuing strong livestock volumes and prices and the recent uplift in the wool market are expected to underpinned agency trading conditions.

After Ruralco delivered its full-year result in November, Bell Potter maintained its hold recommendation while slightly increasing its 12 month price target from $2.88 to $2.98, implying a slight premium to the group’s opening price of $2.80 on Monday morning.

Bell Potter is forecasting Ruralco to deliver an adjusted net profit of $15.3 million in fiscal 2017, up from $13.4 million in fiscal 2016.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.