Rise of the Crypto Currencies

Published 10-AUG-2016 14:42 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Many of us are aware of Bitcoin, a currency that is tracked by a single ledger system known as a “block chain”, but what of the other crypto currencies asks Sam Green of Traders Circle.

The single ledger Bitcoin system means that all transactions are visible and agreed upon by the entire network. The advantage of this system is a thoroughly transparent value transfer system, where users can transact directly between one another, without the need for intermediaries and government regulation.

Bitcoin gained early popularity due to its anonymity, which allowed users to conduct drug purchases and other illicit transactions, without those transactions being visible to government authorities (or indeed, financial institutions who may report to government authorities).

Increasingly however, Bitcoin is being seen as an investment and a store of value. This is due to the inherent decline in growth rate of bitcoin supply (Bitcoins will be released slower and slower over time, as new coins become harder to “find”). As well as increasing concerns about government and monetary intervention in traditional currencies.

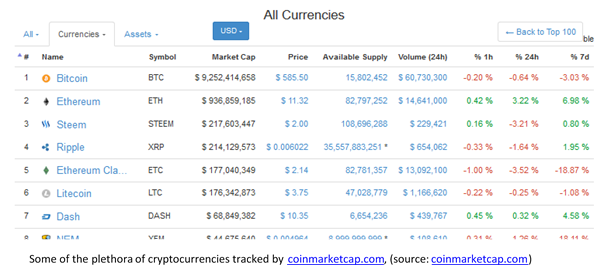

The success of Bitcoin has also led to the creation of a multitude of other cryptocurrencies. In fact, popular value tracking website coinmarketcap.com tracks 688 of them.

The latest big thing in cryptocurrencies has been Ether. Ether is a currency that is used on another block chain based platform called Ethereum. Ethereum supports an additional layer of detail to the previous public block chain infrastructure, in that it supports “Smart Contracts”, which allow parties to irrefutably verify or enforce the completion of contracts. So far, smart contracts have seen very limited application, but a lot of money and thought is being poured into their development.

Ethereum faced a big test recently, where a “hacker” exploited a feature in an associated system to transfer Ether out of the associated system. Part of the Ethereum community supported the winding back of the code to before the hack, and part of the community (the ideological purists) believed that the existing code must be maintained. It has therefore split into two block chains, and now exists as two different currencies (Ethereum and Ethereum classis).

The cryptocurrency space faces numerous risks, and no one should enter a cryptocurrency market without conducting significant research. However, it is an incredibly transient space where many of our future financial ledger systems will be created. As such, immense value grows and disappears in short spaces of time, and fortunes can be made or lost overnight.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.