Rhythm Biosciences surges 80% as catalysts emerge

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Rhythm Biosciences Ltd (ASX:RHY) increased more than 30% on Wednesday morning from the previous day’s close of 17.5 cents to a high of 23 cents, a level it hasn’t traded at for four months.

It is also worth noting that the company’s shares have increased nearly 80% in just over a week.

Today’s surge in its share price occurred under the second-highest volumes recorded in the last 12 months, suggesting there could be some well-informed investors behind the move.

While there hasn’t been any news released by the company since early October that would account for the share price support, management has flagged that it expects to successfully complete the next phase of its key reagent development program by the end of 2018.

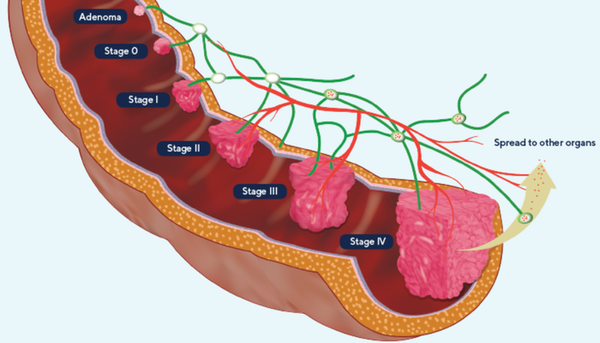

Rhythm Biosciences could have a huge addressable market given the high prevalence of bowel cancer and the fact that it is developing a product that has the potential to assist in early detection, a crucial factor in beating a cancer that has demonstrated extremely positive outcomes for patients with the disease where it has been identified at an early stage.

Global reach is important

Having been granted patents in Australia, the developer of the ColoSTATTM antibody-based blood test targeting the accurate and early detection of colorectal cancer was subsequently granted a European patent.

This covers 13 jurisdictions including large markets such as the United Kingdom, France and Germany, as well as countries in the Nordic, northern European and Eastern European regions.

The company has patents pending in the US, Brazil and India, and a divisional patent application pending in China.

The granting of patents in large markets such as the US and China would be a market moving event for the group, and perhaps there is growing confidence that this will occur in the near term.

Alternatively, investors could be banking on the imminent completion of the next phase of the reagent development program.

Is this part of a broader sector rally?

It was only last week that FinFeed highlighted the recent accelerated interest in biotech stocks.

One of the particularly strong performers in recent weeks has been biopharmaceutical drug discovery and development company, Antisense Therapeutics (ASX:ANP).

The company has two drug candidates, ATL1102 and ATL1103, which it has been studying in clinical trials for use in three diseases: Duchenne Muscular Dystrophy (DMD), Multiple Sclerosis (MS) (ATL1102) and acromegaly (ATL1103).

Antisense is currently conducting a Phase II clinical trial with its flagship drug to treat DMD at the Royal Children’s Hospital (RCH) in Melbourne. The company, and seemingly shareholders, are optimistic as this treatment is the same drug previously used by ANP in successful Phase II trials in MS patients.

When FinFeed highlighted Antisense as one of the high performing stocks in a rampaging sector its shares were up 217% on the day, closing at 5.4 cents.

The rally continued with the company trading as high as 9.4 cents in the following days.

Smaller biotechs continue to outperform

Other stocks that were featured went on to make further gains, including MGC Pharmaceuticals (ASX: MXC), Esense-Lab Ltd (ASX:ESE), Suda Pharmaceuticals Ltd (ASX:SUD) and Prescient Therapeutics (ASX:PTX).

As indicated last week, clinical stage oncology group Prescient was up 18% in early morning trading, but there was plenty more to come.

The company’s shares traded as high as 10.5 cents on Wednesday morning, representing a gain of nearly 50% since we featured the stock.

Suda Pharmaceuticals has also pushed higher after increasing 88% to 7.5 cents when featured.

The company stacked on another 40% in the ensuing days, hitting a four month high of 1.1 cents.

Smaller companies outperform blue chips

This clearly demonstrates that some big gains can be made by looking outside majors such as CSL (ASX:CSL), Cochlear (ASX:COH) and ResMed (ASX:RMD).

Interestingly, these blue chips have dragged the S&P/ASX 200 Health Care Index lower in October with it falling from about 31,500 points to 28,500 points.

The relative performances of these stocks against the broader index over the last three months can be seen below.

Indeed, CSL and Cochlear were both trading above $220.00 in September, and they are now struggling around the $180.00 mark.

There certainly appears to be benefits from throwing the net a little wider when seeking value.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.