Resolute’s revised Ravenswood numbers better than expected

Published 22-SEP-2016 16:43 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

At that stage we saw several catalysts that could push the company’s shares higher, in particular its inclusion in the S&P/ASX 200 on September 16. Another factor in the pipeline was the feasibility study being conducted at the company’s Ravenswood project in Queensland.

Following completion it was announced yesterday that rather than being an asset in wind down mode, Ravenswood was now poised to become an asset capable of delivering annualised production of 120,000 ounces of gold over a mine life of 13 years with all in sustaining costs (AISC) of AUD$1166.

This is yet to occur, of course, and those looking at this stock for their portfolio, should still seek professional financial advice for further information.

While this places Ravenswood at the upper end of the cost curve, it is a volumes story and as pointed out by Duncan Hughes from Somers and Partners there are other similar low-grade profitable projects such as Evolution Mining’s Mt Rawdon operations and Regis Resources’ North Duketon project.

With the Australian dollar gold price hovering in the vicinity of US$1750 there are robust margins on offer. Providing further comfort is the fact that a decline in the gold price is likely to be accompanied by a fall in the Australian dollar against the US dollar, providing a natural hedge for the Ravenswood project.

As can be seen in the chart above, one has to go back to pre-2008 to find a period when the Australian dollar gold price traded below RSG’s breakeven point for its Ravenswood project.

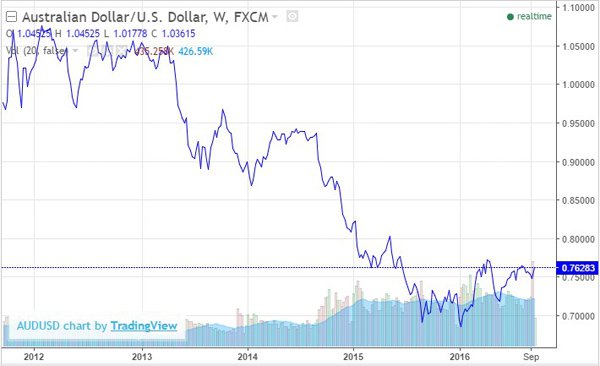

The following chart demonstrates how the decline in the Australian dollar against the US dollar over the last five years has contributed to the strength of the Australian dollar gold price. Any contraction of the Australian dollar versus the US dollar has the impact of pushing the Australian dollar gold price upwards.

The start-up costs for Ravenswood is estimated at $134 million with life of mine major project capital standing at $258 million, representing a moderate outlay for a long life project that will generate significant cash, effectively instrumental in funding the development of RSG’s Syama and Bibiani projects in Africa.

Reflecting on our call a few weeks ago that RSG would spike on the day of its inclusion in the ASX 200, we were on the mark as it hit an intraday high of $2.17 with nearly 100 million shares traded.

This represents the highest number of shares ever traded in the stock, and given that it went on to hit a high of $2.25 on Tuesday, not too far shy of its pre-GFC high of $2.51, it could be technical resistance that provides the next hurdle.

That said, Somers increased his price target from $2.04 to $2.17 and maintained a hold recommendation, noting that the feasibility study reported lower costs, lower capital expenditure and better head grades than expected.

The other potential catalyst for RSG is obviously the gold price. On this note, Somers’ valuation relative to a US$1400 gold price increases from $2.17 to $2.51.

However, previous trading trends are not indicative of future share price performance and they should not be used as a basis for investment. It should also be noted that broker projections are estimates that may or may not be met and independent advice should be sought before investing in ADA.

Consequently, while it wouldn’t be surprising to see support for RSG remain intact around current levels, medium-term upside momentum could emerge as it increases production at Syama and brings the Bibiani project into production.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.