Rate cut welcome, but no panacea for economic woes

Published 05-JUN-2019 16:38 P.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

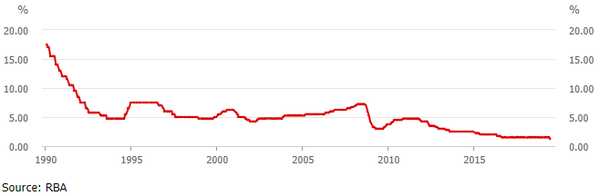

The Reserve Bank has cut its official interest rate by 0.25 percentage points to an all-time record low of 1.25%, in line with analyst’s expectations.

Survey group, Refinitiv had earlier noted that all of the 43 economists it had surveyed had tipped a rate cut in June and there is also an expectation by 80% of those surveyed that another cut will occur in October.

In what has been a lengthy period of stable rates, this is the first change in nearly 3 years.

However, pressure has been mounting for some time on the RBA to create some economic stimulus in the face of falling house prices, weak retail sales, a decline in housing construction activity and constrained wage growth, leading to a contraction in disposable income.

With most of these factors impacting upon each other and exacerbating the problem it is difficult to break the cycle, and that is the conundrum facing both the government and regulatory bodies.

There were further ominous signs for the retail sector when April data was released on the same day the long-awaited rate cut arrived.

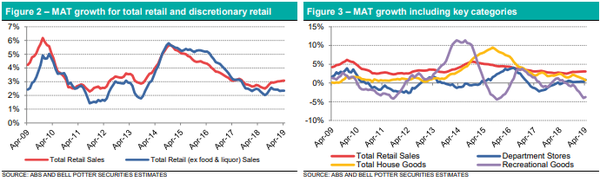

The following charts show the steep decline in moving annual turnover (MAT) growth since 2015 with total retail sales (red line) growing at an underwhelming rate of about 3% over a 10 year period, a worrying sign.

Even more concerning is the fact that the growth rate slips to approximately 2% once the resilient non-discretionary spending items such as food and alcohol are stripped out.

Consumer discretionary sector feels the pinch

It isn’t unusual for consumers to rein in the spending ahead of an election as it is a period that produces uncertainty.

The March/April month-on-month figures reflected this trend with discretionary retail sales falling 0.2%.

However, there is a strong chance that this could reverse in May, particularly now that the RBA has delivered the rate cut.

In fact, there is the potential for a significant month-on-month boost off the low base implied by April figures.

However, that will count for little as it is the long-term trend that is a worry, and dips and darts off a relatively stagnant baseline are fairly insignificant at this point in time.

That said, looking at pockets across the retail sector, one of the more unexpected positives was the month-on-month growth of 1.8% generated by the department store sub-sector.

However, this could point to disturbing news when annual results are rolled out in a few months’ time as the out of sync performance could well have been driven by heavy discounting, a factor that will reflect poorly in margins and profitability.

Stay-at-home stocks could be the safe play

The best performing sector was recreational goods with a gain of 2.8%.

The sector could be receiving support from macro factors such as, ironically, constrained consumer spending, as well as the weakening Australian dollar.

Overseas holidays are being put on the back burner because of the high headline costs and the low buying power of the Australian dollar in overseas destinations.

Consequently, there would appear to be a shift towards the ‘holiday at home’ option as well as day-to-day activities that are less of a drain on the pocket.

That could well account for Super Retail Group’s (ASX:SUL) recent share price strength with its range of sporting and recreational stores likely to be beneficiaries of such a trend.

In particular, the group’s BCF (boating camping and fishing) and Rebel sports and recreational equipment stores could perform well in such an environment.

SUL’s shares have increased from about $7.50 to $9.30 in the last month, and the emergence of the CBA in mid-May as a substantial shareholder is a positive sign.

How have the banks responded

The ANZ was first off the blocks yesterday after the RBA announced its rate cut with the group stating that it would reduce rates by only 0.18 percentage points, or roughly 70% of the RBA cut.

Westpac has also disappointed its customers, committing to a rate reduction of 0.20 percentage points.

The CBA and NAB will pass on the full rate cut.

However, it should be remembered that the banks have been running their own race for the last 12 months with the CBA for example increasing its variable home loan rate by 0.15 basis points as recently as October 2018.

Consequently, it could be argued that they had some slack to play with.

That said, the ANZ announced a similar increase September last year.

The NAB increased its owner occupiers paying principal and interest rate by 0.12 percentage points in January this year, taking it to 5.36% per annum.

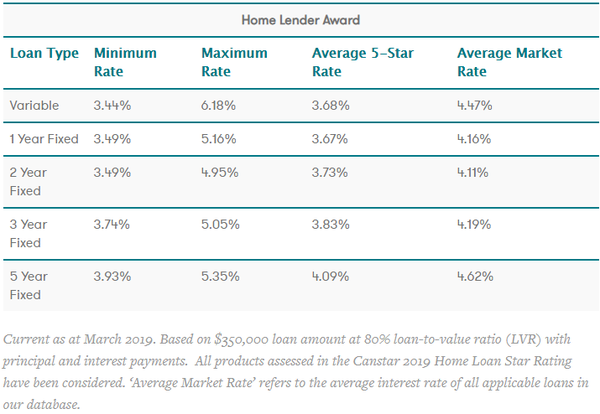

However, a changing landscape always creates opportunities, and it would be an ideal time for homeowners to shop their loan around, particularly given that the weight of opinion suggests anything above 4% is too high.

Indeed, research house Canstar recently noted that there was a 2.86% difference between the lowest and highest home loan comparison rates.

Interest rate cuts have dominated lenders’ movements as 2019 has unfolded, offsetting some of the tactical manoeuvring that occurred in the latter half of 2018.

Canstar’s group executive of financial services Steve Mickenbecker said decreases in home loan interest rates outnumbered increases by two-to-one in February.

Canstar awarded 26 home loan lenders with an overall 5-Star Rating

The lenders recognised as offering outstanding value to customers in the Home Loan Star Ratings are listed below.

This award goes to home loan lenders that provided outstanding value products to owner-occupiers across variable and fixed-rate loan terms considered in these ratings.

Home loans were assessed across four loan amounts ranging from $200,000 up to $750,000, for borrowers making principal and interest repayments.

Here are Canstars’ winners, listed in alphabetical order:

- Bank Australia

- Freedom Lend

- Greater Bank

- Heritage Bank

- Homestar Finance

- HSBC

- ING

- Qudos Bank

- RACQ Bank

Canstar Research found owner-occupiers with a 5-Star home loan had access to lower interest rates compared to the market average, as displayed in the table below.

HIA calls for banks to move in step with RBA

With movements in the cash rate so closely aligned with the housing industry it is only fitting that Housing Industry Australia (HIA) Chief Economist, Tim Reardon gets the last say.

While he said that the rate decision combined with the re-elected government’s retention of current capital gains tax arrangements will go a long way to supporting confidence in the housing market, the banks need to move in step with the RBA.

Though he acknowledged that an easing of interest rates is necessary in light of the slow rate of economic growth Reardon made the point that on their own, a cut to interest rates will not be sufficient to stop the downturn in building activity.

It is worth noting that building activity has always been closely aligned with economic prosperity and consumer confidence, as from an overall perspective it is one of Australia’s largest employers.

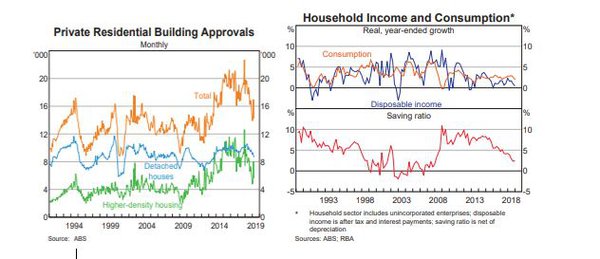

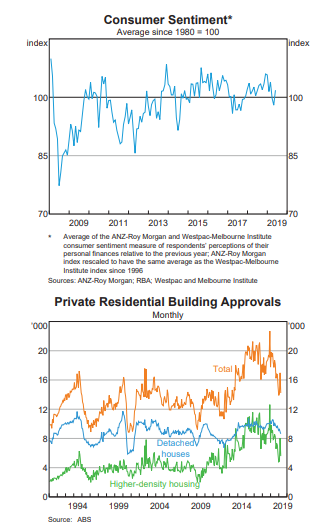

Look at the data in the following two charts and you will see that the marked uptick in consumer sentiment between 2008 and 2017 aligns closely with private residential building approvals.

From every facet of house construction to the manufacturing and distribution of appliances and fittings and right through to furniture and hardware stores, garden supplies and retailers of electrical goods, a buoyant housing market creates employment opportunities.

However, getting back to addressing the issue, Reardon said, it isn’t just about rate cuts.

And he is right - the rot set in during the Royal Commission, and was exacerbated when the Australian Prudential Regulation Authority (APRA) imposed regulatory changes on a banking system that has traditionally been considered worldwide to be one of the best government-guided, but self-regulated financial industries.

Our banking system remained robust when the big US banks went to the wall during the GFC, and Reardon is on the money in his criticisms of APRA.

In part, Reardon said:

“The credit squeeze gathered momentum throughout 2018 and accelerated the downturn in building activity. This will continue to impact the level of home building and the wider economy until these lending restrictions are eased.

“The amount of money that banks are prepared to lend households has been slashed by around 15 per cent over the past year.

“APRA’s regulatory restrictions and increasingly conservative lending practices by banks are the cause of the credit squeeze.

“The impacts of these restrictions are now being seen in the wider economy. Households have clearly tightened their belts in light of falling house prices which have been exacerbated by the tight credit limits.

“If banks do not pass on the full rate cut they will have magnified the impact of APRA’s rule changes and stifled the ability of the RBA to use monetary policy to rectify the damage caused by the credit squeeze.

Reardon also said there is a need for federal income tax cuts, the first home loan deposit scheme and public infrastructure investments to assist in stimulating employment growth and assisting in driving the residential building industry out of the downturn.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.