Pureprofile beats prospectus forecasts: still trading well short of broker price targets

Published 19-AUG-2016 13:57 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

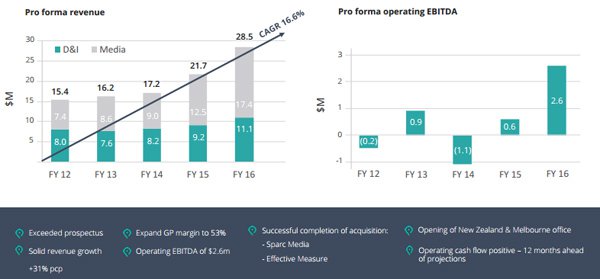

Shares in Pureprofile (PPL) surged 20% from 45 cents to 54 cents on Thursday after the company outperformed prospectus forecasts for fiscal 2016. It was a strong result at all levels with revenue ($28.5 million), margins (53%) and net profit ($1.3 million) beating management’s guidance.

However, the share price performances of PPL should not be used as a guide to future performance or be used as a basis for an investment decision.

While the company only listed on the ASX in July 2015, it can be seen in the table below that this result represents a continuation of the group’s strong performance prior to listing.

With better access to capital PPL is now well-positioned to accelerate its growth strategy and Blue Ocean Equities’ analyst, Gregg Taylor is forecasting profit to increase by 126.4% in fiscal 2017 to $2.9 million representing earnings per share of 4.4 cents.

The broker expects earnings per share to nearly double again in fiscal 2018 to 8.1 cents, implying a PE multiple of 6.6 relative to yesterday’s closing price.

As management outlined yesterday, there are a number of initiatives in the pipeline that have the potential to facilitate this growth. The group is in discussions with its existing partner News Corp with a view to extending its News Connect platform to the US and UK.

PPL expanded its position in the big data industry in February with the acquisition of Effective Measure’s platform in Australia and New Zealand.

The company is now benefiting from strong publisher relationships that came with the acquisition, including Australia Post and Bauer whose specialist audience targeting and measurement capabilities have broadened the group’s range of products.

In terms of target markets, Chief Executive, Paul Chan highlighted that data analytics and programmatic media continued to be aggressively adopted by advertisers, boding well for PPL in fiscal 2017 and beyond.

Chan is looking for top line growth from overseas expansion while also striving to improve margins across the business.

Some of this growth should be evident in the first quarter of fiscal 2017 with the company having secured a number of new managed campaigns in May and June.

Taylor noted that PPL finished fiscal 2016 with two consecutive quarters of positive cash flow and said that cash flow had been strong since June 30, a trend that is expected to accelerate in fiscal 2017.

Taylor has a buy recommendation on the stock with a price target of $1.30, implying substantial upside of 140% to yesterday’s closing price, although it should be noted that analysts’ recommendations and price targets are only estimates and any investment decision should not be based solely on this information.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.