Reporting Season: Primero secures contracts with Rio Tinto

Published 06-AUG-2018 12:00 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Name: Primero Group

Market Cap: $64.1 million

Last Closing Share Price: 44.5 cents

Engineering design, construction and operational services to the minerals, energy and infrastructure group Primero Group (ASX:PGX) has secured important new contracts with long-standing client, Rio Tinto (ASX:RIO).

Primero provides these services to a diverse client base, ranging from mid-sized companies through to international mining and energy houses.

The Rio contracts include the award of two new design and construct projects for infrastructure works at Brockman 2 and Brockman four projects in the Pilbara region of Western Australia, which are expected to complete in 2019.

The company’s energy business has also secured an award for works on Varanus Island, for the design and refurbishment of Quadrant Energy’s condensate storage tanks.

Work is expected to commence immediately and is scheduled to complete in December 2018.

Primero has previously been engaged for ongoing tank modifications and this new award continues to develop the relationship with Quadrant Energy.

Multiple client awards in mineral processing

Promising news also comes from the company’s minerals processing segment with the division securing new contract awards and renewals with several clients including, Galaxy Resources, Tawana Resources, Savannah Resources, Piedmont Lithium and Sigma Lithium.

The contracts cover projects at various stages of the development cycle across a number of jurisdictions.

The range of projects and operations across the development cycle is consistent with Primero’s strategy to add significant value to clients through the study/design phase, construction and ultimately in an operating environment.

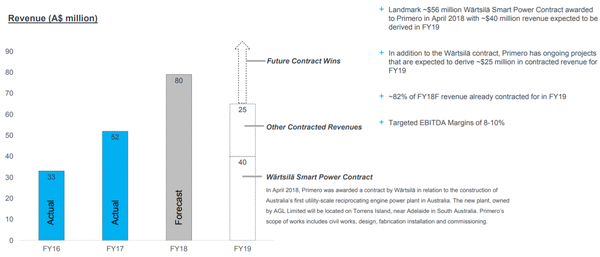

$95 million in contracted revenue in fiscal 2019

In total, the new awards and renewals bring Primero's current order book to over $120 million of work in hand, with $95 million in contracted revenue expected to be derived in the 2019 financial year.

What this revenue figure amounts to is yet to be determined so seek professional financial advice and consider all facts before making an investment decision.

Managing Director Cameron Henry commented, “We are pleased to build on our relationship with our core long term clients and welcome new clients to Primero.

“It is very encouraging to have secured a strong order book at this early stage of FY19 which has Primero well positioned to deliver into FY19 market guidance, which is a core value of our growing business.”

Management is forecasting that the company will generate a pro forma net profit after tax of $4.7 million in fiscal 2018.

The contract with Rio, along with others that were announced on Friday, triggered a 7.2 per cent share price increase on the day.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.