Praemium lives up to broker’s expectations

Published 19-OCT-2016 17:05 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As part of our broker monitoring, FinFeed advised in mid-August that Ivor Ries from Morgans CIMB had upgraded Praemium’s (ASX: PPS) share price target from 49 cents to 57 cents after the company exceeded his profit expectations. This implied share price upside of 40% at that time.

Ries also upgraded forward earnings estimates with the expectation that the company would use its relatively robust balance sheet to continue to invest in technology which would make it more competitive in the self-managed superannuation accounts segment.

Ries was on the mark with his take on the company and his price target of 57 cents, with PPS’s shares touching 53.5 cents last Friday before closing yesterday at 51 cents.

PPS listed on the ASX in 2006 and has gradually established a position in the funds management industry whereby it offers separately managed account (SMA) technology to blue-chip clients.

Consequently, it represents a play on both the financial and the technology sectors. Importantly, over the last three months PPS’s share price has outperformed both the S&P/ASX 200 information technology and financials indices by 40%.

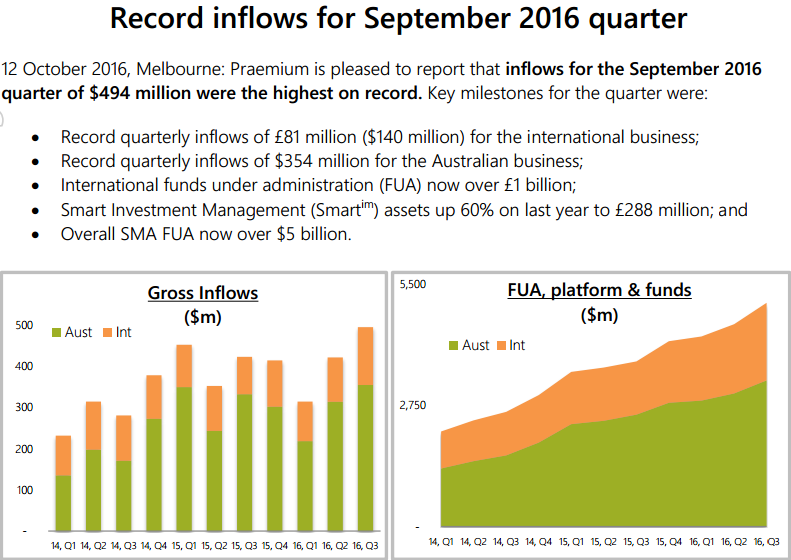

However, Ries sees more upside to come, and he now has a price target of 61 cents on the stock. In particular, he noted that the group had reported strong net fund inflows in Australia and the UK in the September quarter, ending the period with a record $5 billion in funds on platform.

Of course these inflows are no guarantee to continue and investors should seek professional financial advice for further information.

That said, there is no questioning the quality of PPS’s performance in the three months to September 30, 2016, as indicated by the following data.

Praemium’s diversification strategy pays dividends

Importantly, the source of new inflows was highly diversified, reflecting the benefits of PPS’s recent investment in training client advisers on the use of its SMA platform.

Ries highlighted that further account uploads from new clients (including JB Were) should see further strong growth in funds on platform in the three months to December 31, 2016.

The uptick in performance couldn’t have come at a better time as the weakening in the Pound has a negative impact on PPS’s earnings.

Lafitani Satiriou from Bell Potter is also bullish on the stock, recently upgrading his cash earnings per share for fiscal years 2017, 2018 and 2019 by 7.1%, 8% and 7% respectively. He was impressed with the quarterly update and the earnings upgrades are driven by the higher than expected gross inflows referred to by Ries.

Satiriou has pitched his price target substantially higher than Ries, increasing it from 72 cents to 75 cents, in keeping with earnings upgrades.

The main reason for the variation in price targets appears to be a difference of opinion in earnings projections. Ries is forecasting a net profit of $4.3 million in fiscal 2017, increasing to $7.1 million in 2018. For the same periods, Sotiriou is forecasting a net profit of $4.8 million, increasing to $8.1 million.

We will continue to monitor the stock’s progress and broker opinion. The company traditionally provides details of inflows in mid-January, and this is shaping up as a potential share price catalyst.

It should be noted that broker projections and price targets are only estimates and may not be met. Also, historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.