Praemium beats broker forecasts and continues strong earnings growth

Published 13-AUG-2018 11:31 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Name: Praemium (ASX:PPS)

Market Capitalisation: $358 million

Share Price: 89.5 cents

Provider of IT solutions and platforms to the financial services industry, Praemium (ASX:PPS) has delivered strong growth in funds under administration, revenues and underlying earnings in fiscal 2018.

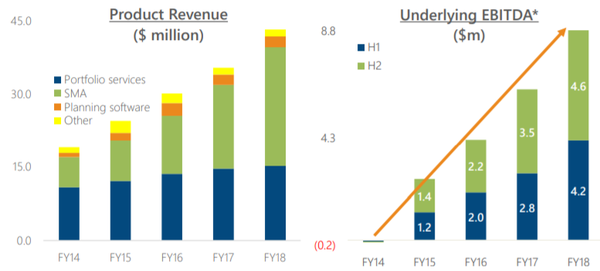

The key takeaways with regards to its fiscal 2018 performance were a 50 per cent increase in gross asset inflows to $3 billion, a 35 per cent increase in funds under administration which hit a record $8.3 billion and underlying earnings of $8.8 million, representing an increase of 40 per cent on fiscal 2017.

As indicated below, this represents a continuation of what has been a rapid period of growth and astute execution over the last five years.

Praemium has a prominent market presence in the provision of investment administration, Separately Managed Account (SMA) and financial planning technology platforms.

It does remain a speculative stock, so investors should still take a cautious approach to any investment decision made with regard to this stock.

The company administers in excess of 475,000 investor accounts covering approximately $110 billion in funds globally, and currently provides services to over 700 financial institutions and intermediaries, including some of the world’s largest financial institutions.

Harking back to the key numbers, it is also worth noting that underlying earnings of $8.8 million were 10 per cent ahead of the expectations of analysts at Morgans. Both Morgans and Bell Potter like the stock with the latter having recently increased its 12 month share price target from $1.18 to $1.38, a premium of more than 50 per cent to Friday’s closing price.

Of course, it should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

Operational developments

A key development in terms of Praemium’s global expansion was the receipt of regulatory approval to sell the company’s Smartfund range of funds directly to the United Arab Emirates (UAE) markets.

UK revenue and other income grew 27 per cent, resulting in a 22 per cent reduction in EBITDA losses to $1.7 million.

Funds under administration (FUA) in the UK were up 20 per cent over last year to $2.7 billion, with assets managed by Smart Investment Management up 15% to $794 million.

Gross inflows in FY2018 of £434 million ($775 million) were 13% higher than FY2017.

Regulatory changes should favour Praemium

Management said that it expects further opportunities to expand the business, particularly with the advent of the Royal Commission as firms seek to reduce risk and move away from providing both advice and product.

The managed account segment of the platform market is now growing quickly and the company’s depth of experience and expertise in this area provides it with an opportunity to increase market share.

The company also noted that it had completed two regulatory initiatives, to adhere to MiFID II and GDPR regulations, further strengthening its position as a fully compliant, efficient and sophisticated platform for key international markets.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.