Pioneer Credit beats consensus forecasts and flags a strong fiscal 2017

Published 22-AUG-2016 14:52 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

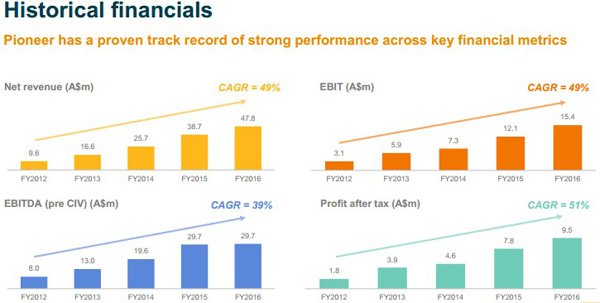

Pioneer Credit’s shares spent most of the first half of calendar year 2016 in a slow and steady slide but a rerating over the last two months resulted in a recovery of circa 20%. It became apparent on Friday that this rerating was well justified as the provider of financial and debt management services delivered a result that featured strong revenue and profit growth.

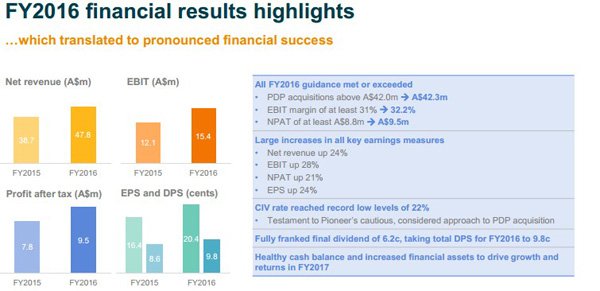

The net profit of $9.5 million was well ahead of management’s guidance of $8.8 million and represented earnings per share of 20.4 cents. This implies a PE multiple of less than 10 relative to Friday’s closing price of $1.95, seemingly conservative for a company that has delivered year-on-year earnings per share growth of 24%.

It is important to be aware that historical share price fluctuations aren’t an indication of future trading patterns and similarly, this data should not be used as the basis for an investment decision.

Management has provided upbeat fiscal 2017 guidance, forecasting a net profit of $10.5 million, up more than 10% on the fiscal 2016 result.

Management has a history of under promising and outperforming, and this may well be the case again in fiscal 2017 given that the company will reap the full benefit of a number of strategic operational measures that were undertaken in the last 12 months in the upcoming period.

Pioneer Credit enters fiscal 2017 with a robust balance sheet, providing it with sufficient funding to undertake various initiatives including management’s goal of acquiring Purchased Debt Portfolios (PDP) to the value of $50 million.

The company is also well-placed to continue its healthy dividend policy, and consensus forecasts currently point to a dividend of 11.5 cents. This implies a yield of nearly 6% relative to Friday’s closing price.

Since listing on the ASX in May 2014 Pioneer Credit has established valuable relationships with the big four banks and these continue to be an integral part of its business. The company also has relationships with an investment bank and consumer leasing providers.

The group’s portfolio consists of retail customer accounts purchased from these organisations that are generally past 180 days overdue.

Another growth driver in fiscal 2017 will be the company’s Pioneer Credit Connect business which was launched during fiscal 2016. This includes a home loan product which is available to both existing and new customers.

Importantly, it allows existing customers to refinance while appropriately consolidating loans and saving on repayments. Pioneer Credit’s ethical approach to an industry which tends to have a tarnished reputation appears to work well for it as it retains customers after helping them to break the debt cycle.

On this note, managing Director Keith John said, “Increasingly, we are seeing a growing preference from the major banks and other loan originators to partner with us as a company that has an exemplary compliance record and a genuine customer orientated approach”.

While Credit Corp tends to dominate the sector as a much larger player and a consistent performer, it is trading on a PE multiple of nearly 15 relative to fiscal 2017 forecasts. It wouldn’t be surprising to see Pioneer Credit match Credit Corp’s consensus earnings per share growth forecasts of circa 14% as this isn’t too far above management’s guidance.

Consequently, if investors were to view Pioneer Credit as due for a PE based rerating it could see the company’s shares maintain the positive momentum demonstrated since June.

Friday’s closing price is 30 cents shy of the consensus 12 month price target of $2.25. However, there is the possibility that the price target could be revised in light of the company’s result beating consensus forecasts.

It should be noted that broker recommendations, forecasts and target prices are projections that may not be achieved and financial investments should be based on this information.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.