Pilbara Minerals project world’s best undeveloped spodumene deposit?

Published 27-SEP-2016 14:53 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Stuart McIntyre from Blue Ocean Equities has responded bullishly to two studies released last week by Pilbara Minerals (ASX: PLS) in relation to its Pilgangoora lithium-tantalum project located in Western Australia.

In his view the studies confirmed the project’s status as the world’s best undeveloped spodumene deposit and galvanised the company’s position as the ‘go to’ ASX lithium exposure.

Of course this is only one broker’s view and there are many factors to consider when assessing this stock for your portfolio. Seek professional financial advice for further information.

In response to these developments, McIntyre increased his price target by 32% to $1.25, implying a return of more than 160% relative to the company’s share price of 47 cents.

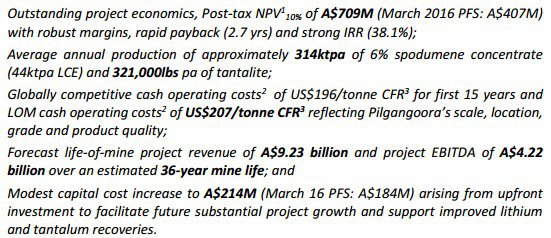

The two studies released by PLS were a Definitive Feasibility Study (DFS) for a base case 2 million tonnes per annum lithium-tantalum development at Pilgangoora. The key metrics were as follows.

Based on this scenario management expects construction to commence in the fourth quarter of calendar year 2016 and be commissioned by late 2017.

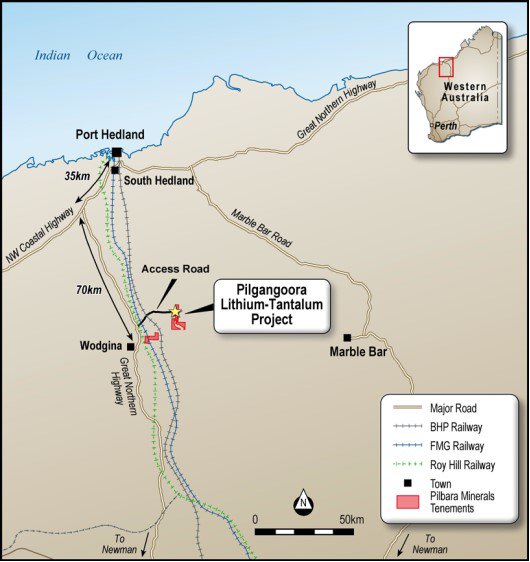

Here’s a map of the area:

The other interesting news referred to by McIntyre was the completion of a Prefeasibility Study (PFS) aimed at assessing expansion options for the future, specifically the establishment of a 4 million tonnes per annum run of mine ore production and processing facility, subject to further engineering studies and future market conditions.

The decision to undertake a PFS in order to examine the prospect of increased production was based on management’s view that the substantial growth in the Pilgangoora ore resource and reserves experienced during the year certainly indicated that having adequate feedstock would not be an issue.

Furthermore, PLS’s Managing Director and Chief Executive, Ken Brinsden pointed to the ‘exceptionally strong outlook for global lithium demand’ as supportive of the development of a larger production facility.

McIntyre looked at both scenarios, highlighting that at current prices he estimates payback for a 2 million tonnes per annum project would be less than 1.8 years, extremely impressive given the forecast 36 year mine life.

He noted that at current prices the net present value of such a project would be circa $1 billion. This compares with the company’s current enterprise value of approximately $490 million.

With regards to the potential for expansion to 4 million tonnes per annum, he is of the view that this could be achieved within three years of commissioning the 2 million tonnes per annum plant. Importantly, he estimates the expansion capital would be a relatively modest $128 million, representing less than one year’s operating cash flow at 2 million tonnes per annum.

Given the potential scalability of the project, McIntyre sees PLS as a takeover target. Factors working in its favour include above average grades, the fact that tantalum credits drive down costs, low permitting and sovereign risk, low capital intensity and relatively quick payback and robust return on capital.

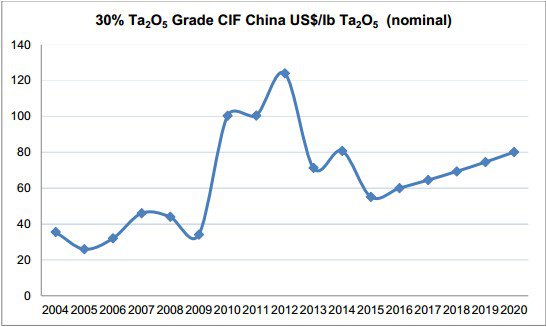

While the sharp escalation in lithium demand tends to dominate the news it is worth looking at the tantalum landscape. According to Roskill’s twelfth edition 2016 tantalum report, the outlook for tantalum supply and demand during the period 2016 to 2020 indicates a possible surplus of supply until 2019 followed by a possible deficit of 40,000 pounds in 2020.

As a point of reference, Roskill has been a leader in international metals and minerals research since 1930 and its publications which cover 75 market reports, data books and newsletters have been published since 1970.

The group is an independent, privately owned company that doesn’t have a stake in mineral projects.

Roskill highlighted that there is a delicate balance in the tantalum market because many of the areas where the mineral is produced are prone to political risks, natural disasters and operational problems (Africa is a prominent producer), indicating that the supply side of the equation can waver quickly and substantially.

The following chart demonstrates the commodity’s historical price volatility while also highlighting Roskill’s projections out to 2020.

Based on McIntyre’s projections, PLS will generate revenues of $333 million in fiscal 2019, its first year of full production. Underlying net profit is expected to be $124 million, representing earnings per share of 9.4 cents.

This implies a forward PE multiple of 4.9 relative to Monday’s closing price of 46 cents.

It should be noted that commodity price projections, earnings forecasts, price targets and past share price performances may not be met or replicated and as such should not be used as the basis for an investment decision.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.