Paragon surges, with more upside possible

Published 09-AUG-2017 12:26 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in healthcare equipment group, Paragon Care (ASX: PGC) spiked from Friday’s close of 81 cents to hit an intraday high of 93 cents on Monday. This occurred under the highest daily volumes recorded in the last five years. The intraday high was repeated again on Tuesday.

It should be noted share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Interestingly, the provider of medical equipment, devices and consumables to the health care industry has traded as high as 94 cents during its circa 10 year history as an ASX listed entity, and it could be technical selling that is currently keeping a lid on the company’s share price.

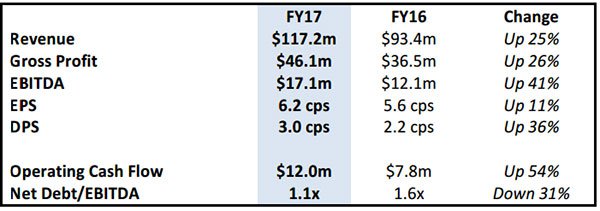

Certainly, the result appeared to warrant a rerating as the impressive key financials below indicate.

While revenues were broadly in line with management’s guidance, there was a slight outperformance at the EBITDA line.

Brokers see further upside

As indicated by John Hester from Bell Potter, PGC is best assessed on its earnings per share performance. As a growth by acquisition story, the company has issued new shares over the last two years, effectively diluting earnings per share.

Consequently, using this measure takes into account the impact of issuing scrip for all or part consideration in relation to acquisitions.

Bell Potter is forecasting earnings per share to increase to 6.9 cents in fiscal 2018, implying a PE multiple of 13.4 relative to its 12 month high of 93 cents. This represents a 50% discount to the broader sector average PE multiple of 26.8.

Of course broker projections and price targets are only estimates and may not be met.

However, some of the larger blue-chip companies tend to push the average multiple higher than what is normally representative of the mid-tier players.

The broker reactions have been interesting with Bell Potter maintaining its buy recommendation and slightly increasing its price target to $1.02.

By contrast, Ian Christie from Argonaut views the current price as good value with his valuation of $1.12 implying upside of 20% to the group’s current trading range. He expects PGC to achieve organic growth of 10% per annum over the next two years with EBITDA margins of circa 15%.

Again, broker projections should only be taken into account with all publically available information.

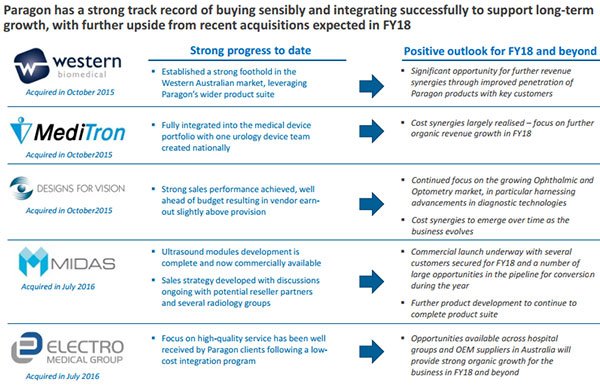

PGC’s Managing Director, Mark Simari was relatively upbeat with his outlook statement, saying that the company is well-placed to deliver growth in future years, driven by a combination of organic and acquisitive growth with the e-health sector offering a new revenue stream.

The addition of services and maintenance contracts will also help, as they provide recurring income to complement revenues generated from the sale of new equipment.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.