Pain or pleasure for Aussie investors?

Published 02-NOV-2015 09:26 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With equity markets across the globe gyrating close to their highs, many investors are looking at their portfolios and asking whether their positioning is appropriate.

This raises an interesting question – do investors care more about their portfolio in good times or bad times?

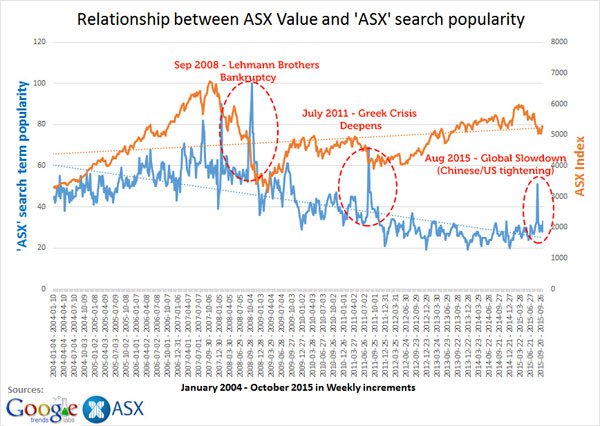

To answer this question, Finfeed has devised a straightforward way to compare how often Aussie investors search for the term Australian Stock Exchange (‘ASX’) with actual ASX price data.

Here’s what we found:

Inverse relationship between ASX Search popularity and ASX Index value.

Our findings show that on a broad basis, investors are more interested in searching for ‘ASX’ when market prices are falling. In other words, on average, Australians are more interested in the stock market when prices are falling compared to when it is rising.

From the chart above, significantly visible spikes in ASX search frequency occurred in late 2008 (GFC), 2011 (Greek crisis) and just recently in 2015 when the ASX fell around 15% from its all-time peak of 6000.

The conclusion is clear – investors do more research into the stock market when it is falling. When stocks are broadly rising, investors are less likely to search for anything ‘ASX’-related on Google.

Our analysis is by no means scientific; but it does provide several interesting insights into the psychology of investors (and traders).

In trading, there is a famous saying: “Markets go up the stairs, and down in an elevator”, which could partially explain the chart above.

If stocks are more prone to 5%+ declines than they are to 5%+ rises, it would make sense that investors are more worried about losing more than they expected, as opposed to being happy earning more than they first thought.

It would seem the fear of losing outweighs the joy of winning when it comes to investor portfolios in Australia.

Looking deeper

There are several factors that could help explain this negative correlation between the ASX Index and how often people search for ‘ASX’.

For one, when markets are falling substantially, they often garner hard-hitting headlines, fear-mongering and paranoia, often fostered by the media in an attempt to sensationalise financial markets.

Next, is the rather unfortunate reality that many investors still consider stock markets (as well as other asset classes such as property) to be perpetually growing in value regardless of any other factors.

Despite widespread calls from regulators – and advice from financial advisers calling for investors to be aware of both the upward and downward trajectories that all investments can take – millions of investors continue to invest their capital in blue-chip stocks they believe to be untouchable and forget about the need to monitor and reappraise investment decisions on a regular basis (regardless of price fluctuations, whether they be up or down).

If this is indeed the approach being taken by a large portion of retail investors, it would help explain why people jump on Google to search for ‘ASX’ as soon they see media reports of drastic declines. And conversely, forget all about the ASX when their superannuation fund is ticking over as they always thought it would.

With the recent market turmoil created by uncertain monetary policy in the US, an economic slowdown in China and ongoing fiscal malaise in the Euro zone, there are clearly many risks to all stock markets in the developing world.

Market volatility (with steep declines) is something that cannot be avoided or ignored.

With this in mind, investors should be aware that markets of all types go through cycles and therefore, analysing and keeping abreast of developments is just as important in good times as it is in the bad.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.