oOh!media’s Oh moment

Published 26-AUG-2016 10:02 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There was unusual trading activity leading up to oOh!media (ASX:OML) delivering its result for the six months to June 30, 2016. The result was announced on Tuesday, but on the Monday the company’s shares plunged from the previous day’s close of $5.58 to trade as low as $4.41 before closing at $4.70.

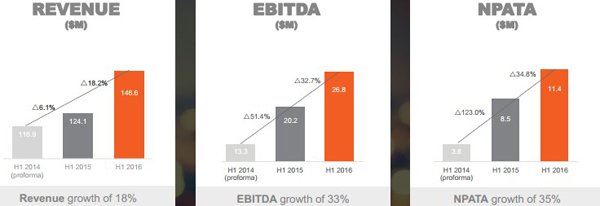

It would appear that the market was preparing itself for a disappointing result, but it was quite the reverse with analysts at Macquarie Wealth Management noting the performance was generally ahead of its expectations, featuring EBITDA of $26.8 million, a year-on-year increase of 32.7%.

The company’s shares responded accordingly hitting a high of $5.20 before closing at $5.12. However, there was some slight weakness yesterday as the company’s shares closed at $4.90.

Based on Macquarie’s commentary this could be a buying opportunity. The broker reinforced its positive take on the result by increasing the share price target from $5.30 to $5.45 while maintaining an outperform recommendation.

The past performance oOh!media is no guarantee of future performance and this data should not be used as the basis for an investment decision. At the same time it should be noted that broker recommendations, forecasts and target prices are projections that may not be achieved.

Macquarie indicated that recent share price volatility could be attributed to Monday’s guidance downgrade by APN Outdoor (ASX:APO). It is of the view that this has cast some doubt over the broader out-of-home advertising market.

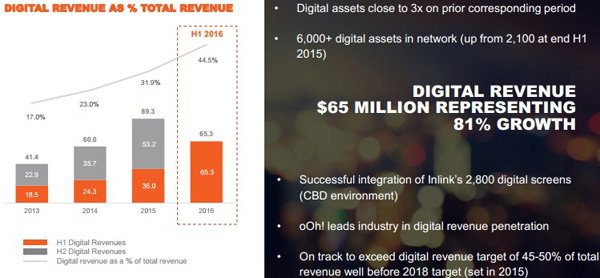

Macquarie is of the view that OML is better positioned to handle a short advertising market than other out-of-home players given it has the most extensive digital portfolio and appears to have maintained solid momentum despite recent industry headwinds.

On that note the broker highlighted that OML is increasing its anticipated capital expenditure in the digital area by $10 million to a range between $20 million and $35 million. Part of the additional investment will relate to new contract wins including the T4 terminal at Melbourne Airport and the Brisbane Virgin Australia Domestic Terminal.

In providing guidance, Chief Executive Brendon Cook said, “OML continues to be well-placed to capitalise on growth opportunities with net debt to EBITDA at 1.7 times, well within the financial covenants of its debt facility agreements”.

He highlighted that this provides headroom to invest for further growth, in keeping with the decision to allocate increased funds for capital expenditure.

Cook said he expected the company to achieve EBITDA in a range between $68 million and $72 million for the 12 months to December 31, 2016.

Macquarie sees second half guidance as conservative, and the broker is forecasting full-year EBITDA of $74.6 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.