Oil – A New Hope or The Empire Strikes Back?

Published 26-FEB-2016 15:10 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After more than a year of doom and gloom surrounding oil there may be a flickering light at the end of the tunnel – but it’s probably not going to be as great as everybody thinks it is.

The current oil crisis comes down to one simple thing: oversupply.

Thanks to the advent of shale drilling on a wider scale in the US to produce oil, the US has had to import less crude than it had been doing previously.

Termed the ‘shale gale’, it prompted talk of the US becoming energy self-sufficient – much to the chagrin of oil producers in other markets.

After all, if the US stops buying oil from the world market, it basically means that the oil which would have been destined for the US finds a way to another market.

This is essentially what happened, with US production meaning there was more oil in the system than previously experienced.

The rational response, one would assume, would be to choke back production to stop the oversupply dragging down prices.

Except, that didn’t happen.

OPEC, which controls roughly 60% of the world’s crude exports decided in its wisdom to keep pumping at current and projected levels.

But why would it do that?

Led by powerful nations such as Saudi Arabia, OPEC’s theory was that if it drove the oil price lower it would send US drillers out of business and effectively kill off US production – which had seen price pressure in the first place.

It made a perverse kind of sense, but as time goes on OPEC has realised that it may just be harder to kill off US producers than first thought.

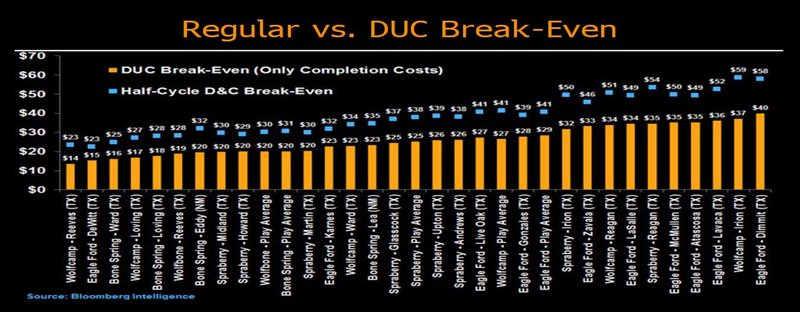

Analysis from Bloomberg’s business intelligence unit in January found that there were quite a number of plays in the US which could happily break even if oil approached $30 per barrel.

Break-even prices for several plays in the US. Courtesy Bloomberg Business Intelligence

There also happens to be a lot more oil in storage than previously thought, which means OPEC may be re-thinking its strategy.

Earlier in the year, it emerged that Russia and Saudi Arabia were meeting to discuss whether or not to cut back production – essentially admitting defeat to the frackers in the US.

It has since emerged that Venezuela and Qatar will be added to those talks when the four meet next month.

Venezuela in particular has been hit hard by the current oil crash, with much of its economy geared to crude exports.

But, and this is the sticking point, the meeting is expected to be about a freeze in the rate of production rather than a wholesale cut – which had been the hope of the market.

The Saudi Arabian oil minister Ali Ibrahim Al-Naimi said this himself. You’d figure he’d have idea of the way the parties are thinking.

While a freeze in the rate of production is nice, it’s hardly going to captivate the market or oil traders in the short-to-medium term the way an immediate production cut would.

So why the conservatism?

Iran.

The lifting of US-led sanctions against Iran earlier this year has changed the game for OPEC. Iran, one of the OPEC members, had been restricted in who it could sell its multitude of oil to for years.

However, when the US government lifted the sanctions in response to cooperation over Iran’s nuclear energy program it meant Iran was now free to play the market and sell to whomever it chose to do so.

While stats are fast and loose at this stage, the signs are there that Iran is keen to jump back into the market and get its economy going again.

After all, it’s just bought 118 jet planes from France to replace its dated fleet – a deal valued at a cool $25 billion.

Can you imagine telling Iran that it won’t be able to take full advantage of its new-found freedom in the oil market because OPEC is cutting back production?

It would be political bedlam.

Instead, a freeze in production increases may be more palatable while offering a road back to an oil price environment which suits both OPEC and the US.

That’s why hopes of an immediate cessation to the trade war against OPEC and the US is perhaps a touch hopeful.

Instead, an oil price increase is likely to play out over a longer term.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.