It’s official: @Twitter is in #trouble

Published 01-AUG-2017 09:37 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It turns out that Snap Inc. isn’t the only social media platform doing it tough. It was a dirty week for Twitter too, as Facebook continued to pull ahead of the pack.

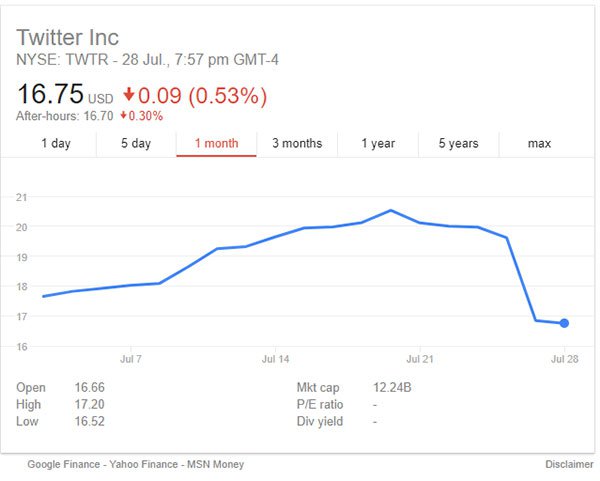

Twitter’s second quarter earnings proved a major blow for investors, with the social media giant reporting stagnant active user growth and a concerning drop off in ad revenue. The company’s share price took a hammering after the disappointing numbers, with the company trading below its IPO price.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Twitter’s chief operating officer, Anthony Noto, addressed shareholders.

“While we still have a lot of work to do for revenue growth to get it to track audience growth, the improvements in revenue growth reflect the progress executing against our top revenue-generating products in the second quarter as well as strengthening business fundamentals,” he said.

Unfortunately, Noto failed to address the white elephant in the room and one that should cause investors take to a cautious approach to their investment decision.

One of Twitter’s ‘top revenue-generating’ products is its advertising platform and despite registering a 95 percent year over year increase in advert engagement, Twitter posted an eight percent loss in ad revenue.

To make matters worse, digital trends analysis firm eMarketer believes its share of global market advertising will shrink to just 1.5 percent, despite forecasting an uptick in total ad revenue for the platform this year.

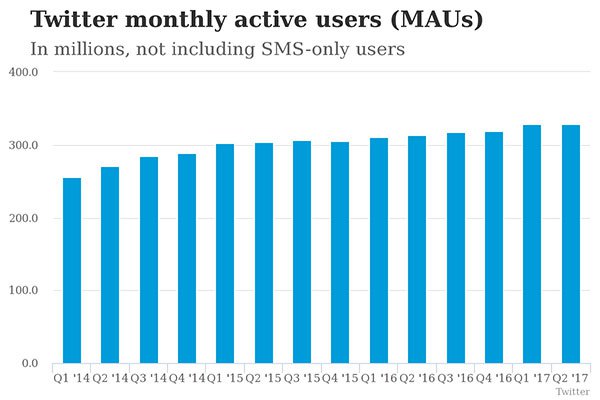

It’s an alarming trend for Twitter, which continues to fall short of figuring out its stagnant user growth.

It may have 328 million active users, but that number is piecemeal when compared to Facebook’s two billion plus active users.

In comparison, Facebook performed strongly over the quarter. Its earnings exceeded all projections across the board as the platform accrued around 70 million new active users for the three month period.

Victor Anthony, who is an internet analyst with Aegis Capital, spoke about Twitter late last week. “You have zero user growth versus Facebook reporting 70 million new users,” he said. “It’s not a recipe for a stock you want to buy.”

Is Twitter its own worst enemy?

To further compound woes for investors, the lax moderation of its platform may have scared advertisers and potential buyers away. Why Twitter took so long to address its largest criticism is still unknown.

Twitter has long been rumoured for sale, with Google, Apple and Disney all exploring purchasing it in the past.

Salesforce (CRM: NYSE) was the latest company that explored acquiring the platform, but it ultimately pulled out, citing a variety of reasons for the decision.

Salesforce CEO Marc Benoiff spoke candidly on the non-purchase. “In this case we’ve walked away. It wasn’t the right fit for us,” he said. “It’s not the right fit for us for many different reasons ... You’re going to look at price, you’re going to look at culture, you’re going to look at everything.”

Twitter has reduced abusive accounts by 25 per cent over the past 12 months, but it was a case of too little too late for past interest.

Despite its controversial reputation online, Twitter CEO Jack Dorsey maintains optimism, claiming that continued improvements will increase its active user base. “People are reporting significantly less abuse on Twitter today than they were six months ago, and that will have a flow on effect,” he said.

Where to from here?

There are still some positives for Twitter.

The company exceeded revenue projections for the quarter by roughly US$40 million, finishing with US$574 million in total.

Twitter also showcased its renewed approach to expanding its flat lining user base, releasing ‘Twitter Lite’ on April 6.

Twitter Lite is a far less data-intensive version of the platform that can only be accessed via mobile web browsers. The program takes up less than one megabyte of storage and is geared towards increased usability for users in developing countries.

Dorsey conceded that its traditional offering was ‘way too slow to access’ in some regions, which may have impacted active user growth substantially.

All in all, the remainder of the 2018 financial year will provide investors with further insight into whether Twitter can turn the corner, or fall the way of past social media behemoths who couldn’t adapt in time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.