Nuclear – will China become the region’s powerhouse?

Published 20-APR-2016 12:12 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In developing countries such as India and China, nuclear energy may represent the best shot of a low-carbon, and more importantly rapid, transition away from fossil fuels for electricity generation.

In the past decade or so, there has been a massive urbanisation and manufacturing effort underway in China to build the infrastructure needed to urbanise the middle class.

It’s the reason why China has been buying a mess of our iron ore in recent years.

To turn the iron ore into steel, China had to install a smattering of high-intensity, high-emission coal plants – which provided the baseload energy needed.

China was seen as a major hold out as little as three or four years ago, as the world turned away from fossil fuels, driven by concern over climate change.

Since then China has changed its tune – not because of massive concern over climate change, but mostly because coastal and more populous cities became hubs of smog from coal-powered plants.

This is not exactly the best way to endear yourself to the populace the Chinese government hopes to placate, thereby keeping its hold on power.

Over the past two years, China has undergone a rapid shift in thinking to become a world leader in climate change mitigation.

Nuclear power

According to the World Nuclear Organisation, in November 2014 it announced that about 20% of its primary energy consumption to be from non-fossil fuels by 2030, at which time it intended its peak of CO2 emissions to occur.

At the climate conference in Paris last year, China expanded on this to include a goal of reducing carbon dioxide by 60-65% on 2005 levels by 2030.

According to Cleantechnica, China has eclipsed lean, green Germany to have the highest installed base of photovoltaic capacity in the world on the back of the targets.

But, as it turns out, China is also a massive producer of solar panels. In fact, it’s so big that it’s been accused of dumping lower price panels into other markets, notably the US and Europe.

So the Chinese government saw a market opportunity for its domestic producers to be able to sell into the domestic market – it just needed to mandate more solar PV installation.

While the world marvels at China’s solar boom, it has also quietly been adding nuclear power capacity at a rate of knots – and Australia just happens to have a bunch of the stuff powering them.

Because of the power profile associated with solar, it isn’t the best for baseload power needed by factories to do things such as produce steel from ore – so the Chinese government has been looking at nuclear as a way to replace legacy coal-fired stations with a cleaner alternative.

As part of its post-Paris targets, the Chinese government has said that its nuclear power generation would be 120 to 150GWe.

This is starting to translate to the number of nuclear energy projects on the slab in China.

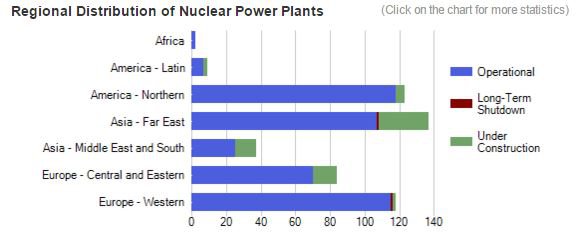

The chart below shows the number of reactors under construction and the current base for nuclear around the world – as you can see, China (under the guise of ‘Far East’) is responsible for the lion’s share of current construction.

The Far East region will become the highest nuclear users in the world – and Australia has a unique opportunity to ride the wave of demand which will follow.

According to the International Atomic Energy Agency, Australia has over 30% of the world’s uranium reserves.

A nuclear hopeful, Toro Energy, said in its 2015 annual report that the demand side was robust.

“Market sentiment continues to improve as emerging economies embrace low-emission nuclear power,” it said, according to the Sydney Morning Herald.

“Demand increases of between 15 per cent and 22 per cent by 2020 and 37 per cent to 58 per cent by 2025 are expected.”

It’s why the South Australian government at least is getting serious about uranium.

In March last year China called for a Royal Commission into whether a further nuclear industry – both in storage and exploration would be viable.

At the time, South Australian premier Jay Weatherill who had been against a nuclear industry in South Australia made more positive noises.

“When the facts change, people should change their mind,” he was quoted by the Australian Financial Review as saying.

The Commission is slated to report back next month.

In any case, the report will spell out the economic opportunity for South Australia and more than likely Australia as a whole by setting itself up as a key supplier of uranium to feed Chinese demand.

Hence, you’re starting to see some emerging action in the sector, right from the big boys down to smaller players such as listed Boss Resources (ASX:BOE).

Boss has picked up the Honeymoon Uranium Project in South Australia via the acquisition of Uranium One, and has moved into a joint venture with private company Wattle Mining.

As part of that transaction, it also picked up a mothballed processing facility which is capable of producing 880,000 pounds (almost 363,000 kilograms, or 363 tonnes) per year.

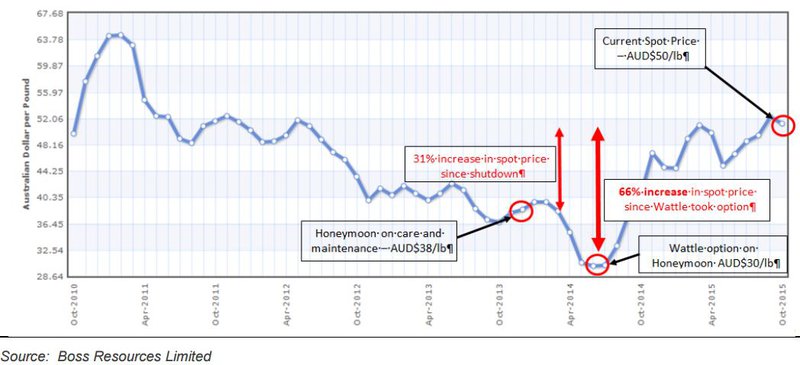

This chart from brokers Patersons shows why the junior resource space is now looking at nuclear again.

Chart showing the price of uranium since October 2010

Its Honeymoon site is also fully permitted, making it just the fourth in Australia after Ranger in the Northern Territory, Olympic Dam, and Beverley in South Australia.

So, are we about to see companies which hadn’t thought of nuclear as an option dust off their old tenements and go exploring?

BOE has betted that the Royal Commission will find that more should be done to extract the state’s uranium reserves, and with BHP attempting to cut costs every which way it is more than likely going to take a while for it to talk Olympic Dam expansion.

It may be up to the junior end of the market to prove up resources – but whether they do so in time to catch the China wave is up for debate.

Companies which have already delineated a uranium resource and for one reason or another mothballed the project may be in the box seat.

Junior companies can take years to prove up a resource and get into production, so if they want in they’re going to need to get their skates on.

In any case, the demand side appears robust in China – not to say anything of India which is expected to also be a big demand driver.

It’s now up to the supply side to get into gear if it wants the opportunity, and should the Royal Commission come back with favourable findings it could kick off renewed interest in the sector.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.