The next big stocks in communications?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed recently highlighted the changing configuration of the Communications Services Index (ASX:XTJ) which now casts a wider net by including stocks like Telstra Corporation (ASX: TLS) that own telecommunications networks to a wide range of companies providing various means of communication.

For example there has been the emergence of high growth companies such as REA Group (ASX:REA) and carsales.com Ltd (ASX:CAR) which are breaking new ground in digital media and advertising that have provided significant growth momentum in a sector that has traditionally been dominated by defensive stocks.

The impact they have had on the broader index is evidenced by XTJ’s gain of approximately 25% over the last 12 months.

However, with these stocks having experienced strong share price gains it is time to identify the next wave of emerging players, and it could be argued that this requires looking even beyond the areas featured in the new look telco sector.

In the US, big names such as Facebook Inc. and Alphabet Inc. (Google) were transferred from the technology index to the communications services index, joining traditional telcos such as AT&T Inc. and Verizon Communications.

Companies linked to the social media should continue to thrive, but identifying emerging entities that are active in the influencer and artificial intelligence industries could throw up some good value under the radar stocks.

Similarly, Finfeed has identified fast-growing emerging companies making strong progress in communications activities.

Vonex Ltd

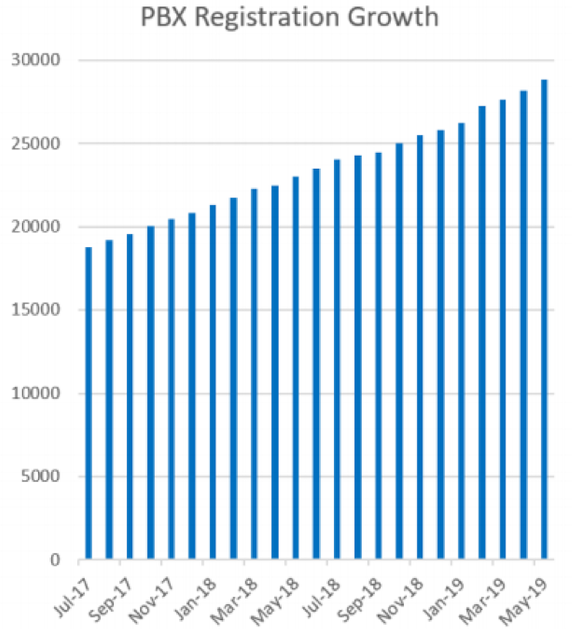

Telecommunications innovator Vonex Ltd (ASX:VN8) has continued to deliver strong growth in its retail business, exceeding a record 29,000 registered Private Branch Exchange (PBX) users as at June for 2019

The company’s targeted nationwide marketing program and constructive engagement with its network of channel partners are having a positive effect on business activity, with May 2019 the most productive sales month in Vonex’s history.

As indicated below, this outreach is also driving consistent growth in Vonex’s active user base, which at 29,000 users has grown by 24% in the last 12 months.

PBX registrations are a key indicator of business development progress as Vonex penetrates the multibillion-dollar Australian market for telco services to small and medium enterprises (SMEs).

Vonex is a full service, award-winning telecommunications service provider selling mobile, internet, traditional fixed lines, and hosted PBX and VoIP services - predominantly to the small to medium enterprise (SME) customer under the Vonex brand.

Management is targeting the NBN rollout in Australia’s capital cities as its campaign develops, which should drive website traffic growth and yield new customer leads online and through channel partners across the country.

In unison with this operational progress, management has made strong inroads on the research and development front.

Vonex’s soon to be released Oper8tor product is a disruptive aggregated communications platform which targets the inclusion of conference, voice, message and video functionality, facilitating user communication across a broad range of channels.

The mobile app aims to seamlessly link all voice calls as well as messaging across multiple platforms and devices, making it an extremely efficient tool for small to medium enterprises and large businesses, suggesting strong demand, as has been the case with the group’s other products.

Not only does the app feature innovative and state-of-the-art technologies that make for an impressive product in its own right, it offers another cross-selling opportunity for Vonex as it continues to build scale across its broad offering.

Oper8tor will ultimately solve the need for simplicity in telecommunications by being platform and device agnostic.

Management sees a clear path to global scale which will keep Vonex at the forefront of voice and messaging aggregation.

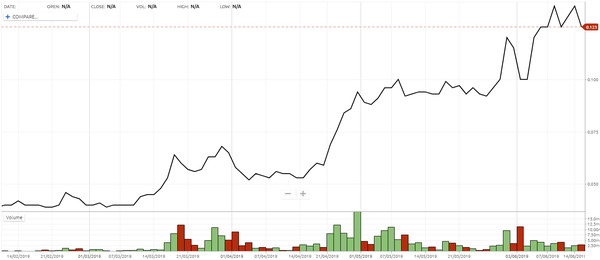

After management informed the market on April 30 that it had exceeded the 28,000 mark in terms of Private Branch exchange (PBX) users, the company’s shares surged more than 50%.

Given Vonex now has 30,000 users in its sights and is on track to deliver 25% year-on-year growth in new customer orders in the June quarter, accelerating from the 20% growth rate achieved in the March quarter, it could be argued that the company could easily be trading at the top end of the above range.

However, there appears to be a strong chance of a rerating when new customer order data for the June quarter is released.

Alcidion Group Ltd

Informatics solutions provider Alcidion Group Ltd (ASX:ALC) has made strong progress in the last three months, winning important contracts both overseas and in Australia.

Alcidion services the resilient healthcare sector, providing intuitive solutions that meet the needs of hospital and allied healthcare, worldwide.

The group consists of healthcare software companies Alcidion Corporation, Patientrack and Smartpage, and MKM Health, an IT solutions and services provider.

Each company brings a complementary set of products and skills that create a unique offering in the global healthcare market.

The company has developed proprietary technologies that support interoperability, allow communication and task management, and deliver clinical decision support at the point of care to improve patient outcomes.

With over 25 years of combined healthcare experience, the Alcidion group of companies brings together the very best in technology and market knowledge in providing communications delivery that enables sound decision-making at the clinical level.

The company had a major breakthrough in March when it was awarded a contract with Dartford and Gravesham National Health Service (NHS) Trust in the UK to roll out its full product suite.

The contract win was timely as it coincided with the UK’s National Health Service (NHS) transitioning to artificial intelligence (AI) and paperless systems, and allocating £4 billion (A$7.5 billion) to transition to a paperless environment.

Although the company had a strong presence in the UK with Patientrack, this was the first integrated installation of the complete product platform - Miya Precision, Patientrack and Smartpage - outside of Australia.

The product suite provides electronic patient observations, electronic paper charts, clinical assessments, clinical noting, patient flow, bed management and electronic discharge summaries for GPs.

The clinical team also has online access to patient information 24 hours a day, where and when required to provide the optimum level of patient care through mobile computing.

Just as REA and CAR provide 24/7 mobile access to a huge database of real estate and motor vehicle information, as a medical informatics provider Alcidion is servicing the medical profession in a similar way.

Such is the demand for Alcidion’s technology that the company has gone on to win other contracts in the UK and Australia, the most recent being its engagement to build and integrate two components for a proposed national child digital health record database in two New South Wales health districts.

Hence, the strong share price performance that can be seen below, reflecting a better than three-fold increase since March.

engage:BDR

One of engage:BDR’s (ASX:EN1;EN1O) goals is for the company’s IconicReach platform to deliver ‘the Google AdWords of influencer marketing’ to brands and agencies.

The company acknowledged that influencer marketing is very young but budgets will total US$10 billion by 2020.

Management noted that automation is scarce in this emerging area of marketing, and EN1’s competencies in programmatic and automated marketing technologies enable a shorter learning curve.

In May, the group announced that its IconicReach division was working to incorporate YouTube influencers as part of its standard marketing technology strategy.

To date, IconicReach has integrated influencer marketing channels from Facebook, Instagram and TikTok.

Since 2014, EN1 has proven video advertising contributes significant returns on investment for brands and is an immediate opportunity for the company’s revenue growth.

This integration further enables EN1’s vision for IconicReach to be the ‘Google AdWords of influencer marketing.’

Shares in EN1 have also performed well since mid-March, increasing 200% from 1.7 cents to hit a high of 5.1 cents in April.

While there appears to have been some sporadic profit-taking since then, as indicated below the share price is still up by approximately 100%.

Flamingo Ai Ltd

Shares in artificial intelligence and machine learning company Flamingo Ai Ltd (ASX:FGO) have performed strongly in May/June after the company negotiated a production contract with HSBC Bank Australia.

This followed a successful Proof of Concept (PoC) of its Virtual FAQ & Knowledge Assistant product in the December quarter of 2019.

Flamingo subsequently signed a Master Services Agreement (MSA) with HSBC Bank Australia, as well as agreeing to the first Statement of Work (SOW) under the MSA to deploy the technology into a production environment.

The contract includes the annual upfront payment of monthly subscription licence fees, as well as income generated from providing services and deliverables.

Consequently, there is scope to generate both recurring income and regular cash flow from ongoing services.

The MSA has an initial term of three years which can be extended up to 5 years.

The Flamingo Ai suite of Cognitive Virtual Assistants empowers employees and customers to quickly and accurately locate compliant, up to date information.

This results in improved operational efficiencies and customer response times, making it an extremely valuable tool in the communications chain, and underlining the future impact artificial intelligence is likely to play in communications within and beyond the enterprise network.

As the chart indicates, the HSBC deal prompted a 60% share price increase, and the company has continued to trade in line with this rerating.

Simble Solutions

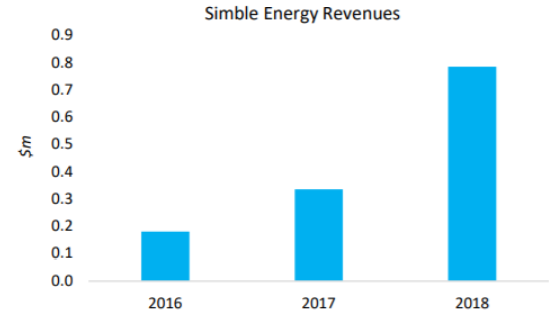

Simble Solutions (ASX:SIS) is an Australian software company focused on energy management and Internet of Things solutions.

The Simble Energy Platform or ‘SimbleSense’ is an integrated hardware and real-time software solution that enables businesses to visualise, control and monetise their energy systems.

In short, the company’s technologies communicate with their users in real-time in order for immediate informed decision-making to occur, rather than wondering what should have been after the event.

Consequently, it is very much a communications technology, and one that is gaining momentum in the utilities space.

The company’s Software as a Service (SaaS) platform has Internet of Things (IoT) capabilities and empowers enterprises and consumers to remotely automate energy savings opportunities to reduce their energy bills.

Simble operates in the SME and residential market and targets the distribution of its platform through channel partners.

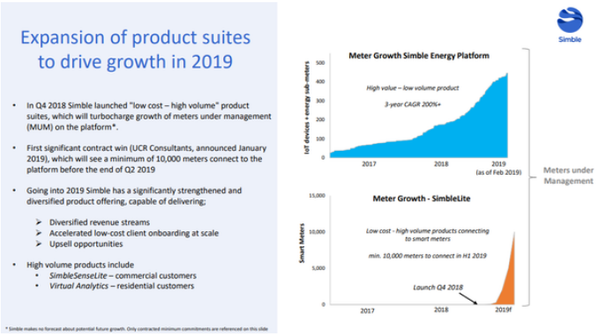

In May, the company extended its deal partnership with Australian technology company BidEnergy Ltd (ASX:BID) and UK energy broker UCR Consultants (UCR).

The importance of this development was reflected in a rebound in the company’s share price which had declined in March/April due to a lack of news flow, but with new developments in the pipeline and proof of strong growth in recurring income, a sustained recovery would not surprise.

The introduction of BidEnergy’s Robotic Processing Automation (RPA) platform as a new feature bundled into Simble’s smart energy technology solutions will allow UCR to expand deployment to 60,000 meters ahead of schedule.

The updated deal is worth up to £3.5million (AU$6.4million) over a three-year term, a significant increase on the original deal struck in January which was valued at $3.4 million.

Importantly, this will result in a substantial increase in the group’s recurring revenues, providing financial stability and improved earnings visibility in the near to medium-term.

To fast-track market penetration, UCR Consultants was appointed as a non-exclusive distributor to the UK energy broker channel targeting a further 200,000 meters, a four-fold increase on the initial target market announced in mid-January.

Over 2 million meters are serviced by energy brokers in the UK, highlighting the significant market opportunity for Simble which is valued at approximately $28 million.

As the rollout commences immediately, Simble expects to deliver substantial recurring revenues from this partnership, targeting monthly six figure income streams within the first 12 months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.