New age of automotive vehicles isn’t just about batteries

Published 16-JUL-2018 12:04 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The surge in the prices of lithium, cobalt and more recently vanadium is driven by the anticipation that there will be a significant uptick in demand for battery materials, creating unprecedented demand for these commodities.

One of the biggest demand drivers will be the electric vehicle (EV), but bear in mind that there is another factor at play, being the emergence of self-driving vehicles (SDV).

That said, the overall thematic is still very much in place. In fact, the emergence of parallel innovations such as SDVs should only strengthen demand for electric power systems.

While both are likely to be powered by batteries that contain the aforementioned commodities, there is other unique and proprietary componentry required for both the EV, and in particular SDVs - a power source just starts the engine and keeps it going.

While new technologies in recent hybrid vehicles may have been mainly limited to power source, storage and supply, this will change as they become more sophisticated.

However, when large numbers of SDVs hit the assembly line the landscape will change altogether and so will the fortunes of many companies that supply the vital machinery, components and IT systems essential to their functionality.

Emergence of ETF highlights sector diversification

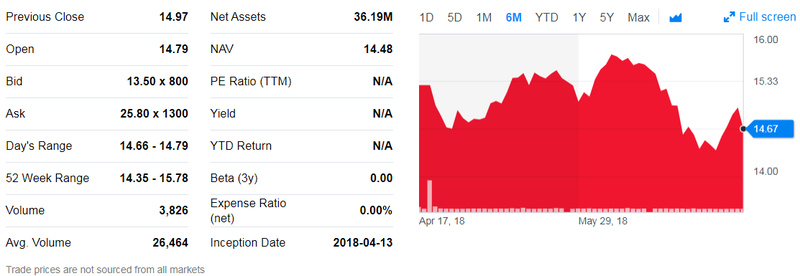

On April 13, 2018 Global X, wholly owned by Seoul-based Mirae Asset Global Investments Group which offers asset management expertise to international clients launched the Global X Autonomous & Electric Vehicles (DRIV) exchange traded fund (ETF).

It should be noted that investors should seek professional financial advice about this fund if considering assets under its management.

Mirae had assets under management of US$126.5 billion as at March 31, 2018.

This includes companies involved in the development of autonomous vehicle software and hardware, as well as companies that produce EVs, EV components such as lithium batteries, and critical EV materials such as lithium and cobalt.

Management is of the view that DRIV enables investors to access high growth opportunities through companies critical to the development of autonomous and electric vehicles – a potentially transformative economic innovation.

This is a snapshot of the ETFs share price performance to date as well as some basic fundamentals.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Importantly, the make-up of its portfolio doesn’t have a narrow focus on particular areas such as battery power.

The group throws the net much wider across many sectors, industries and geographic regions, tracking emerging technological themes.

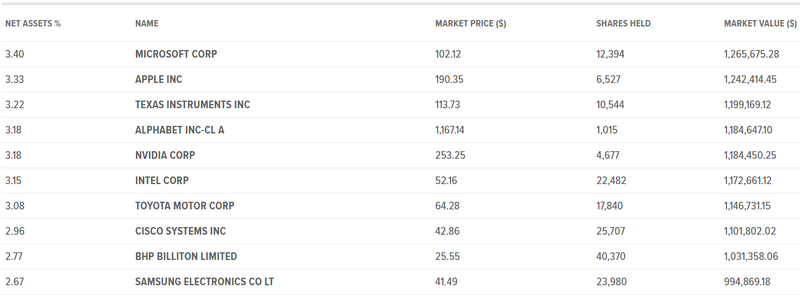

Consequently, investing in the ETF provides exposure to numerous companies leveraged to the EV and SDV themes, which as you can see below also incorporate some of the largest multinationals that would have a place in most global blue-chip portfolios.

These were the top 10 holdings ordered by market value as at July 10, 2018.

While these fluctuate as management consistently overviews and realigns the portfolio to meet emerging trends and new developments, the main factor from an investment viewpoint is that the focus will always be on maximising shareholder returns from investing in companies leveraged to the EV and SDV sector.

What is behind the diversification

With the companies in the portfolio diversified in their own way, one could argue that their exposure to areas outside the EV and SDV sector dilutes their leverage to this theme.

By contrast though, investing in narrow fields such as lithium, cobalt and vanadium which often involves exposure to speculative stocks operating in regions where there is sovereign risk can be more hazardous.

In the top 10, investors have global mining giant BHP Billiton (ASX:BHP) as a means of tapping into the materials sector.

It is also worth noting that Rio Tinto (ASX:RIO) sits just outside the top 10, and other Australian battery material producers and emerging producers such as Orocobre (ASX:ORE), Mineral Resources (ASX:MIN) and Pilbara Minerals (ASX:PLS) are also in the mix.

While Toyota Motor Corporation (NYSE:TM) is the only motor vehicle manufacturer in the top 10, many other leading manufacturers including Tesla Inc. (NASDAQ:TSLA) sit outside the top 10.

Why so many tech stocks

The top 10 is skewed heavily towards tech stocks, the main reason being that this new age of automotive development will require the development of technological components that weren’t even thought of 10 years ago and may not be developed for another 10 years.

It is the likes of Microsoft (NASDAQ:MSFT), Apple Inc (NASDAQ:AAPL) and Alphabet Inc. (Google) (NASDAQ:GOOGL) that will be pouring billions of dollars into the new age technologies required to provide driverless vehicles with the intuition, the safety awareness, the navigating ability and decision-making capabilities that have until recently been something only a human could provide.

While it has received little publicity, extensive research and development has been taking place over the best part of a decade to meet the needs of an SDV.

Alphabet was one of the early movers, and while it is best known for its Google search engine, it has been working on self-driving technology since 2009.

Both Google and its self-driving car affiliate, Waymo have the same parent company in Alphabet Inc.

Tomorrow will take a closer look at the progress Waymo has made and relay the thoughts of one broker of the view that it could be one of the best tech plays in the EV/SDV sector.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.