New age of automotive vehicles isn’t just about batteries - Part Two

Published 17-JUL-2018 16:22 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Yesterday we highlighted the extensive multi-sector activity that will be generated by the emergence of electric vehicles (EV) and self-drive vehicles (SDV).

While there is much hype surrounding battery minerals, it could be argued that the billions of dollars being invested by technology companies aiming to develop the best intellectual property for components that extend beyond the basic battery warrants just as much if not more attention.

Alphabet Inc’s wholly owned subsidiary, Waymo, has been one of the most active players in terms of investing in research and development in this area.

It should be noted that any investment in Alphabet based on Waymo’s R&D would be speculative, so investors should seek professional financial advice if considering this stock for their portfolio.

Waymo poised to enter its tenth year

Demonstrating its commitment to not just being the first to deliver the technology, but also being the best so that it can dominate a niche fast growing market, Waymo has even built a city with roads, buildings and houses where it tests the cars.

Waymo drives more than 25,000 autonomous miles each week, mainly in urban areas and the group’s software also completed 2.7 billion simulated miles in 2017.

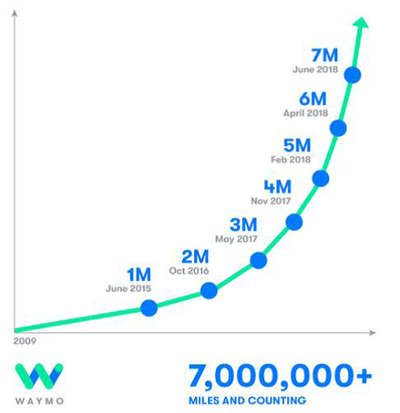

Analysts have noted that the one million mile updates have increased in regularity, suggesting an accelerated growth rate as seen in the chart below produced by the company.

Testing starts this year and Waymo will add up to 20,000 I-PACEs to its fleet in the next few years, enough to drive about a million trips in a typical day.

Brokers backing Alphabet in a game changer

On July 10, 2018, Mark Mahaney, analyst at RBC Capital Markets said, “We believe the commercialisation of Waymo by year-end in Phoenix could be a catalyst in the near-/medium-term, leading to a potential rerating in Alphabet Inc’s (NASDAQ:GOOGL) multiple.

“Our two long-term monetization scenarios for Waymo, developed with RBC’s Auto Analyst Joe Spak, generate potential enterprise values of US$119 billion to US$180 billion.

“We see an upside scenario of $1,500.”

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

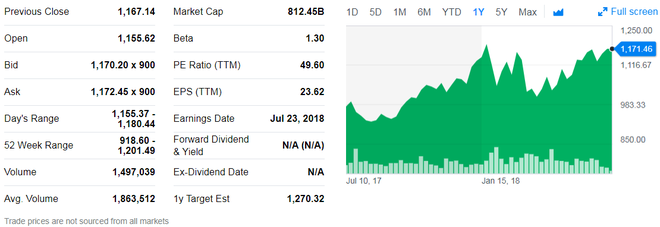

The following shows GOOGL’s share price performance over the last 12 months with the company hitting an all-time high of just over US$1200 per share, but more recently hovering in the vicinity of US$1170 per share. Step back five years and GOOGL was trading just above US$400 per share – the subsequent three-fold gain can be attributed mainly to its technological expertise, and if it continues to deliver on that front the company could well lead the way in providing components for the new age automotive industry.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Owning the network company versus licensing the IP

Under the first scenario, RBC believes Waymo will buy vehicles from original equipment manufacturers (OEMs) and outfit the custom vehicles with its autonomous driving technology and become its own transportation network company.

By 2030, a potential circa 1.5 million Waymo vehicles could account for 1.5% of total new vehicles on global roads.

The key financial points revolve around the generation of US$1.9 billion in annual revenue with an annual operating loss of US$1 billion by 2022 and US$65 billion in annual revenue with an annual operating profit of US$20 billion by 2030.

Under this scenario, RBC estimates that Waymo could achieve breakeven operational income in 2025.

Under the other scenario, RBC assumes Waymo will license its self-driving operating system (SDOS) to OEMs in the form of a recurring, yearly software subscription.

Under this scenario Waymo is forecast to grow its penetration from 25 per cent to 34 per cent of the new autonomous vehicle market over circa 10 years, assuming other OEMs and tech companies take the remaining market share.

The key financial points are that RBC believes that Waymo will be able to generate US$736 million in annual revenue with an annual operating profit of US$250 million by 2022 under this scenario, increasing to US$53 billion in annual revenue with an annual operating profit of US$35 billion by 2030.

For this scenario, the broker built in a discounted cash flow (DCF) and assigned an exit multiple of 15x earnings before interest, tax, depreciation and amortisation (EBITDA), deriving an enterprise value of US$180 billion.

Given that this model is less capital intensive and higher margin, RBC assumes this would be GOOGL’s preferred monetisation strategy.

Whichever way you look at it, this is big bucks so if GOOGL can get it right it would have a material impact on the value of the Global X’s Autonomous & Electric Vehicles ETF.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.