Netlinkz revenue surges 846%, remains on track for $15M revenue by year end

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A number of developments within recent weeks have contributed to a transformational change for Netlinkz Limited (ASX:NET), a company that provides secure and efficient cloud network solutions for large enterprises.

One of the key developments is the appointment of former Australian ambassador to China, Dr Geoff Raby (AO), who will be instrumental in furthering NET’s existing footprint in the Asia Pacific region and bringing further recognition to the company’s technology.

Netlinkz’s technology makes Fortune-500 cloud network security commercially available for organisations of all sizes. The company has received numerous industry awards for its technology, including being a worldwide winner of the Global Security Challenge.

The company has established a solid platform underpinning its recent growth and is evolving into a leading global Virtual Secure Network (VSN) company for blue chip corporations and government.

Multinational corporations taking up the company’s VSN is excellent validation of the technology, and over time, these corporations are likely to deploy the VSN into other international markets in which they operate.

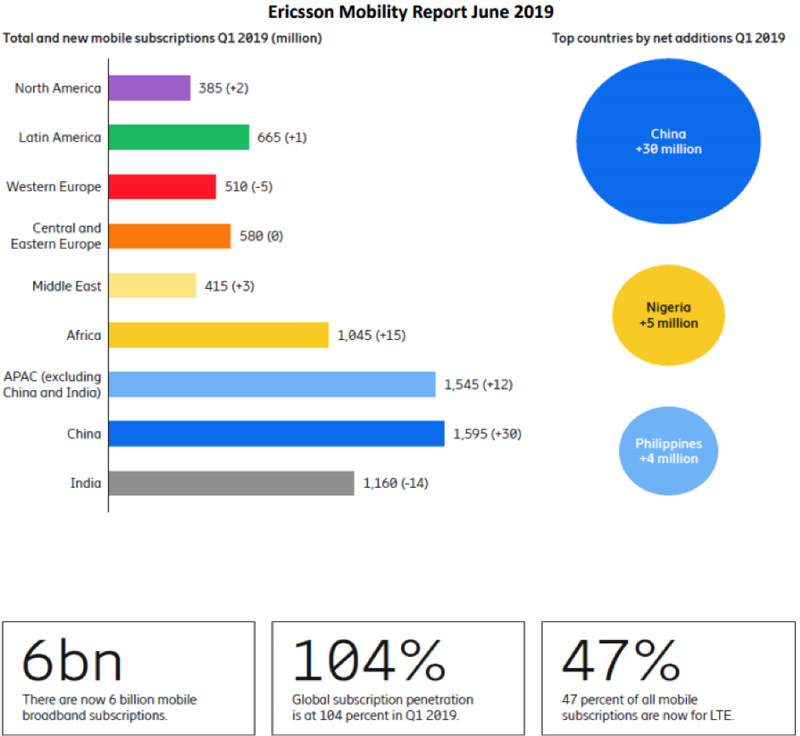

Telecommunication companies need to adapt to changing times and cybersecurity is becoming an increasingly important factor, so it is no wonder that Netlinkz ultra-high efficiency and premium security communications products are in demand.

The success of its technology is driving exceptional growth, with the company recently reporting fiscal 2020 sales of $5.25 million, up 846% on the previous corresponding period.

Revenue growth has been mainly attributable to rapidly increasing sales in China, however the company has also entered the Indian market in a recent deal.

Importantly for investors with an eye to future growth, the $179 million capped company remains on track for its previously stated guidance of $15 million of customer receipts by year's end.

Having flown under the radar until recently, investors appear to beginning to grasp the merits of Netlinkz with its shares increasing more than 60% in the last month, including a surge of 27% yesterday.

No doubt, Netlinkz is also benefiting from the increased focus on cybersecurity given the significant benefits that its technologies offer in this field.

While executive chairman James Tsiolis was very pleased with the headline numbers, he was quick to highlight that fiscal 2020 was the start of something much bigger as he said, “The 2020 financial year has been a transformational one for Netlinkz and we now have in place the foundation to capitalise on the initiatives we undertook during the year to really fast-track growth in the current financial year and beyond.

“We remain on track to meet our previously stated guidance of $15 million of customer receipts by year-end, with the Board being of the firm view that we are only just in the very early stages of growth.

‘’We have market-leading VSN (virtual secure network) technology, an expanding global footprint, quality partners, a growing base of blue chip and government customers, as well as other revenue streams and technologies that underpin this confidence.

‘’As such, Netlinkz is exceptionally well positioned to capitalise and it has a very strong market advantage.”

From a corporate perspective, the company held $3.9 million in cash at June 30, 2020, and in late July proposed to raise $18 million through a Convertible Note issue to strengthen the balance sheet and underpin sales growth, subject to shareholder approval at a General Meeting this week.

The convertible notes have a conversion price of A$0.10 each, which is a premium to NET’s current share price. The funds from the capital raise are intended to be used to repay loan facilities with Lind Globla Marco Fund, LP and CST Capital Pty Ltd, and seek to drive sales across multiple growth opportunities across the globe.

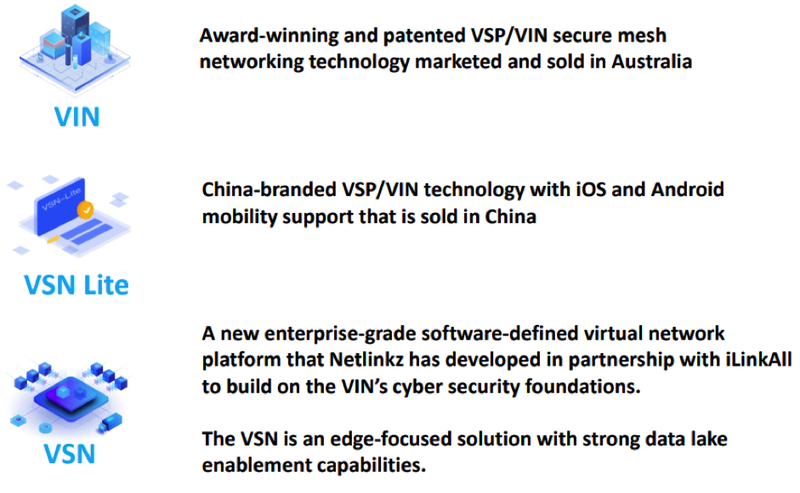

Understanding VIN and VSN

Understanding the group’s technology is essential in terms of appreciating how it is driving superior growth to its peers, but also it provides an insight into Netlinkz’s growth profile going forward with management forecasting revenue accretion of nearly 200% in fiscal 2021.

A key growth driver is the company’s Virtual Secure Network (VSN) product, which evolved out of Netlinkz’ Virtual Invisible Network (VIN).

The award-winning Virtual Invisible Network or VIN is an evolutionary step in virtual networking that can be used over any other type of established public or private network, including the Internet.

The technology is evolutionary because it introduces the ability to create an entirely new LAN (local area network) fabric over WANs (wide area network or other larger networks).

VIN creates a unique LAN type network over a WAN, providing organisations with heightened security, faster virtual network speeds and increased network reliability over small or long distances.

In essence, the VIN can allow an organisation to enjoy all the benefits of a LAN network but over a wide area.

The LAN fabric is extremely adaptive and fluid, a technology that can achieve the same efficiencies and benefits as a traditional localised LAN typically found in a home or office.

VIN has been proven to hold connections better than any other VPN based solution, even if the underlying network fails or encounters intermittent problems.

The technology employs the traditional security methods expected of any private network layered over a public one but is also far more secure by design.

Further, VIN offers the same networking flexibility as traditional physical ethernet networking and it can be interconnected with any other type of IP-based network making for infinite possibilities.

Taking a step forward, the VSN platform of technologies is an integrated solution delivering network connection, security, flexibility, control, management and monitoring of any network requirements for any enterprise client.

Because VSN embraces all aspects of technology including SD-WAN, cloud, mesh, edge, peer to peer and IOT it can deliver scale and scope applications across many different industries and user cases.

Netlinkz is therefore positioned to cater for basic to extremely complex client-driven customised solutions.

The VSN product line and technology solutions as a platform allows for other vendors to connect to the Netlinkz platform and ‘bundle’ their products as part of a service.

Netlinkz is well positioned to grow revenue satisfying both ‘connectivity’ to basic infrastructure demand and growing demand for Cloud hosting and delivery of services to clients’ (SaaS) business models.

Chinese enterprise customer base forms the bedrock of revenue growth

Revenue growth in China commenced in the March quarter of 2020, representing the start of the Company’s go to market strategy.

In order to capture the value of the potential market in China, Netlinkz has worked with large carriers like China Telecom, Government Authorities and established distributors, to develop a made for China business model which includes the necessary corporate, regulatory and legal infrastructures that satisfy the demands of enterprise businesses in China.

In simple terms this means that the IP developed for the VSN line of products is owned by iLinkAll, a Chinese company which Netlinkz owns 80% of in conjunction with Isoftstone, a major engineering technology development company with operations in China and around the world.

The revenue share required to be achieved for significant shareholder value creation compared to total market opportunity and size is extremely small.

The barriers to entry in China are significant and offer a ‘moat’ around Netlinkz’ established positioning, and the company enjoys a prime mover and cost advantage and access advantage given market dynamics in China.

Entry into India

In late August, NetLinkz entered India and other international markets through a Master Services Agreement (MSA) signed with emerging technology software solutions provider Natsoft Corporation.

Founded in 2004 in the US and with a delivery centre in Hyderabad, India, Natsoft has a global network of offices staffed with over 700 professionals delivering enterprise solutions and digital technologies like Blockchain, Robotics Process Automation, Big Data, Artificial Intelligence, Industrial IoT and Behavioural Analytics solutions that seamlessly integrate into the transactional systems.

Natsoft’s customers include blue chip organisations such as Novartis, Equinox, Twitch, Sun Power, IBM, TechM, Wipro (www.natsoft.us)

Management has engaged Natsoft to develop and source selected international markets and customers through a reseller agreement for Netlinkz’s products.

Part of the agreement also includes establishing an IoT Lab in Natsoft’s offices in Singapore and India, as well as managing the software source codes for the company’s VSN technology.

Development of the IoT lab commenced immediately and this will build on the experience of the existing Netlinkz IoT labs.

There was also an important development on the client front with a number of new customer opportunities in India having already been identified.

Under the MSA, the parties will agree commercial fees to be paid to Natsoft for services provided pursuant to each scope of works (SOW) to be agreed between the parties.

Size of Indian market provides substantial organic growth opportunities

Management’s decision to partner with Natsoft will deliver clear commercial benefits to both parties in a relatively short period of time.

India has been identified as the first high growth market opportunity, given many industries in that region are migrating to cloud service providers which in turn increases demand for VSNs.

India is a large market in Asia Pacific and therefore presents enormous upside for Netlinkz with more immediate sales opportunities.

Commenting on the significant growth opportunities provided by teaming up with Natsoft, Tsiolis said, “This partnership is a great opportunity to fast-track our organic growth in India and other international markets with a capable, well-established and highly regarded partner in Natsoft.

‘’While we continue to experience very high demand for our VSN technology in our existing markets, India represents a huge opportunity that we can quickly tap into without a huge upfront investment.

‘’We know the Natsoft team well and there are some promising near-term customer opportunities that we will aggressively pursue.”

Opportunities in the Asia-Pacific region

Looking beyond India, management has identified a suitable large scale established technology firm to partner with in similar fashion to iSoftStone - again Netlinkz will be the majority owner.

The expansion plan will see IP from Netlinkz modified for use ex-China, engineering, sales, technical and customer support centres established and enterprise level product sales to commence in the December quarter of 2020.

Geographic development will increase the scale and scope of business growth throughout the Asia-Pacific (APAC) region.

Netlinkz’s subsidiary Netlinkz Japan KK has established an IoT Lab in Tokyo and it currently has Japanese corporate and multinationals testing the VSN for their enterprises.

The first commercial contract from the Japan IoT Lab is expected in the September quarter.

Further international expansion is also being pursued in Europe with a key IT integrator and reseller to establish an IOT Lab there as well.

Sales and support centres are already planned for Singapore as a secondary hub - ex India.

The APAC capabilities are also fit for access to a number of EAME (European, Africa and Middle Eastern) markets, particularly in the Middle East.

Acquisition of SSI Pacific expands Australian presence

Netlinkz has also been busy in Australia, acquiring leading system integrator and value-added reseller SSI Pacific Pty Ltd (SSI) for $10.2 million which has considerably strengthened its domestic operations.

SSI is a Melbourne-based reseller specialising in Lawful Intervention (LI) and Data Retention (DR) system design/development, implementation and maintenance/support solutions.

It has an established customer base in Australia, New Zealand and the Asia Pacific regions, including top-tier telecommunications companies, and it is growing well as part of Netlinkz.

SSI will also act as a distribution channel for Netlinkz products.

Since completion of the acquisition, SSI continues to grow its revenue through the retention and renewal of existing customer contracts (including a five year renewal with Spark Telecom), as well as adding new telecommunication customers.

Delivering growth in fiscal 2021

Netlinkz is now aggressively pursuing sales with medium and large enterprise engagements, as the VSN is more saleable for enterprise-grade corporations and government customers.

Management is deploying its product via the cloud, allowing it to participate in the growing global trend of cloud migration.

Netlinkz will pursue local resellers to integrate its VSN product as part of bundle solutions for the enterprise market.

Management anticipates that its strong growth will continue in the medium and long term under the direction of its talented and highly motivated executive leadership team that is delivering tangible outcomes.

As touched on earlier, the Board was recently strengthened with the appointment of former Australian ambassador to China, Dr Geoff Raby (AO).

His appointment is extremely important given his vast knowledge of the region from a regulatory and corporate perspective.

Raby is particularly well-connected in China, and this isn’t his first board appointment in relation to an ASX listed tech and communications company looking to expand its presence in the country.

He also brings important experience to the team in terms of dealing with big corporates through his company directorships with the likes of Yancoal, Oceana Gold and Fortescue Metals Group (ASX: FMG) with the latter having an extremely robust relationship with China.

Harking back to Netlinkz’ growth drivers, more sales are expected in China through iLinkAll’s accelerated release of the latest version of its VSN product, and the recently announced entry into new markets, most notably India, positions the company favourably.

For the remainder of the December half, the company will focus on continuing to enhance the VSN and VIN technology, introducing additional features to provide flexibility and scalability for secure enterprise network solutions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.