MVP back on the radar after striking Korea distribution agreement

Published 07-SEP-2016 13:23 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

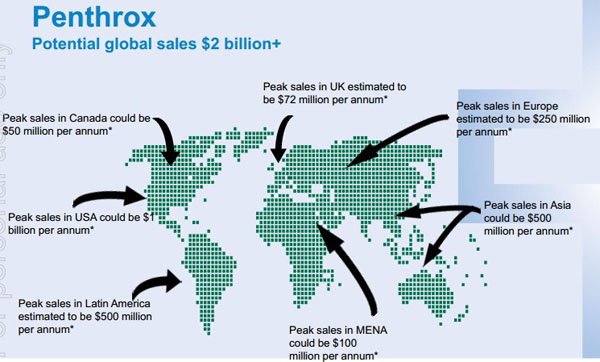

Shares in Medical Developments (ASX: MVP) surged on Tuesday in response to the company’s announcement that it had reached an agreement for the exclusive distribution rights of Penthrox in Korea, a development that should generate sales of 300,000 units per annum.

The 8% rally from the previous day’s close of $4.85 to $5.25 was in keeping with the material nature of this development. However, it is worth noting that the company’s shares were trading in the vicinity of $6.40 only two months ago and appear to have slipped off the radar for no apparent reason.

This is still looming as an important share price catalys, as is the launch of Penthrox in France which Bell Potter expects will occur next month. These upcoming developments, along with potential upside from distribution of its Anti-static Space Chamber Respiratory Device supports the broker’s substantial earnings growth forecasts over the next three years.

Bell Potter analyst, Tanushree Jain, expects MVP to deliver compound annual earnings per share growth of nearly 70% between fiscal 2016 and 2019 inclusive. There would be few stocks that can match this growth profile across any sector, suggesting the 12 month share price target of $7.70 is fundamentally sound.

Consequently, yesterday’s share price bounce could be the start of bigger things to come particularly given the fact that MVP is trading at a discount of more than 40% to Bell Potter’s 12 month share price target.

However, it should be noted that historical trading patterns and broker projections are not an indication of future share price performance and investors should disregard these factors in making investment decisions.

One of the appealing aspects of MVP’s business is that it offers both earnings visibility and reliability from existing distribution agreements, while presenting blue sky opportunities for rollout of its products into new markets.

Industry dynamics within the global health services industry should continue to support organic growth in existing markets. There is a correlation between the number of visits to emergency departments (EDs) and the use of Penthrox, and with these numbers climbing due to out of hours primary care services predominantly being dealt with by EDs, sales volume should increase.

The distribution of Penthrox throughout Australia, South Africa, Singapore, Ireland and the UK is currently generating robust revenues. As MVP expands into mainland Europe and moves towards approval in the US it appears reasonable to assume that the company’s share price will align with its earnings trajectory.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.