Morgans bullish on Inghams chook business

Published 17-FEB-2017 11:02 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

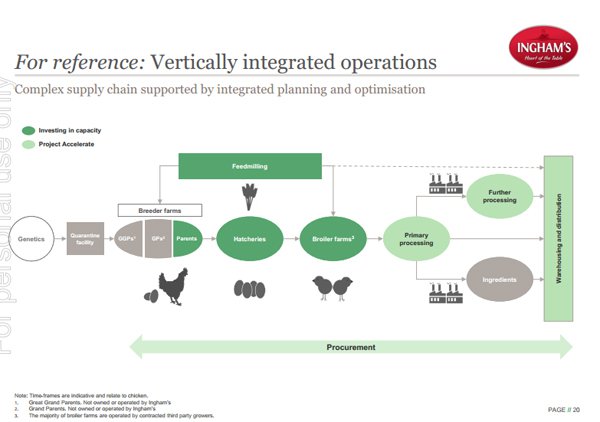

Vertically integrated poultry production and distribution business, Inghams Group (ASX: ING) delivered an impressive result for the first half of fiscal 2017 with the pro forma net profit of $51.3 million representing growth of 13.8%.

This compared favourably with Morgans CIMB’s expectations of $47.4 million, and the broker has reaffirmed its buy recommendation and 12 month price target of $4.00, implying a premium of approximately 20% to Thursday’s closing price of $3.30.

There was a mixed reaction to the result as the company’s shares initially increased from the previous day’s close of $3.39 to hit a high of $3.46 before closing at $3.33.

Inghams listed on the ASX in November and given that the first half performance was in line with prospectus forecasts and management reconfirmed that it was on track to achieve full-year pro-forma net profit guidance of $98.8 million a more upbeat share price response wouldn’t have surprised.

It should be noted that broker projections and price targets are only estimates and may not be met. Also, historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.\

One detracting factor may have been management’s comments regarding challenging market conditions in New Zealand which are expected to continue in the second half.

Morgans CIMB has lowered its earnings expectations in relation to the New Zealand business, but it is of the view that the Australian operations will offset lower than expected earnings from that region, resulting in the broker reaffirming its full-year earnings forecasts. Furthermore, Morgans believes that management’s fiscal 2017 forecasts is conservative.

Group analyst, Belinda Moore believes strongly in Inghams and the poultry industry saying, “For a market leader with an integrated network, leverage to attractive industry fundamentals and significant upside from transforming a previously family run business, we believe that ING is undervalued on a fiscal 2017 forecasts PE multiple of 12.8.

Inghams Chief Executive, Mick McMahon said, “The results for the group are in line with prospectus forecasts and reflect strong demand for Ingham’s quality products with our customers continuing to investing chicken as the healthy and competitive protein”.

Inflated beef and seafood prices drive increased demand for chicken

There is no doubting the fact that chicken has become more competitive from a pricing perspective. Both beef and seafood prices are at all-time highs, while there has been little price movement in chicken.

A reasonable comparison is the price difference between skinless chicken breast and rib/eye fillets steak as both have very little wastage and are high in protein. Chicken breasts sell for circa $10 per kilo while the price of fillet steak generally fluctuates between $35 and $55 a kilo, with better quality cuts more often than not at the top end of that range.

As a source of Omega 3, Tasmanian salmon was promoted heavily as a health food, but challenging growing conditions have resulted in its price rising from well below $30 per kilo to $35 per kilo and higher.

This appears to have pushed up the price of other table fish such as snapper and barramundi with the former now fetching top of the range eye fillet type prices.

Consequently, one can only see demand for chicken increasing, and with Inghams being Australia and New Zealand’s leading integrated poultry producer, supplying the retail, restaurant and consumer markets, it is well-positioned to take advantage of this trend.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.