Mining begins to thaw as commodity freeze persists

Published 21-JUN-2016 14:47 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The weird and wonderful world of Mining has been through the proverbial meat grinder in recent years — and lived to tell the tale.

According to Pricewaterhouse Coopers, the world’s leading accountancy and corporate finance firm, the Mining sector is “slower, lower, weaker — but not defeated”. PwC publishes an annual status check report of the Mining sector as a whole, and each year, the report’s title gives a good insight into true sentiment in the sector.

In 2005, PwC’s report was titled, ‘Enter the Dragon’, astutely identifying the entrance of China on the commodity world stage. In 2007, the report was titled ‘Riding the wave’, which turned to ‘As good as it gets?’ in 2008. In 2009, ‘When the going gets tough’, and then in 2011, ‘The game has changed’.

Aggregated together, the world’s top 40 mining companies have been left hurt and bruised by the commodity ‘bust’ that followed the ‘boom’. Of the 40 companies, two filed for bankruptcy over the past 12 months while all 40 saw their shareholder dividends slashed alongside huge reductions in capex and over $200 billion in cumulative write-offs.

The fundamental reasons behind the downbeat assessment are well known amongst Mining investors, and with much of the negativity now firmly priced in, PwC sees a strong chance of the protracted commodities decline, finally beginning to turn.

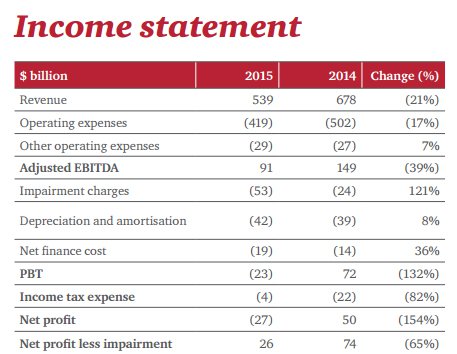

In a recent overarching report on the core of the world’s mining sector, as represented by the largest 40 Resources companies, PwC found the globe’s 40 biggest miners made a collective loss of $US27 billion (A$37 billion) in 2015. This was the first loss that weighed on the entire industry with the big players suffering most, hit by China’s slowing economy and a 25-40% fall in commodity prices last year.

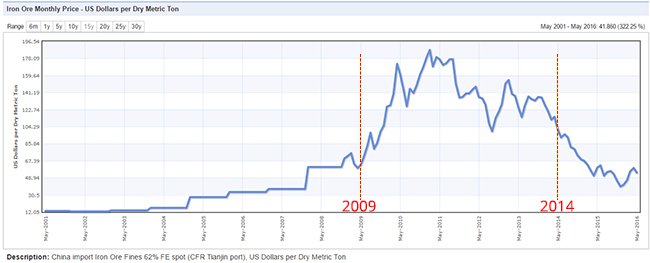

PwC estimates that the market value of the world’s top 40 miners, fell 37% to equal US$494 billion in nominal terms, thereby erasing all the gains from the Australian mining boom, loosely ascribed to the period between 2009 and 2014.

Australia’s favourite commodity, iron ore, perfectly illustrates the frayed state of affairs in Mining since 2009. A protracted rise in demand for industrial commodities and metals led to rising prices for most commodities. But the boom period lasted barely 5 years before oversupply and waning global demand began to weigh on prices.

PwC sees the commodities cycle as following its normal expected pattern with the big miners switching away from new exploration, and focusing on more efficient production at lower cost. In other words, consolidation and doing better with what they already have.

Mature mining companies are now forced to take-on tougher deposits, found at greater depth or with additional processing required, which effectively means they are working harder just to remain where they are. One of the biggest surprises from the PwC report is the finding that productivity among the top 40 miners rose, despite the sharp falls in commodity prices.

“Commodity prices have broadly fallen by around 25%, but the market caps of the big miners have fallen by over 50%” said PwC Mining Leader Chris Dodd, via a webcast broadcast by PwC. “The Mining industry is in uncharted territory” he added.

Digging down into exactly why such a heavy impact on big miners has occurred, and how this could effect future Mining activity, PwC says that, “Investors are punishing poor allocation of capital and inefficient capital expenditure. As exploration falls, future sustainability of the industry is now coming into question”.

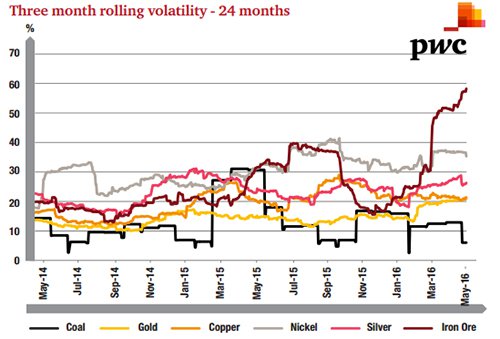

For the time being in 2016, we’ve seen a sharp reversal in commodity prices but with the unwanted caveat of heightened volatility. PwC says it’s still “premature” to call 2015 the bottom.

PwC concluded that Mining is not defeated just yet, “It is within the power of the Top 40 to rebuild their investment propositions and rise off the canvas. But if there is one thing that 2015 has shown, it is that the foundation cannot be as dependent on China”.

To read PwC’s full 52 page report, click here.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.