When is a miner a ‘green’ stock?

Published 11-AUG-2016 12:45 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Can lithium miners be considered a ‘green’ stock? As it turns out, kind of.

Unless you’ve been hiding under a rock in recent times, you would have noticed that a slew of lithium miners are cropping up to take advantage of an expected supply/demand imbalance driven (quite literally) by Tesla and others’ lithium-ion batteries.

Aside from Tesla, a slew of Chinese manufacturers have joined the race to produce as many electric cars as possible – spurred on by a government getting serious about climate change.

While Tesla’s much-hyped 35 GWh Gigafactory has the potential to double the world’s demands for lithium, China is adding 52GWh of new capacity as well.

The unprecedented demand side is driving the expected price of lithium through the roof.

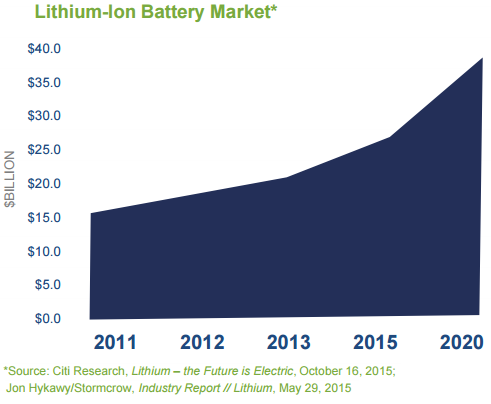

Below is just one estimate of the demand side.

Lithium demand chart

Normally a miner would simply point to the supply/demand dynamics at play, but lithium hopefuls have also been able to add another number to their repertoire – they’re green plays.

Because of lithium’s role in lithium-ion batteries, lithium miners have been claiming that they could be construed as a green investment.

This is because lithium-ion batteries are also being used in solar storage projects.

One of the key things holding solar power back is that a lot of energy is lost at night and in cloudy conditions, but what if you could take excess power generated during peak times and store it in a giant battery?

It’s been tried before, but the batteries were not sophisticated enough to store the maximum amount of energy needed to do things like power a home or a car.

Driven by gains from tech companies such as Tesla, we’re now standing on the precipice of a world where powering a home via battery is a near possibility.

The process, however, of digging up and processing lithium can be extremely dirty.

With a few notable exceptions (Lithium Australia, for example), a lot of lithium processing includes roasting of ores – a hugely energy intensive process.

If this process is powered by fossil fuels, does this offset the potential net zero gain from the lithium-ion battery that lithium will be in?

Nobody has yet conducted a life-cycle analysis, so it’s a difficult thing to try and pinpoint.

It’s why a lot of lithium plays are able to claim that they are a green stock by simply pointing to the role lithium will play in de-carbonising the electricity grid.

The question is can they credibly claim this?

As it turns out, kind of.

Australian Ethical is a superannuation fund with the sole purpose of making sure dollars under its purview go towards green and sustainable sectors.

Head of ethics research Stuart Palmer told Finfeed that on the surface of it, the fund would be open to investing in lithium miners.

“Although we don’t currently invest in the mining sector, our Ethical Charter would allow us to invest in lithium mining companies which appropriately manage their social and environmental impacts,” Palmer said.

“This is because of the crucial role lithium plays in expanding battery energy storage needed for the transition from fossil fuel to renewable energy.”

Its charter explores things like what role the proposed mineral plays in society and whether the mining of the mineral harms the environment.

Although lithium mining literally involves digging a giant hole in the ground and processing, its end use made lithium a compelling case to be considered a ‘green’ mineral.

“We look not only at the potential positive uses of the mineral, but also whether the amount required for those positive uses could be met from higher levels of recycling and reuse of previously mined material; or whether there are alternative, more sustainable materials which can fulfil the same function,” Palmer said.

“As a result of this analysis we generally avoid investment in the mining sector – but with potential exceptions as in the case of lithium.”

UniSuper, which has ‘sustainable’ investment options, says lithium miners raise “a very interesting point”.

“Our sustainable options screen out fossil fuel explorers and producers, which (in a practical sense) means that we exclude most diversified miners,” a spokesperson told Finfeed. “A lithium miner that does not explore for or produce fossil fuels could be considered for inclusion in our sustainable options.”

They added, however, that it did not have a dedicated sustainable options manager for the small cap space, but its Global Environmental Opportunities investment product did have a small exposure to lithium.

If any companies or individuals are in a position to rule in or out what’s ‘green’ or not, it’s the people and funds putting dollars into green opportunities.

If they deign lithium to be a green option (with caveats), it would seem that lithium miners do have a legitimate claim when they claim to be green companies.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.