Minbos executes merger of equals

Published 18-MAY-2017 14:09 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Minbos Resources is located in Angola, a region which currently carries high sovereign risk. Those considering this stock as an investment should take this very high risk environment into account and seek independent financial advice for further information.

African focused phosphate explorer and developer, Minbos Resources (ASX: MNB) has executed a definitive binding share sale agreement (SSA) with the shareholders of Petril Phosphates Limited under which MNB will, subject to satisfaction or waiver of the agreed conditions, acquire all of the shares in Petril.

Under the proposed ‘merger of equals’, MNB will acquire all of the shares in Petril in a mostly scrip transaction that will result in Petril and MNB shareholders each owning circa 50% of the enlarged MNB.

The merger will expand the group’s pipeline of future developments in the Zaire project with the combined entity operating under MNB controlling 100% of the Cabinda and Pedra de Feitico Rock Phosphate projects, as well as approximately 70% of the Lucunga Project.

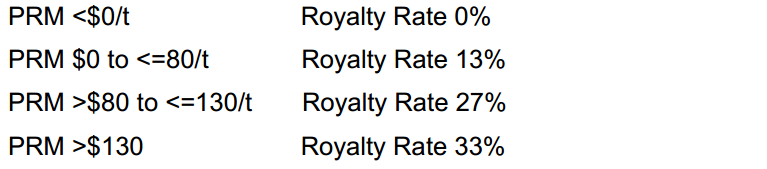

The company has also agreed to pay Petril shareholders a structured royalty on any future production solely from the Lucunga Project.

The royalty will be payable on any phosphate product produced and sold from the project attributable to the project interest acquired by MNB. The royalty is based on the Phosphate Rock Margin (PRM) produce from the project and is based on the sale price per tonne of Phosphate Rock less Phosphate Rock costs and ingredient cost per tonne of Phosphate Rock.

Payable for 15 years from the date of first sales of product, the royalty is structured as follows.

It should be noted, however, that any further catalysts are speculative at this stage and should not be taken as guaranteed. Investors should seek professional financial advice for further information.

Cacata the main game with stage one completion scheduled for end of 2017

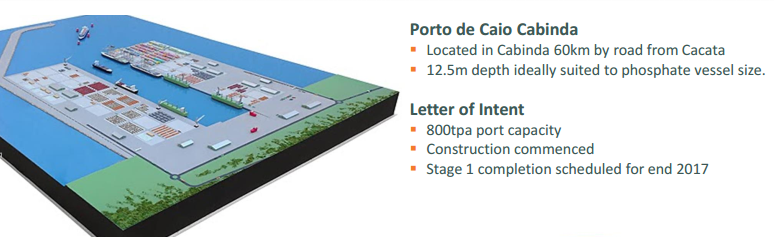

MNB and Petril are currently 50:50 joint venture partners in the Cabinda Phosphate Project in Angola, part of which is the Cacata deposit, where a Bankable Feasibility Study (BFS) is underway.

Petril also holds rights to two other phosphate projects in the Zaire Province of Angola, the Lucunga and Pedra de Feitico projects, which will be acquired by MNB as part of the SSA. The Lucunga Project is a joint venture with minority partner Haifa Chemicals, an international speciality fertiliser producer. More than US$9 million has been invested in the project, which Is located near Mucula in the Zaire Province.

Petril holds the rights to 100% of the Pedra de Feitico Project, located on the southern banks of the Congo River. This project has river access for potential transport of product via the port of Soyo, Angola. Only minimal work has been completed on the Pedra de Feitico Project to date.

Commenting on the ratification of the merger agreement, Chief Executive Officer, Lindsay Reed, said, “Minbos is excited to finally execute the definitive sale agreement with Petril shareholders, as the merger will consolidate the ownership structure of the Cabinda Project and simplify engagement with financiers and customers to finalise offtake and financing arrangements for the project later this year”.

Through its subsidiaries and joint ventures, MNB is exploring over 200,000ha of highly prospective ground hosting phosphate bearing sediments. However, the development of the high grade Cacata deposit that forms part of the Cabinda Project remains its focus.

MNB is looking to grow its current resource base in incremental stages on the remaining deposits in Angola. In terms of upcoming milestones, MNB expects to finalise offtake agreements and financing in 2017, developments that would be potential share price catalysts.

From an overall perspective, MNB’s strategy is to specifically target the exploration and development of low cost fertiliser-based commodities in order to tap into the growing global demand for fertilisers. Phosphate is an essential component in certain agricultural fertilisers, with the market supported by the increasing global demand for food and bio-fuel products.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.