Markets Stumble As English Citizenry Knocks EU Out of the UK

Published 27-JUN-2016 11:11 A.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

You know it’s been a momentous day, when the Prime Minister of a G7 country promptly resigns without warning — and it’s not considered the biggest news of the day.

The 23rd of June is being hailed as UK’s Independence Day by British EU sceptics, after the UK decided to exit the economic union she first swam into back in 1973 (at the third time of asking).

The first two attempts in 1963 and 1967 were both swatted away by French President Charles De Gaulle on ‘compatibility’ grounds, and fears over the UK’s ability to integrate into the European Community, as envisioned by Europe’s founders.

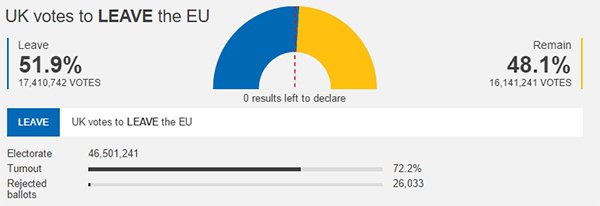

Over 50 years since, almost 52% of UK’s citizens voted to leave the EU and rocking the very foundations of British politics and way of life, not to mention the existing status-quo for 27 other EC countries.

And proving Mr. De Gaulle rather correct.

The enigmatic ‘Leave’ campaign figurehead Boris Johnson referred to UK’s EU membership as “what was once a noble idea, that is no longer fit for this country”.

Brexit Leave campaign figurehead, Boris Johnson (left) and soon-to-be former UK Prime Minister, David Cameron.

Europe hasn’t worked for the UK, and the majority of the problems have been to do with compatibility and integration with the European ‘blueprint’.

Back in the 1970s, the UK was entrenched in bitter domestic strife and lethargic productivity by relative comparisons. Margaret Thatcher took the UK into the European Economic Community, or common market, with the intention of improving trade and making the UK better off.

By and large — with some notable exceptions aside — that move has led to significant improvements to the UK’s terms of trade, GDP performance, financial sector prominence, and the list could go on.

But now, half a century later, the diametric opposite has transpired. Now, the UK is leaving a union, that’s rather different to the shiny new project it looked like all those years ago. And according to some, to find better economic prosperity elsewhere.

Once, joining Europe was deemed as opportunity, but now, leaving it is seen as a necessity. How times have changed.

Decades of wasted money, political infighting and shadow boxing between UK and their EU counterparts has finally led to divorce proceedings being initiated.

Meanwhile, the pulse of the Brexit campaign has arguably been immigration — which despite having both positive and negative consequences — is one of the prime reasons for generating the intense national support for Brexit, with England as the epicentre.

By looking at the voter statistics, a couple of incredibly interesting patterns emerge, indicating that the Brexit vote has caught the majority of political and economic glitterati completely off guard — the vast majority of senior UK and European politicians, as well as business figureheads, have now been left dazed, unknowing how to logistically proceed in disentangling the pile of UK-European inter-connections.

Voter insights

Intriguing splits in voters occurred according to age and socio-economic status, with younger under 45s tending to vote to Remain, while the over 45’s opted for Leave.

Also, it appears that the lower socio-economic strata’s of society tended to vote to Leave, especially in the northern parts of England where economic disparities and inequality are noticeably higher.

In broad strokes, Brexit has defined clear divisions in the social fabric of the UK, between the younger liberal generation aspiring to take advantage of various EU-related perks, versus the older, sometimes wealthier conservative generation, fed up with European integration.

Aye Aye Captain

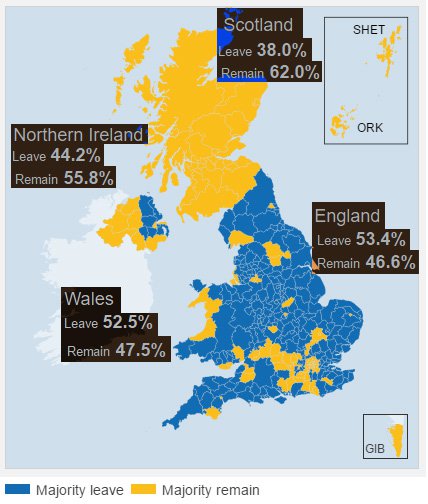

Meanwhile in Scotland, the Scottish voted for Remain, but got ‘Remove’ from the EU, despite a strong 62% majority being pro-EU, and with every district voting Remain.

The same in Northern Ireland, where the majority of people voted to Remain. By far the largest proportion of voters for Brexit came from England and Wales.

If shocked pro-Europeans are looking for anyone to blame, then it’s surely the English citizenry — and more specifically, the lower-income, older and rural dwelling people from the northern and midland parts of England.

Every large metro city voted for Remain with parts of London recording Remain votes at 80%+.

Long-time anti-EU campaigner, Brexit supporter and UKIP member, Nigel Farage, with supporters.

United Kingdom, Divided Britain

Moreover, the complexities of the division extend further.

The division extends into a deeper socio-economic division between the ‘haves’ and ‘have-nots’. Many of the Brexit voters were simply voting for change to the ongoing austerity measures and brewing level of apathy in poorer areas of society. It doesn’t help that those same areas have been gradually growing due to increasing unemployment and a blitz of structural decline across a whole spectrum of local communities across the UK.

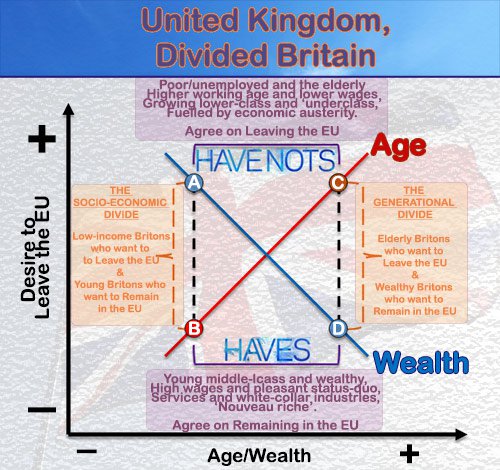

It would seem that when it comes to voting preferences, two clear factors emerged that show the fault lines in British society and vividly display its divisions.

In the chart above, the two prime factors behind voting Leave were Age and Wealth, shown as a proportionally direct relationship for Age, and inverse for Wealth. Older voters were more likely to vote Leave, while wealthy voters were more likely to vote Remain.

Point A represents the poorer parts of society preferring to Leave. Point B is the younger generations preferring to Stay. The gap between the two, AB, represents the Socio-Economic divide between lower-income, less educated Britons (mainly from northern England), and the younger, hip generations flocking to the cities, and looking to relocate, study or do business in Europe.

Simultaneously, there also exists the diametric opposite. Point C represents the older conservative generation that wants to leave the EU, while Point D, the wealthy parts of British society who prefer to stay. The gap between the two, CD, represents the Generational Divide. This divide is clearly borne out in the Brexit voting patterns, with a clear tendency for older citizens to vote to Leave, while the wealthier parts preferring to stay in the EU.

Divided and classes apart

In addition to these divides — two class divides also appear, in the form of the ‘Haves’ (Points BD), and the ‘Have-Nots’ (Points AC). Points BD represents the two predominant parts of the UK that wanted to remain in the EU — the young, and the wealthy. Points AC, the elderly and the poor who wanted to leave.

In the UK, this is the prime fault line dividing public opinion of Brexit and explains the broad strokes comparisons to Leave being ‘anti-Establishment’.

It’s arguably true, that the recent economic crisis and its consequences, have exacerbated these two camps; with the retirement age rising, while real-wages are falling. Large parts of British society feel they are “left-behind”.

For others, such the younger generations making it to University in record numbers and dreaming of travelling and working in Europe — they tended to vote Remain, combined with wealthy parts of the UK such as metropolitan cities and people that have some form of exposure to European business and trade.

Combined, these two slabs of citizens comprise the current middle-class and young adults who aspire to follow in their footsteps. Those with higher incomes tended to vote Remain and the perception is that the white-collar sectors enjoy the comfortable status-quo, most enjoyed in cities by young professionals and educated European interlopers.

Inequality is growing because of economic austerity measures, and their effects are having a disproportional impact on different parts of the UK — the EU referendum voting provides that insight.

An inter-generational struggle? Or a kicking of the Establishment?

The EU referendum was a shock-wave to the UK in several ways. Some immediately and tangibly visible. And some, not.

For one, Brexit shows that the old adage of ‘It’s the Economy, stupid!’ is not always true when it comes to mass public opinion. Brexit (just like the London Riots, the student protests and anti-war movements) indicate a growing chasm between different socio-economic and demographic groups in Britain. Far more predominant than Economics, for UK voters at least, is Immigration and giving the Establishment a kicking for the lack of both economic opportunities, and for paying more attention abroad than at home.

Brexit could also be an early insight into the growing insurrection of mass opinion against Big Politics and disconnect between voters and their elected peers.

When glancing across the pond to the US, a similar rhetoric of immigration-first, combined with a growing distrust of the existing political order, has propelled Mr. Donald Trump as the favourite for the White House.

Coincidentally, it was only Mr. Trump who publicly praised the Brexit vote, most probably because the themes that are borne out from its voting, dovetail so nicely with his own agenda of protecting borders, domestic workers, and showboating to the poorer and elderly parts of society, who feel left out and left behind.

Shell-shocked Remain campaigners after EU exit vote.

It’s also worth bearing in mind the slender margin of the Brexit victory. The gap between 51.9% (Leave) vs. 48.1%(Remain), is the equivalent of 1 in 50 people. The UK is quite literally split down the middle in terms of numbers, with additional regional variations that have only made things spicier politically.

Many in the UK have been left feeling that the UK has left one job, without another to go to. Uncertainty awaits, but opportunity does also.

In terms of the markets, Brexit is likely to undermine the value of Sterling for years, overshadowed by looming exit talks that could sway in a plethora of different directions.

Then there’s the possibility of tariffs, import/export controls and quotas for everything ranging from products, to people, to capital. If Brexit becomes a messy divorce, it could lead to retaliatory measures and tit-for-tat spats that British politicians, MEP members and European officials are already so famously known for — negotiations have been pencilled in to last 2 years, expect that to be summarily revised upwards and can-kicking analogies to promptly surface. This again, will only wreak havoc on business confidence and economic stability.

The political ramifications could be even more seismic. The UK may cease to be a union and split into individual countries to be known as England, Scotland, Ireland and Wales — just like in feudal times.

What will happen to the existing divide between the Republic of Ireland and Northern Ireland, current border between England and Scotland and Gibraltar’s status, if and when the UK leaves the EU? Scotland could be an independent European country bordering England while Northern Ireland, as an independent country, may decide to reunify with the Republic of Ireland.

If Scottish people are seemingly more interested in being part of Europe than they do of the UK, could the same be true of the Irish? Could the Euro find its way into Scottish pockets, and wouldn’t it make sense for Northern Ireland to follow suit?

There are still so many future ramifications of Brexit that have yet to be thought of, but already, UK’s national renegotiation teams have their work cut out.

As a whole, the UK has made a decision, but its constituent parts are just as divided as Europe ever was. Splintered UK citizens have voted to leave a union for being dysfunctional and costly, but in getting their wish, they have simultaneously exposed their own internal divisions, dysfunctions and costs.

Desperate knee-jerk calls for a 2nd EU referendum (the result has not gone down well) are unlikely to displace the underlying mood and class-struggle in the UK. If anything, another referendum could bring the masses out in their true mass force with the 30% or so non-voters likely to side with the Leave camp. All the young professionals voted because they all knew what it meant, but around 30% of the lower-income and elderly camps didn’t; for want of a better word, they didn’t care about the result. A 2nd referendum could only bloat this underbelly of unrest even further, and widen British divides.

The United Kingdom but a divided Britain is leaving the EU — in the words of Groucho Marx, “I don’t want to belong to any club that will accept me as a member”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.