Markets gear up for an update on Monetary policy

Published 25-AUG-2017 14:58 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Over the coming days we will hear from central bankers in Europe and the US about their plans for monetary policy moving forward. The prevailing belief so far this year has been that a decade of ultra-low interest rates is starting to cause signs of growth in the global economy; and that we will now need interest rate rises to combat against an overheating economy and rampaging inflation.

However, despite some signs of an economic recovery in the developed world (such as low unemployment, and strong asset prices), we are yet to see economic growth and consumer prices (CPI) return to target levels.

Indeed, in Europe they are still continuing with quantitative easing after a round of bad inflation reports late last year. However, it appears that his has led to increases in risk asset prices rather than consumer prices, and Eurozone CPI growth is still languishing around 1.3 percent, which is below desired levels.

In some places, and by some measures, economic growth and inflation are slowly rising, but it is certainly not across-the-board. In fact, CPI growth in practically every developed jurisdiction is weaker than just about everyone’s estimates – especially the inflation bullish central bankers’ models. The only real inflation we have seen is the growth in risk asset prices.

However, despite the obvious lack of CPI inflation, central bankers keep parroting on about it and stating that we will need to see higher interest rates to combat this phantom inflation.

Whilst I agree that high inflation can be a bad thing, and that quantitative easing should be ended. I entirely disagree with raising interest rates solely to combat potential future inflation, as it does not stack up with the wider economic fundamentals we are seeing. In fact, I believe that anyone talking about inflationary pressures on consumer prices is talking about the wrong thing.

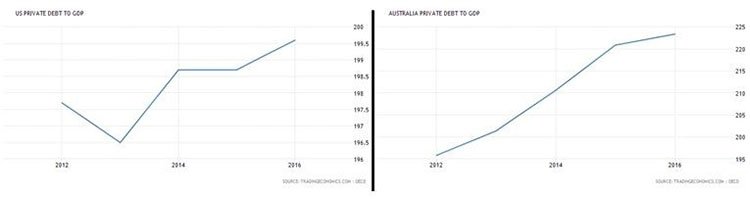

The small pick-up economic growth we have seen from the developed world in recent years is likely due to increases in debt levels, which have increased substantially over the last few years with interest rates at historically low levels.

In addition, while private debt levels have increased in many developed nations, wage growth has stagnated. Wages when accounting for consumer price inflation have not increased in the developed world since approximately the late 80’s. In the absence of this growth in wages, a growth in private debt levels has helped to fuel economic growth.

The issue is that if we now see rises in interest rates (as central bankers have been telegraphing for some time); salaries may not have raised enough to sufficiently cover interest repayments at higher rates. Therefore, if we raise interest rates, we are likely to see increased levels of delinquency on debts.

I do not think a sudden attempt to stop phantom inflation is worth risking another credit or liquidity crisis and so I hope that central bankers in the US and Europe will be less “hawkish” in their coming statements.

However, that doesn’t mean I believe monetary policy should be unchanged; as the low interest rates and quantitative easing has created its own problems (such as the growth in debt levels), which will need to be addressed. In the absence of wage growth, monetary policy settings are therefore likely to be a balancing act between growth in debt and debt delinquency rates moving forward – until someone can come up with some better ideas on how to manage an increasingly difficult to finesse global economy.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.