Lithium in high demand

Published 24-AUG-2016 16:03 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

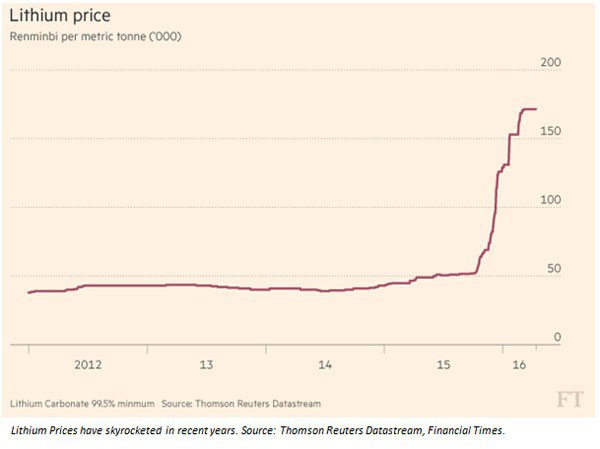

There has been much hype around Lithium (and Lithium related stocks) recently, as prices of the metal skyrocket writes Sam Green, Advisor at Options Educator, TradersCircle.

The prices of lithium and related stocks have risen on the back of strong demand growth for the silvery-white metal, with lithium consumption doubling in the twelve years from 2000.

The increases in demand have primarily come from lithium use in battery technology. Lithium-Ion batteries are a type of rechargeable battery, that tend to be more energy dense than other rechargeable battery types.

In fact, modern rechargeable lithium-ion batteries can be as much as sixteen times as energy dense as a traditional lead-acid car battery. Such energy density means lithium-ion batteries are perfect for mobile phones, laptops, power tools, home electricity storage, and electric vehicles.

Electric vehicles are forecast to be a huge driver of lithium demand growth in the future. So far, the Nissan Leaf (a small all-electric vehicle) has already sold more than 200,000 units, and The Tesla Model S (a larger, more luxurious all-electric vehicle) has sold more than 120,000 units.

The lithium-ion rechargeable battery market is forecast by Roskill Information Services Ltd, to grow at 21.5% per year. Much of this growth will be driven by the automotive sector, which uses large format lithium-ion batteries, which can contain kilograms of lithium, rather than the couple of grams in our phone batteries.

Caltex Australia, an oil refiner and seller reported their half-year earnings results today. Following the release, CEO Julian Segal provided commentary on their view of growth in electric vehicle use. Mr Segal believes that electric vehicles will eventually replace traditional internal combustion vehicles, in much the same way that the motorcar replaces the horse and buggy. However, he believes it could be a few years before the major transition takes place.

“Certainly you are not going to have any significant dent in the next 5 to 10 years at the very least,” Mr Segal stated this morning.

As an oil refiner and seller, Caltex has a vested interest in keeping internal combustion engines around. Therefore, Mr Segal’s comments can be seen as something of an admission from the fossil fuel industry that electric vehicles will soon become pervasive on our roads.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.