Was last night’s sell-off the start of a broader reality check?

Published 06-APR-2017 11:01 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There were a number of market catalysts at play in the US overnight with President Trump reinforcing infrastructure spending promises, the Fed spooking the market by flagging its intention to reduce its $4.5 trillion balance sheet, IEA data pointing to higher than expected oil inventories which took the wind out of the sails of energy stocks and positive employment data.

This resulted in a rollercoaster ride for the Dow as it increased from the previous day’s close of 20,689 points to hit an intraday high of 20,888 points before closing at 20,648 points, broadly in line with the day’s low.

Fed delivers the fatal blow

With regard to the overall market the big swing factor was the release of Fed minutes late in the day. In somewhat uncharacteristic fashion the Fed even bought into the sharemarket performance, suggesting it may have run ahead of itself by pricing in the proposed Trump administration’s fiscal stimulus initiatives.

On that note, Trump reinforced his trillion dollar infrastructure spend, as well as indicating his emphasis on a swift move to project commencements across all areas of infrastructure.

He promised to cut red tape around project approval processes, resulting in a reduction from 10 years to one year in terms of getting projects underway. Once again, another bullish promise which sounds a little too good to be true.

Trump even went so far as to say that if a project would take more than 12 months to get underway it would be wiped. Perhaps this is his get out clause if the number of projects promised doesn’t meet expectations.

Jobs the key early session driver; Fed the overdue reality check

Strong job numbers were the catalyst for the early market surge, while the Fed commentary was responsible for decimating those gains towards the end of the day. Negative sentiment is likely to flow into other global markets, and quite possibly US markets could experience further downside.

However, it could be argued that commentary by the Fed was an overdue reality check. The country’s balance sheet looks just as ugly today as it did under the Obama administration.

If anything, Trump’s multi trillion dollar infrastructure spending and tax reduction promises are more unaffordable today than they were just over 12 months ago when the Dow was 5000 points shy of its current level.

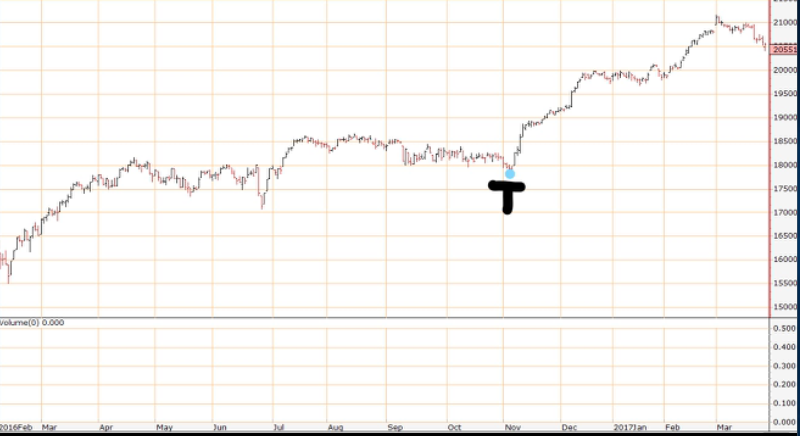

The meteoric rise since Trump Day (T marks the spot) can be seen in the following chart, as can the unprecedented 5500 point rally between February 2016 and March 1, 2017.

Spike in the Dow not supported by relative corporate earnings growth

The 14 month/35% increase in the Dow certainly hasn’t been supported by corporate earnings growth, which means much of the momentum has been driven by hope and hype, a dangerous combination that can result in markets rapidly unravelling, similar to the tech and mining ‘boom to bust’ scenarios that have unfolded in the last 20 years.

While both of those meltdowns had severe repercussions, it is important to note that the booms were founded on genuine positive industry dynamics. There was a tech revolution that drove the tech boom and there was the emergence of China which predominantly drove real supply demand based rises in commodity prices.

There isn’t an industry specific quantum change that has driven markets higher in the last five months. There was a presidential election in November which triggered a circa 3000 point market rally, and none of the promises that underpinned that election victory have materialised to date – in fact some have already fallen by the wayside.

Is economic strength underpinning data or is upbeat data a function of Trumphoria

While market commentators are pointing to indicators such as job numbers, business confidence and retail spending these are areas that can also be beneficiaries of a change in sentiment. Businesses assume that conditions are about to change for the better and begin to invest in capital goods, as well as human resources.

Hence, this has a positive impact on GDP from a broader perspective, but more specifically there is jobs growth which results in improved consumer confidence, increased household spending, which in turn generates earnings for businesses.

However, if the fiscal changes promised by Trump don’t materialise, confidence fades, the earnings boost anticipated by businesses isn’t realised, companies are forced to cut costs by laying off staff and reducing investment in equipment, and the cycle unwinds.

Unwinding the balance sheet isn’t a matter of if, just when

With regards to the broader US economy, a balance sheet adjustment has to happen sooner rather than later, and there is no hedging around the fact that this will have a negative impact on equity markets.

In Paul Keating terms there will be a ‘recession (of sorts) we had to have’ moment in time, which could well present itself at a stage when it becomes apparent that Trump can’t deliver on his promises of fiscal stimulus and the Fed bites the bullet and takes the hard decisions in terms of monetary policy to restore true economic equilibrium

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.