It took Tesla 4x less years to reap a higher market cap than Samsung

Published 24-MAR-2021 16:26 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Electric vehicle manufacturer Tesla (NASDAQ: TSLA) has witnessed a tremendous increase in its market capitalisation, directly competing with other established technology industry players in existence for decades writes Oliver Scott.

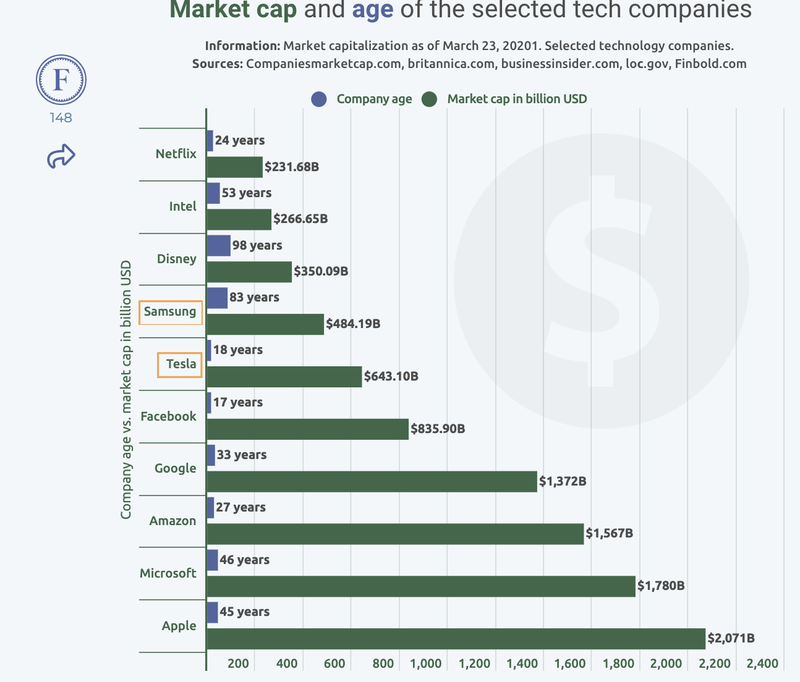

Data calculated and analysed by Finbold indicates that it took Tesla at least four times less years to amass a higher market capitalisation than South Korea’s electronic giant Samsung. As of March 23, 2021, Tesla was only 18 years old with a market capitalisation of $643.10 billion, which is higher than 83-year old Samsung with a market cap of $484.19 billion.

We have compared the two companies because they are both in the technology industry and are established leaders in their specific niches. Furthermore, both companies have a similar market capitalisation, and they are leading manufactures.

The analysis compares the age and market cap of the other eight selected companies. Apple, founded 45 years ago, has the highest market capitalisation of $2.07 trillion.

Why Tesla’s market cap has soared in fewer years

Despite being two big players in the tech world, Tesla’s market capitalisation has obviously grown at a faster rate to rank higher than Samsung. The rapid surge has been aided by the fact that the company is benefitting from a general euphoria around electronic vehicle stocks, alongside the tightening of emissions regulations globally. The firm has also cemented its position as a key player in the electric vehicle market hence poised for growth.

Worth mentioning is that Tesla’s market capitalisation significantly grew in 2020. The stock split made it more affordable for individual investors to own a part of Tesla driving retail investor enthusiasm. At the same, the firm benefitted from the surge in technology stock witnessed during the coronavirus pandemic. Since going public in 2010, Tesla’s stock has ballooned by over 20,000%, while last year alone, the stock rocketed by over 700%.

Furthermore, Tesla CEO Elon Musk can not be overlooked in the company’s market cap growth. Musk is outspoken and commands a loyal social media following through platforms like Twitter. He inspires an army of Tesla proponents and investors thanks to success accomplished by his other affiliated ventures like SpaceX and PayPal. Musk’s position in the tech industry cannot be easily emulated by other tech industry players.

Samsung market cap growth derailed

As Tesla’s market surged over the past decade since going public in 2010, Samsung has fluctuated. The market cap has benefited from the company’s position as one of the leading 5G chipmakers. The demand for 5G chips and devices has surged as the technology continues to take center stage.

However, the market cap’s growth partly stalled amid corruption scandals that hit the company. The conglomerate’s Vice Chairman and heir Jay Y were arrested over a corruption scandal linked to former South Korea President Geun-hye. Such instances slowed down the company’s growth in valuation, giving room for new players like Tesla to surge forward. Although Tesla has been hit with several controversies, especially on meeting demand, the events have not significantly affected its valuation.

Samsung also faces stiff competition as competitors like Huawei continues to slash the prices of their smartphones. Furthermore, Huawei also leads with the highest share of 5G-ready devices globally, while Samsung lags behind. Elsewhere, Tesla continues to be a market leader in the EV sector, fuelling electric vehicles’ mass adoption globally.

Although Tesla has used fewer years to amass a higher market cap than Samsung, both companies differ in profits. For 2020, Tesla reported a profit of $721 million while Samsung recorded about $32.1 billion.

Although Tesla’s market cap has surged sharply, there have been concerns from different financial sector players. Some predict it will soar even higher, while others urge investors to be cautious, stating the stock is driven mainly by speculation.

Author: Oliver Scott

Oliver is a revolutionist in the sense that he embraces change as it comes. He is passionate about blockchain, digital assets, the Internet of Things, Artificial Intelligence, and all evolving technologies. At Finbold.com Oliver covers data-driven stories and researches that reveal meaningful insights for the reader.

This article was originally published on Finbold.com

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.